Featured Article:The Spanish Financial Crisis: Economic Reforms and the Export-Led Recovery

By

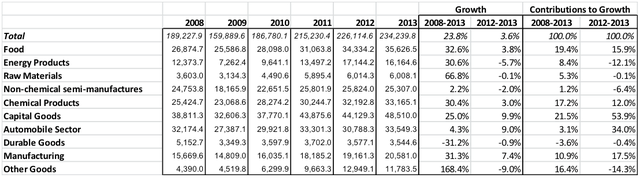

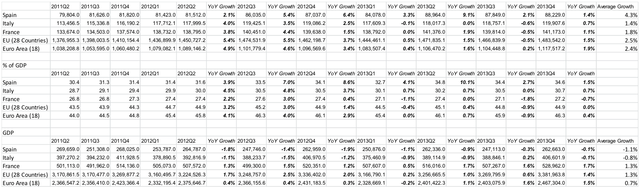

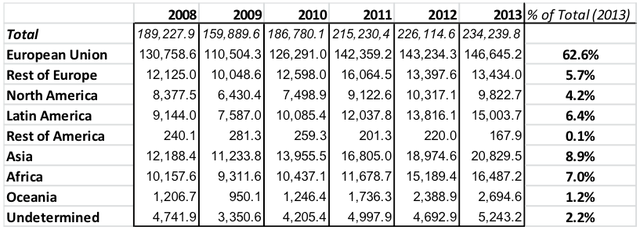

2014, Vol. 6 No. 10 | pg. 4/4 | « Effect of Reforms on ExportsThe three areas of reform seem to have had a significant effect on their intended impact in Spain: driving an export-led recovery. Since the reforms were instituted in the second quarter of 2012, Spain has averaged 4.3% annual growth in exports, and has increased its share of exports to GDP from 31.6% to 34.6%.61 While many critics claim that exports have increased primarily due to the necessity of Spanish companies to look outside with the decrease of domestic demand, this section will present compelling evidence using comparable countries to suggest that the reforms have in fact led the export driven recovery. First, to ensure that exports have increased in a substantial way since the reforms in 2012, the goods contributing to the increase were analyzed. Data on exports of goods was broken down by economic sector, and then contribution to export growth from 2012 to 2013 was compared to contribution of export growth from 2008 to 2013. This analysis should help to isolate which sectors were affected most by the reforms, specifically the labor reforms, beginning in the second quarter of 2012. As seen in Exhibit A, the contribution of capital goods grew to 53.9% from 21.5%, the contribution of automobiles grew from 3.1% to 34.0%, and the contribution of consumer goods grew from 10.9% to 17.5%. Conversely, the contribution of exports of energy decreased from 8.4% to -12.1%. Furthermore, the exports of services, which account for 32% of all exports in Spain, have increased 2.7% from 2012 to 2013, and within that, tourism has increased 3.9%. The data shows that the increase in exports were in sectors where access to capital and labor costs are important. Additionally, exports of energy, a sector largely with high volatility due to market prices, actually decreased. This would suggest that the reforms have had a significant impact in increasing exports in Spain.Next, to provide evidence that Spanish companies have not just increased their focus on exports, France and Italy will be used as controls. France elected Francois Hollande of the Socialist Party in 2012. During a similar timeframe as Rajoy's reforms, Hollande has allowed public spending to rise to the highest level in the Eurozone (57% of GDP), and has largely ignored pension reforms that are needed in France. He has not instituted labor reforms, and wages in France have increased since 2012.62 Italy, on the other hand, has had a fragile coalition at the head of its government over the past two years. The Italian government has had trouble passing any reform laws during the time of political gridlock.63 As seen in Exhibit B, the Spanish GDP has decreased an average of 1.1% since the second quarter of 2012, while that of Italy and France has decreased 0.8% and increased 1.3% respectively. These numbers show that domestic demand in all three countries has been weak, and all three countries, especially Spain and Italy, would have a strong incentive to attempt to sell products abroad. Meanwhile, Spanish exports have increased 4.3% during that time, while Italian and French have only increased 1.4% and 1.8% respectively. Additionally, as seen in Exhibit C, 68% of Spanish exported goods go to European countries. While the GDP of European countries grew 0.8% between 2012 and 2013, Spanish exports to European countries grew 2.2% from 2012 to 2013. While far from conclusive, this data suggests that the reforms implemented by the Rajoy government have had a significant impact in the export-led recovery of Spain. Italy and France are two countries with similar trading partners and economic conditions to Spain that have not instituted the level of reforms that the Rajoy administration has, especially with regards to increasing exports. Yet, despite similar domestic demand growth, especially with Italy, the exports of Spain have increased around three times the rate of Italy and France. Additionally, Spanish exports to European countries increased more than the GDP in those countries, implying that Spanish goods were more attractive in those countries. These two pieces of data show that Spanish products have certainly become more competitive in the global landscape, and the information presented earlier in the paper seems to connect this increase in competitiveness with the reforms instituted by the Rajoy administration. Risk FactorsWhile the initial results of the export led recovery seem promising, there are four key risk factors that exist that could change the fate of the Spanish recovery. First and foremost, there is no assurance that the Rajoy administration and the Popular Party will be reelected in 2015. Although 29% of people plan to vote for the Popular Party compared to 23% for the socialist workers' party (PSOE), two different parties, the United Left (IU) and Union Progress and Democracy (UPyD) have grown in popularity, each with an expected 13% of the vote. Both upcoming parties lean left on the political spectrum, and could cause difficulties in passing further reforms in Spanish, and, at worst, could reverse some of the reforms Spain has already made. Additionally, the approval rating of Rajoy is only 22%, above that of the PSOE leader (16%), but below that of the IU (23%) and the UPyD (32%) leaders.64 Second, the ongoing secessionist movement by Catalonia has stoked concerns for the export-led recovery in Spain. The region with Barcelona as its capital has complained that the Spanish government takes a disproportionate amount of tax revenue from the wealthy region, and disrespects the Catalan language and culture. The risk is a serious one, especially considering 48% of Catalonians would prefer independence from Spain. In addition, while only accounting for 16% of the Spanish population, the region accounts for 26% of total exports.65 Yet, the Spanish government has continually struck down Catalonia's attempts to call a referendum on independence, and the region would have difficulty pleading its case to join the EU if it did proclaim independence. Third, Spanish exports are very dependent on the health of the Eurozone, and the global economy as a whole. While Spain has decreased its share of exports to the Eurozone from 57% before the crisis to 49% in 2013,66 the region with negative growth in 2012 and 2013 and persistent debt problems still makes up a large share of its exports. Additionally, if global demand decreases, Spanish exports will likely take a hit, although the IMF predicts global GDP growth of almost 4% in 2014.67 Overall, this risk factor is low because of Spain's efforts to increase exports to developing economies and the prediction that both the Eurozone and global economies will grow in the future. Finally, Spain faces the risk of Italy and France, its direct competitors in many respects, instituting similar reforms to increase global competitiveness. Francois Hollande came out in the beginning of 2014 boasting his agenda to lower taxes and government spending while instituting reforms to increase competitiveness. While he has asserted such promises before, political experts say it is something that must be done if he wants to have a chance at reelection in 2017.68 Likewise, Italy's new leader, Matteo Renzi, has also pledged a reform of tax and spending cuts, as well as a 10% cut in labor costs paid by the private sector. Similar to France's situation, the talk is there, but neither country has moved to take great action.69 Currently, this risk factor should be seen as low for impeding the export-led recovery of Spain, but that could change if the Italian or French governments implement serious reforms. ConclusionSpain has taken impressive steps to restore credibility and confidence in its economy while at the same time improving its global competitiveness. The export-led recovery championed over the past 24 months, aimed at increasing domestic demand and decreasing debt, has so far been relatively succesful. Backed by financial market reforms, fiscal measures and labor market reforms, Spanish exports have performed favorably in comparison to its direct competitors and neighbors. However, some uncontrollable risk factors exist that could still hinder the recovery, chief among them the political landscape in Spain and the reaction of France and Italy to their own economic challenges. AppendixExhibit A: Sector Breakdown of the Export of Spanish Goods (€) Source: Ministerio de Comercio Exhibit B: Spain and Competitors Export and GDP Information (€) Source: Ministerio de Comercio Exhibit C: Spanish Exports by Destination (€) References"Austerity Measures in Crisis Countries - Results and Impact on Mid-term Development."Intereconomics(): 21-26. Print. Bartha, Emese. "Bonds of Italy, Spain Narrow Gap with U.S., German Yields." The Wall Street Journal. N.p., 8 Apr. 2014. Web. . "Can Francois do a Gerhard?."The Economist. N.p., 11 Jan. 2014. Web. . Candel, Maria Teresa. "Spain passes major labour law amendments."Lexology. N.p., 2 Apr. 2012. Web. . Chislett, William. "What does the economic future hold for Spain?." N.p., 25 Mar. 2014. Web. . "Current Account Balance."The World Bank. N.p., n.d. Web. . Dinmore, Guy. "Italy's Matteo Renzi pledges tax cuts and labour reforms."Financial Times. N.p., 12 Mar. 2014. Web. <"Can Francois do a Gerhard?." The Economist. N.p., 11 Jan. 2014. Web..>. "EU austerity drive country by country."BBC. N.p., 21 May 2012. Web. . Etxezarreta, Miren. "Boom and (deep) crisis in the Spanish economy: the role of the EU in its evolution.." N.p., 1 Sept. 2011. Web. . "Financial Assistance Programme for the recapitalisation of Financial Institutions in Spain." European Commission, 1 Jan. 2014. Web. . Galloni, Alessandra. "Messy Italian Election Shakes World Markets."The Wall Street Journal. N.p., 26 Feb. 2013. Web. . Glazer, Emily. "Investors Breathe Life into European Banks' Bad Loans." The Wall Street Journal. N.p., 30 Mar. 2014. Web. . Hofstede, Geert. "Spain."The Hofstede Centre. N.p., n.d. Web. . "IMF World Economic Outlook."International Monetary Fund. N.p., 1 Jan. 2014. Web. . "Indices de opinion publica."Simple Logica. N.p., n.d. Web. . "Informe mensual de comercio exterior."Ministerio de economia y competitividad. N.p., 1 Jan. 2014. Web. . Karaian, Jason. "Spanish real estate has lost more than a third of its value, but it's still overvalued."Quartz. N.p., 13 Sept. 2013. Web. . "Labour Compensation per Employee."OECD. Web. . Lafraya, Conchi. "Las contradicciones del credito."La Vanguardia7 Apr. 2014: n. pag. Print. "Ley 26/2013, de 27 de diciembre, de cajas de ahorros y fundaciones bancarias." Boletín Oficial del Estado. N.p., 28 Dec. 2013. Web. . Mars, Amanda. "Mitos del 'boom' emprendedor." El Pais, 6 Nov. 2013. Web. Minder, Raphael. "Mix of Politics and Banking in Spain's Woes." 3 June 2010. Web. . Moffett, Matt. "Export Prowess Lifts Spain From Recession." The Wall Street Journal. 30 Oct. 2013. Web. . Operé, Fernando, and Carrie B. Douglass.España y los españoles de hoy: historia, sociedad y cultura. Upper Saddle River, N.J.: Pearson Education/Prentice Hall, 2007. Print. Pallares, Ignacio. "Royal Decree Law 24/2012 address restructuring and termination of Spanish credit entities."Lexology. N.p., 24 Sept. 2012. Web. . Patnaude, Art. "Spain Launches $9.6 billion Property-Loan Sale." The Wall Street Journal. N.p., 16 Apr. 2014. Web. . "Posición de inversión Internacional de España." Banco de España. N.p., n.d. Web. . "Presupuesto Generales de las Comunidades Aútonomas." Ministeria de Hacienda y Administraciones Públicas. N.p., 1 Jan. 2013. Web. . "Private debt in % of GDP."Eurostat. N.p., n.d. Web. . Randow, Jana. "ECB Said to Consider Minus 0.1 Percent Deposit Rate." Bloomberg. N.p., 20 Nov. 2013. Web. . Roman, David . "Madrid Austerity Plan Boosted to $80 Billion."The Wall Street Journal. N.p., 12 July 2012. Web. . Rooney, Ben. "Spain’s Financial Crisis a Boost to its Startup Economy."WSJ. N.p., 17 Oct. 2013. Web. . "Royal Decree-Law 3/2012 of urgent measures to reform the employment market."Herbert Smith. N.p., n.d. Web. 1 Feb. 2012. . "Savings and Groans." The Economist, 19 Nov. 2009. Web. . "Spain Government Bond 10Y." Trading Economics, n.d. Web. . "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . "Stability Programme Update." The Spanish Economy. N.p., 1 Jan. 2013. Web. .center/interest-rates/Pages/TextView.aspx?data=yield>. "Technical features of Outright Monetary Transactions."European Central Bank. N.p., 6 Sept. 2012. Web. . "The 2012 Labour Market Reform in Spain: A Preliminary Assessment."OECD. N.p., 1 Dec. 2013. Web. . "The adjustment of the Spanish Real Estate Sector." Ministerio de Fomento, 1 Jan. 2012. Web. . "The Residential Investment Adjustment in Spain: The Current Situation." Banco de España, 20 Dec. 2010. Web. . "The Spanish Government imposes an €8 billion budget adjustment on the Autonomous Communities in 2014 and 2015."Catalan News Agency. N.p., 17 Oct. 2013. Web. . Tremlett, Giles. "Spanish election: convincing victory for People's party."The Guardian20 Nov. 2011: n. pag. Print. Tremlett, Giles.Ghosts of Spain: travels through Spain and its silent past. New York: Walker & Co. 2007. Print. "Unit Labour Costs - Annual Indicators."OECD. N.p., n.d. Web. . U.S. Department of the Treasury. N.p., n.d. Web. Xydias, Alexis. "Spain ETF Grows as Rajoy Attracts Record U.S. Investments." Bloomberg. N.p., 16 Apr. 2014. Web. . Yahoo Finance. N.p., n.d. Web. . Endnotes1.) Tremlett, Giles.Ghosts of Spain: travels through Spain and its silent past. New York: Walker & Co. :, 2007. Print. 2.) Operé, Fernando, and Carrie B. Douglass.España y los españoles de hoy: historia, sociedad y cultura. Upper Saddle River, N.J.: Pearson Education/Prentice Hall, 2007. Print. 3.) Ibid 4.) Hofstede, Geert. "Spain."The Hofstede Centre. N.p., n.d. Web. . 5.) Rooney, Ben. "Spain’s Financial Crisis a Boost to its Startup Economy."WSJ. N.p., 17 Oct. 2013. Web. . 6.) Mars, Amanda. "Mitos del 'boom' emprendedor." El Pais, 6 Nov. 2013. Web. 7.) "The adjustment of the Spanish Real Estate Sector." Ministerio de Fomento, 1 Jan. 2012. Web. . 8.) "Current Account Balance."The World Bank. N.p., n.d. Web. . 9.) "The Residential Investment Adjustment in Spain: The Current Situation." Banco de España, 20 Dec. 2010. Web. . 10.) Chislett, William. "What does the economic future hold for Spain?." N.p., 25 Mar. 2014. Web. . 11.) "The Residential Investment Adjustment in Spain: The Current Situation." Banco de España, 20 Dec. 2010. Web. . 12.) Karaian, Jason. "Spanish real estate has lost more than a third of its value, but it's still overvalued."Quartz. N.p., 13 Sept. 2013. Web. . 13.) Etxezarreta, Miren. "Boom and (deep) crisis in the Spanish economy: the role of the EU in its evolution.." N.p., 1 Sept. 2011. Web. . 14.) "Spain Government Bond 10Y." Trading Economics. N.p., n.d. Web. . 15.) "Private debt in % of GDP."Eurostat. N.p., n.d. Web. . 16.) "Labour Compensation per Employee."OECD. N.p., n.d. Web. . 17.) Minder, Raphael. "Mix of Politics and Banking in Spain's Woes." N.p., 3 June 2010. Web. . 18.) "Savings and Groans." The Economist, 19 Nov. 2009. Web. . 19.) See Exhibit C 20.) "Spain Government Bond 10Y." Trading Economics, n.d. Web. . 21.) "Spain Unemployment Rate." Trading Economics, n.d. Web. . 22.) Lafraya, Conchi. "Las contradicciones del credito."La Vanguardia7 Apr. 2014: n. pag. Print. 23.) Tremlett, Giles. "Spanish election: convincing victory for People's party."The Guardian20 Nov. 2011: n. pag. Print. 24.) "Technical features of Outright Monetary Transactions."European Central Bank. N.p., 6 Sept. 2012. Web. . 25.) Pallares, Ignacio. "Royal Decree Law 24/2012 address restructuring and termination of Spanish credit entities."Lexology. N.p., 24 Sept. 2012. Web. . 26.) "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . 27.) Ibid 28.) "Financial Assistance Programme for the recapitalisation of Financial Institutions in Spain." European Commission, 1 Jan. 2014. Web. . 29.) "Austerity Measures in Crisis Countries - Results and Impact on Mid-term Development."Intereconomics(): 21-26. Print. 30.) Ibid 31.) "EU austerity drive country by country."BBC. N.p., 21 May 2012. Web. . 32.) Roman, David . "Madrid Austerity Plan Boosted to $80 Billion."The Wall Street Journal. N.p., 12 July 2012. Web. . 33.) "Austerity Measures in Crisis Countries - Results and Impact on Mid-term Development."Intereconomics(): 21-26. Print. 34.) "The Spanish Government imposes an €8 billion budget adjustment on the Autonomous Communities in 2014 and 2015."Catalan News Agency. N.p., 17 Oct. 2013. Web. . 35.) "Unit Labour Costs - Annual Indicators."OECD. N.p., n.d. Web. . 36.) "Royal Decree-Law 3/2012 of urgent measures to reform the employment market."Herbert Smith. N.p., n.d. Web. 1 Feb. 2012. . 37.) Candel, Maria Teresa. "Spain passes major labour law amendments."Lexology. N.p., 2 Apr. 2012. Web. . 38.) "The 2012 Labour Market Reform in Spain: A Preliminary Assessment."OECD. N.p., 1 Dec. 2013. Web. . 39.) Moffett, Matt. "Export Prowess Lifts Spain From Recession." The Wall Street Journal. N.p., 30 Oct. 2013. Web. . 40.) Bartha, Emese. "Bonds of Italy, Spain Narrow Gap with U.S., German Yields." The Wall Street Journal. N.p., 8 Apr. 2014. Web. . 41.) Randow, Jana. "ECB Said to Consider Minus 0.1 Percent Deposit Rate." Bloomberg. N.p., 20 Nov. 2013. Web. . 42.) "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . 43.) Patnaude, Art. "Spain Launches $9.6 billion Property-Loan Sale." The Wall Street Journal. N.p., 16 Apr. 2014. Web. . 44.) "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . 45.) Glazer, Emily. "Investors Breathe Life Into European Banks' Bad Loans." The Wall Street Journal. N.p., 30 Mar. 2014. Web. . 46.) "Ley 26/2013, de 27 de diciembre, de cajas de ahorros y fundaciones bancarias." Boletín Oficial del Estado. N.p., 28 Dec. 2013. Web. . 47.) Glazer, Emily. "Investors Breathe Life into European Banks' Bad Loans." The Wall Street Journal. N.p., 30 Mar. 2014. Web. . 48.) Lafraya, Conchi. "Las contradicciones del credito."La Vanguardia7 Apr. 2014: n. pag. Print. 49.) "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . 50.) Lafraya, Conchi. "Las contradicciones del credito."La Vanguardia7 Apr. 2014: n. pag. Print. 51.) "Spain: Financial Sector Reform - Fourth Progress Report." International Monetary Fund, 1 Nov. 2013. Web. . 52.) "Stability Programme Update." The Spanish Economy. N.p., 1 Jan. 2013. Web. . 53.) "Presupuesto Generales de las Comunidades Aútonomas." Ministeria de Hacienda y Administraciones Públicas. N.p., 1 Jan. 2013. Web. . 54.) "The Spanish Government imposes an €8 billion budget adjustment on the Autonomous Communities in 2014 and 2015."Catalan News Agency. N.p., 17 Oct. 2013. Web. . 55.) U.S. Department of the Treasury. N.p., n.d. Web. . 56.) Xydias, Alexis. "Spain ETF Grows as Rajoy Attracts Record U.S. Investments." Bloomberg. N.p., 16 Apr. 2014. Web. . 57.) "." Yahoo Finance. N.p., n.d. Web. . 58.) "Posición de inversión Internacional de España." Banco de España. N.p., n.d. Web. . 59.) "The 2012 Labour Market Reform in Spain: A Preliminary Assessment."OECD. N.p., 1 Dec. 2013. Web. . 60.) Ibid 61.) Exhibit B 62.) "Can Francois do a Gerhard?."The Economist. N.p., 11 Jan. 2014. Web. . 63.) Galloni, Alessandra. "Messy Italian Election Shakes World Markets."The Wall Street Journal. N.p., 26 Feb. 2013. Web. . 64.) "Indices de opinion publica."Simple Logica. N.p., n.d. Web. . 65.) "Informe mensual de comercio exterior."Ministerio de economia y competitividad. N.p., 1 Jan. 2014. Web. . 66.) Exhibit C 67.) "IMF World Economic Outlook."International Monetary Fund. N.p., 1 Jan. 2014. Web. . 68.) "Can Francois do a Gerhard?."The Economist. N.p., 11 Jan. 2014. Web. . 69.) Dinmore, Guy. "Italy's Matteo Renzi pledges tax cuts and labour reforms."Financial Times. N.p., 12 Mar. 2014. Web. <"Can Francois do a Gerhard?." The Economist. N.p., 11 Jan. 2014. Web. Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |