From Interstate - Journal of International Affairs VOL. 2011/2012 NO. 2How Will the Crisis in the European Single Currency Change the Direction of Intergration Europe?

By

Interstate - Journal of International Affairs 2012, Vol. 2011/2012 No. 2 | pg. 1/1

IN THIS ARTICLE

KEYWORDS

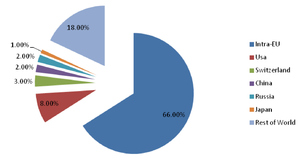

This essay will analyse the on-going events in the Eurozone single currency area. It will look at the current sovereign debt crisis, most obviously manifested in Greece, Portugal and Ireland, and try to envisage how it will change the future course of integration in the European Union. The European Union has evolved through time: the European debt crisis is just the latest in a string of challenges, which will leave its mark on the European Union. The question is what kind of European Union we will be left with when the crisis is resolved. I will do this by briefly looking at two established theories of integration: the intergovernmental approach1 and the supranational approach.2 I will use these two integration theories as a basis for analysing the Eurozone crisis and the potential effects on European governance. My analysis of the composition of European institutions will then be viewed in this context. Finally, I will look at national figures concerning the debt crisis and draw some conclusions on the direction I believe Europe3 will move in as a consequence of it. The Eurozone Crisis in ContextThe events currently engulfing the Eurozone are yet another hurdle which will profoundly affect the course that Europe will take in the years that follow. As with all organisations, the European Union and Eurozone are affected by global events, and the subsequent measures they take to combat these difficulties. The European Integration Project envisaged by Jean Monnet of ‘ever closer union between the states of Europe’ was dreamed out of a desire to see that Europe did not return to war again. Europe had, at that time, experienced two hugely destructive wars within a generation of each other. From the 1950s until the collapse of the Soviet Union and reunification of Germany, in 1990, the propellant for integration was a fear of the influence of Communism or invasion from the Warsaw Pact. With America’s financial and military resources increasingly stretched - due to the Korean and Vietnam wars - it became obvious that Europe was going to have to take a proactive move to integrate economically. Monnet ‒ widely regarded, along with Robert Schuman, as one of the pioneers of European integration ‒ had repeatedly stressed that: ‘economic development and prosperity could best be achieved at a European rather than a national level, and that therefore the route to political integration was a long road that inevitably lay in economics’.4 In many respects, the expectancy of the United States that Europe should increasingly run its own affairs supports this view in the context of 1950s and 1960s Europe. Therefore, in retrospect, and considering Monnet’s views on integration, it seems only logical that Europe has found itself moving along a path towards greater and greater unity. During the winter of 2011 the German Chancellor, Angela Merkel, discussed forging ahead with a new treaty for European Union which would have seen an even closer bond between the states of Europe.5 She had even suggested that she was willing to give up more sovereignty to achieve this aim6. Merkel’s view of how Europe should develop conflicted, however, with how other European countries perceive the European Union’s trajectory. This is precisely because different states view the European project from different angles. Britain, for example, takes a more “hands off” approach to integration, often pressing for the lowest common denominator in European negotiations, the option which retains the most influence for state actors. Britain maintains an intergovernmental approach in its dealing with the European Union. Europe is once again torn between an intergovernmental approach evident in the summit meetings between Nicolas Sarkozy and the German Chancellor, or further supranational integration, which could effectively lead to the creation of a United Federated States of Europe. At the moment, Europe is neither, which fuels confusion as to the direction that integration in Europe should take. The Maastricht Treaty tried to be everything to everyone, with both supranational and intergovernmental functions attached – leading to the creation of the pillar system of both intergovernmental and supranational elements. The treaty led to a less coherent structure for the European Union. The Lisbon Treaty, which came into effect in late 2009, has attempted to correct the deficiencies of Maastricht and push integration forward after the failure of the Constitutional Treaty. Functionalism and SpilloverThe difficulties of the European Union, and thus also of the Eurozone, difficulties stem from a central problem: they are neither fully integrated nor completely intergovernmental organisations. The countries are in so much difficulty not because they are similar in economic structure, as federalists would hope, but exactly because they are profoundly dissimilar: some member states – mainly in Northern Europe – have been much better equipped to deal with the on-going difficulties with debt; others less so equipped, such as many Southern states of Europe overwhelmed by a toxic concoction of rising expenditure, negative or low growth and rising, unsustainable debt levels. The Eurozone crisis has highlighted that having a single currency, in other words uniting the currencies of Europe under a single monetary policy, should have been accompanied by greater coordination of fiscal policy. The idea of having a single monetary area devoid of any kind of fiscal coordination simply does not work. The coordination of fiscal policy should have been seen as a natural progression from monetary union. The situation we find ourselves in at the moment is one where some states in Europe have been able to borrow greater funds than they could manage over the long term. States like Portugal, Ireland and Greece are finding themselves in toxic situations where global and especially European growth has fallen and remained stagnant and, therefore, their debt to GDP ratios have increased to unstable levels. The Maastricht Treaty created the foundations for the introduction of a currency union but not a fiscal union. If these states had not entered the single currency, the solution would have been relatively straightforward. They would have had monetary independence. They could have simply reduced their interest rates, deleveraged their currencies and cooled down their economies long before debt levels became unsustainable. They could have cut their way back to competitiveness on the international stage. The fact that monetary union moves this element of integration to the supranational level takes away the member states’ control over their own economies. However ‒ as David Mitrany and functionalists have suggested ‒ there is a spillover effect from monetary policy onto other policies. Mitrany pointed out that a functionalist approach would mean that ‘as more and more areas of control were surrendered, states would become less capable of independent action’.7 When states handed over control of interest rates to the European Central Bank (ECB), they surrendered their capability to control their own monetary policy. However, in handing over this power to a higher authority, the states should have also surrendered parts of their fiscal policy: the two policies are inextricably linked. It seems that leaders, in their rush to introduce the currency and to get a consensus on the Maastricht Treaty, did not create the necessary solid common fiscal groundwork, and chose instead to set up a weaker system of fiscal criteria. It is now apparent that these criteria failed comprehensively to bind the states involved to create a true single economic zone needed for a single currency to function properly. States within the Eurozone decided not to create a supranational organisation to govern fiscal policy at the inception of the single currency in 1999. There is now little choice but to integrate fiscally. If the Eurozone fails to draw up a plan to at least begin the process of tax harmonisation and Eurozone-wide government bond insurance, the consequences could be enormous - potentially including the collapse of the Euro and European integration. The Future of the Eurozone and the European UnionThere is now a very real possibility that we will end up with a two-track Europe, with the Eurozone member countries integrating faster than the wider European Union. It is evident that not all of the wider European Union member states are willing to integrate at the same pace as those in the Eurozone. The Eurozone member states will be forced together by the circumstances of the debt crisis: the argument for integration of non-European single currency states, whilst perhaps desirable, is not so pressing. It has always been an aim of the central European states to move towards “ever closer union”: it is a founding concept of the integration process. The difficulty for integration arises because different states interpret Europe differently. Germany, for historical reasons, has generally been more willing to move along a more supranational path to integration and its views are shared by the other members that originally founded the European Community and European Atomic Energy Community (EURATOM). However, countries like the United Kingdom and Denmark view European integration from a much more intergovernmental perspective, as a collection of European states coming together to form an economic free trade zone. The Amsterdam Treaty correctly analysed that the European Union, to move forward, was going to need flexible integration. This means that some states in Europe will integrate faster than others. The Schengen Area and the Euro currency are two very obvious manifestations of this new way of going about integration. It seems that whilst useful to allow states to choose which areas of European integration they want to sign up to and want to develop further permits a less rigid approach, it creates greater incoherence as to the general direction of integration, and can cause confusion amongst member state citizens. It has created a multi-speed integration project. A Federal Europe or the Collapse of the European Project?Since the 1986 signing of the Single European Act at Fontainebleau in France, it has been evident that Europe has been given a one way ticket towards further integration. The realisation that debt difficulties in one European country can have a knock on all the others is a vindication of just how far Europe has come on its long journey towards becoming a federal entity. Some cynics would argue that a federal state has always been the end goal, and that we are already there in all but name with the establishment of the European External Action Service (EAS)8 under the command of the High Representative for Foreign Affairs and Security Policy – a position currently held by Baroness Catherine Ashton of the United Kingdom. External Relations was one of the last areas that Europe lacked any real competence in before Lisbon, but now finds itself as a key actor. Passerelle clauses, which were introduced in the Lisbon Treaty and allow member states to vote upon policies using qualified majority voting rather than unanimity, could also lead us to expect an erosion of sovereignty in the arena of foreign affairs.9The economic interdependence of European states – and the realisation of a truly interconnected and global capitalist system in the wider context – has been made glaringly obvious by the on-going debt crisis. In terms of indebtedness, ‘fourteen out of 27 countries in the European Union had public debt exceeding 60% of their gross domestic product at the end of 2010’.10 Out of these countries, some of the worst offenders were those that share the Eurozone currency including Greece at ‘166%’11, Portugal at ‘106%’12 and Ireland at ‘109%’13 of their GDPs respectively. The financial crisis has completely distorted Eurozone member states budget deficits and for the worst-affected countries their budget deficits will likely not return to the 3% budget deficit needed for initial entry into the Euro zone for many years to come. The Lisbon Treaty has tried to wrestle even more powers from member states to create a more coherent Europe: in doing so they have moved further towards Monnet’s original aim to cement ‘the development of supranational institutions as the basis for building a genuine economic community that would adopt common economic policies and rational planning procedures’.14 The most recent Euro barometer polls have been suggesting that, despite Europe’s limbo about how it should respond to the crisis, Europeans still believe that it is at a Eurozone and European level that the debt crisis can best be managed, and not at the level of member states: ‘23%’15 of respondents felt that the European Union was best placed to deal with the current difficulties compared with ‘20%’ of people who felt that national governments should take the lead. ConclusionGreater integration is now no longer an option but rather something that cannot be escaped: countries that have the single currency will have to align their economies – or treat the Eurozone as one large economy and give their ability to raise taxes to a central supranational organisation. Many countries in Europe have been swamped by the financial crisis. If Europe fails to achieve further integration, perhaps with the creation of Euro bonds or by giving the European Central Bank (ECB) the power to act as a supranational lender of last resort, and continues with the European Union that existed before the financial crisis then there is the real possibility that the entire integration project could be pulled down. As this essay has highlighted, the Eurozone crisis puts European Integration at yet another crossroads and there is no reason to suggest that Europe will make it to the other side. The European Union is being presented with another hurdle to jump: just as the Soviet threat and global political environment during the mid-twentieth century pushed Western European states together, and then the collapse of the Soviet Union prompted the adaptation and eventual eastern expansion, Europe has to change and acknowledge the global political and economic environment post-credit crunch. The Lisbon Treaty was a compromise agreement to replace the failed Constitutional Treaty. However, it failed to foresee and get the necessary reforms through that will be needed for the institutions of the European Union to deal adequately with the continuing fallout of the financial crisis. A new treaty will be needed to prepare Europe for the challenges that lie ahead, but increasing scepticism about Europe – especially from countries like the United Kingdom – will make this difficult. Yet, failure to do more and make radical changes – perhaps greater than those proposed by Nicolas Sarkozy and Angela Merkel at their many summits in the winter of 2011 – could put the whole project for European integration in jeopardy. It will take bold leadership to make sure Europe comes out of this crisis prepared to face the international political environment stronger than before.This essay predicts that we may well see a break-away group comprising of Euro currency member states. Passerelle clauses introduced by the Treaty of Lisbon16 will serve their intended purpose and be used to get around domestic opposition to further integration amongst Eurozone member states. The further integration required will be unacceptable for non-Eurozone member states. We may even see two European Unions appearing: a supranational quasi-Federal Europe of single currency member states; and a “Europe of the rest”, an organisation orientated along intergovernmental lines resembling a gathering of states related in much the same way as Switzerland and Norway’s current relationship with the European Union. Endnotes

Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |