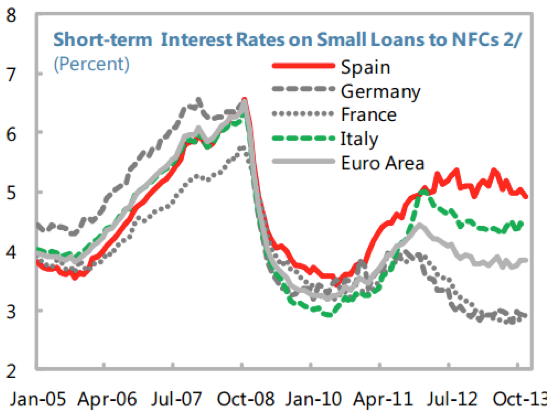

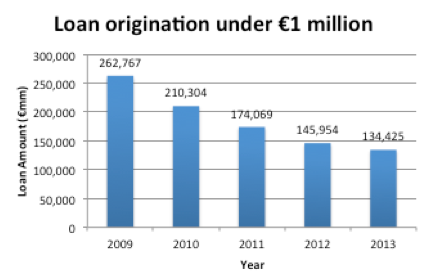

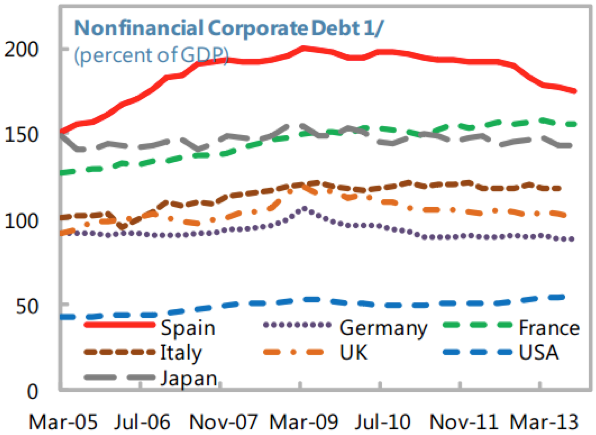

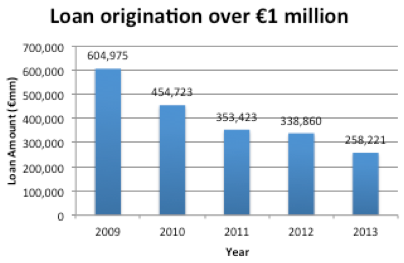

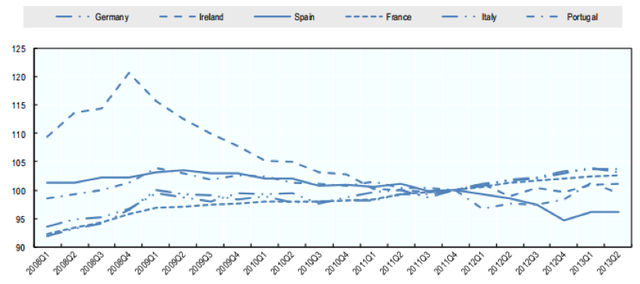

Featured Article:The Spanish Financial Crisis: Economic Reforms and the Export-Led RecoveryDirect Effects of Spanish ReformsThe reforms implemented by the Rajoy administration have been largely linked to an 'export-led recovery' to lead Spain out of its crisis. 39 Domestic demand has decreased so significantly, with no real signs of recovery, that growth will initially come from outside Spain. The growth in exports will help companies pay down debt faster, create more tax revenues for the government, and create more jobs inside Spain, each of which will eventually lead to higher domestic demand. The three areas of reform have attempted to address the issue of increasing Spanish competitiveness, and this section will show that while the reforms have had some success, the full effects of the reforms will not be felt for many years to come. Moreover, there are a few key risk factors associated with the reforms that could derail the recovery. Financial Market Reform EffectsWhile the effects of financial and budget reforms do not seem to have a direct correlation with increasing exports, they are important in reestablishing credibility for the Spanish economy to the outside world and decreasing cost of capital while increasing access to capital for Spanish firms.All indicators suggest that the Spanish financial market reforms have had a remarkable impact on restoring credibility and confidence in the banking sector. As an overview, interest rates have converged towards those of Germany, banks have recapitalized in order to pass European Union stress test benchmarks, and the banking sector is on its way to being cleaned up. Yet, Spanish banks are still holding a lot of bad assets on their balance sheets for fear of taking losses and the entire Spanish economy is in the process of deleveraging. The Outright Monetary Transactions announced by the head of the European Central Bank, Mario Draghi, have been quite successful in lowering borrowing rates for Europe's periphery countries. Spain's 10-year treasury is down from a peak of 7.64% in July 2012 to 3.08% in April 2014. 40 Draghi has continued his rhetoric on lending countries 'whatever it takes', and he has even considered making the European Central Bank deposit rate negative to spur investment and inflation.41 The European Central Bank seems committed to providing countries with the proper access to capital while making sure banks are properly capitalized to reduce the chances of another crisis. The plan of recapitalization of Spanish banks is currently on track. The initial reforms have created multi-year plans which include management overhauls, lending restrictions and cost cutting. Initially, ten banks were found to face capital shortfalls of €56 billion based on a benchmark of a 6% capital ratio. These shortfalls were mainly filled in the first quarter of 2013, 70% by public capital, 23% by junior debt bail-in, and 7% by private capital. Despite considerable progress, the banks still need to be cleaned up further, and in a follow-up action, capital requirements were increased to 9% by the European Commission to be enforced by the end of 2014. 42 The 'bad bank' SAREB is also on track, as the program has completed the transfer of assets, issuances of bonds and injections of capital. The Fund for Orderly Bank Restructuring, a government entity created to help the restructuring of the cajas, and the owner of 45% of SAREB, held 18% of total gross loans in all of Spain at the end of 2012. The government is currently divesting assets to private, international investors with the hope of finishing by the end of 2017. Catalunya Banc and Commerzbank AG are respectively marketing portfolios of €6.95 billion of residential home loans and €4.4 billion of commercial-property loans to investment banks and U.S. private equity firms such as Blackstone Group LP, Cerberus Capital Management LP and Apollo Global Management LLC.43 Although SAREB estimates a loss in 2013, total cash flows exceeded operating expenses, and it was able to redeem some of its senior debt. 44 While the future profitability of the entity will depend on a housing rebound in Spain, prices for distressed real estate debt in Europe have been around 80 cents on the dollar, much higher than prices that investors normally pay for similar debt. European banks increased their sales of troubled debt by 40% in 2013, implying that at the current prices, the Spanish government may be profitable in the sale of the assets of SAREB.45 Finally, structural reforms have remade the cajas system. On December 27, 2013 the Spanish government enacted Ley 26/2013, de cajas de ahorros y fundaciones bancarias to strengthen regulation for the savings banks by enhancing corporate governance and limiting the size and scope of the banks outside the native region.46 Further, many savings banks were spun off as commercial banks before the reforms were instituted, and these commercial banks accounted for one-sixth of all assets of banks. The Spanish government has ensured that the new commercial banks were transformed into banking foundations over which the Banco de Espana has regulation. These foundations are required to describe ownership policies, hold investments in diversified assets, and hold a reserve fund of liquid assets. Additionally, nonbank financing has strengthened. In December 2013, the first bond market for pymes (small and medium sized enterprises) opened. Throughout this year, hedge funds and private equity firms have increased their investments in Spain, offering banks a buyer for the troubled assets and offering pymes credit that is not available from Spanish banks, although at a much higher rate than before the crisis.47 The financial reforms, with respect to the export-led recovery, were aimed at increasing credibility in the financial sector to decrease the cost of capital to companies. Yet, ironically, the deleveraging of the economy has created a dearth of capital in Spain. While Spanish treasury yields have converged toward those of Germany, the inexpensive capital has not reached small and medium sized companies, and the amount of net new commercial credit extended in Spain has decreased each of the past 5 years.48 As seen in Figure 1, the cost of small loans in Spain is still very high compared to its European peers. While the spread between German and Spanish bonds is around 200 basis points, the spread between credit to small and medium sized companies in Spain and Germany is near 500 basis points. After implementing capital requirements, Spanish banks have been wont to extend loans of any type for fear of increasing their liabilities to unsustainable levels. Spanish banks have been additionally wary of loaning to small and medium sized businesses because of risk-weighted capital requirements. While loans to the Spanish government carries a low risk-weight, loans to small businesses are weighted much more, thereby increasing the capital requirements.49 Now, growing small businesses cannot receive credit from banks at any rate, and are forced to look to European and American investment firms lending at a rate nearly 500 basis points higher than Spanish banks were before the crisis.50 As a result, as seen in Figure 2, loans under €1 million to companies have decreased 49% since 2009. Figure 1 Additionally, the Spanish private sector is in the process of deleveraging. As seen in Figure 3, throughout the crisis, the Spanish private sector became more highly levered than Italy, France, or Germany, peaking at above 200% of GDP in 2009. Companies experienced difficulty making debt payments during the crisis, and are now attempting to decrease the amount of debt on their balance sheets in order to improve their leverage and coverage ratios. Even though spreads on interest rates for large companies in Spain have decreased, 51 few large Spanish companies are looking to borrow. As seen in Figure 4, in order to reduce the risk of bankruptcy and financial troubles in the case of another downturn, even the large companies in the Spanish private sector borrowed 57% less in 2013 than in 2009 to decrease the amount of debt it holds. Figure 2 Figure 3 The combination of the deleveraging of the banking system with the deleveraging of the private sector has led to a high cost of capital for small companies in desperate need of capital, as seen by the 500 point spread between small loans in Germany and Spain, and low demand from the companies who can borrow at an attractive rate, as seen by the decrease in large loan origination of 57% over the past five years. As banks and private entities finish cleaning up their balance sheets, this trend has should bottom out by the end of 2014 and the reforms should have significant effects on the access to capital for Spanish companies. Figure 4 Fiscal Measure EffectsThe European Union placed austerity measures on Spain to increase confidence not only in the Spanish economy but also in the future of the EU as a whole. Spain has been diligent in decreasing its deficit to sustainable levels, and is seeing the benefits in international markets. The spending cuts and tax increases implemented by the Spanish government helped Spain decrease its budget deficit from 4.2% of GDP in 2012 to 3.9% in 2013. The European Commission has granted Spain a two-year extension, until 2016, to reduce its budget deficit to 3%, which it expects to accomplish.52 Additionally, the autonomous regions have instituted reforms to lower their budget deficits. Between 2012 and 2013, the aggregate budget deficit of the regions dropped from €10.5 billion to €7.5 billion, a 28% decline.53 Further, the regions are required to adjust their budgets by an additional €8 billion in 2014 and 2015.54 There are many signs that the austerity measures have had positive effects on the credibility of Spain to the rest of the world. As previously mentioned, interest rates on Treasuries have decreased by almost 460 basis points since July 2012, and are only trading at a 30 basis point premium to those of the United States.55 International investors have begun to take larger positions in Spanish companies,56 as the Spanish stock market is up 68% from a low in April 2012 of 6,065 to 10,205 in April 2014.57 In addition, Foreign Direct Investment increased 5% from 2012 to 2013, suggesting a willingness of foreign investors to take large positions in Spanish companies.58 All three pieces of data seem to suggest that the austerity measures have been successful in creating a renewed sense of confidence in the Spanish economy. Labor Market Reform EffectsThe effects of the reforms on the labor market seem to have been the most profound and direct in the landscape of the Spanish economy, although the data is limited to the 24 months since reforms began. Overall, unit labor costs have decreased, the hiring rate has increased, and small firm start-ups have increased. Based on an OECD report in December 2013, unit labor costs have been reduced 3.9% in Spain between the fourth quarter of 2011 and second quarter of 2013,59 although some of this number has to do with reducing public sector wages. The report estimates that the labor reforms induced a drop of between 1.2 and 1.9%. Additionally, the report estimates that the reforms increased the hiring rate by 8%, permanent contracts by 13%, and full-time open-ended contracts by 18%. Finally, the reforms are projected to have raised the share of exits from unemployment to permanent employment by about 14% and increasing small firm start-ups by 30%.60 The labor reforms appear to have the most obvious and significant correlation to the export-led recovery. Because Spain cannot depreciate its currency to increase exports, it must decrease the price of its goods and services another way. By reforming archaic labor laws, Spain appears to have achieved a mechanism of decreasing the unit costs of labor and increasing productivity. As seen in Figure 5 below, Spain has been able to decrease its unit labor costs relative to the costs in the fourth quarter of 2011, while its main competitors in the Euro area have been unable to do so. This decrease gives Spain a distinct advantage in the ability to lower prices of exports. Additionally, the productivity of Spanish workers has increased 1.2% compared to the Eurozone, mainly due to the relative ease of firing workers that the labor reforms have allowed. Figure 5 Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |