|

From Interstate - Journal of International Affairs VOL. 2013/2014 NO. 1 The Interests of Minority and Majority Shareholders in the EU

By Angelika Gorak

Interstate - Journal of International Affairs

2014, Vol. 2013/2014 No. 1 | pg. 2/2 | «

Having examined these theoretical concepts, it is encouraging to see that, in 2001, there was a gleam of hope for minority shareholders in the EU in forms of the Legrand decision in France. A billion-euro takeover was stopped on the grounds that the terms of the deal were unfavourable towards minority shareholders. '[T]he message to French companies is that they can no longer treat their investors, especially minority shareholders, with disdain ... [The cases of Deutsche Telekom, Telekom Italia and Hermes all confirm this positive trend.]'.30 It seems that the Europe Union has awakened to the idea of minority shareholder protection as an actual concept.

More generally, the starting point of a discussion of the EU's mediation between minority and majority shareholders, should be determining the legal basis of the Elfs interference in protection of shareholders' rights. This is said to be Article 54 (3)(g) of the EEC Treaty (later followed by Article 44 (2) (g) of the EC Treaty), which postulates that one of the prerequisites- of the freedom of establishment and the promotion of integration is-the co-ordination of safety measures for the protection of the interests of members in companies, including shareholders. This was a mission entrusted to the Commission and the Council of Ministers.31 It set off an avalanche of measures, starting off with the Fifth Directive. Originally, it envL-.ioned the general meeting as the key tool for this task, with the second and third proposals putting forward the one share-one vote principle. which means that each share entitles to the same voting right.32 However, the project was dropped in 2001. Next, the 1999 Financial Services Action Plan emphasised the need for uniformity across a single market of financial services-, doing away with the significant national differences- in shareholders' rights regulation.

The Societas European Regulation and Directive represented a missed opportunity for modeling such rules. In 2003, the "Modernising Company Law and Enhancing Corporate Governance in the European Union - A Plan to Move Forward" ( Company Action Plan 2003) put share hold ers ' protection on top of the list of priorities in EU company law. This should h appen in a three-fold way: 1) access to information , 2) other shareholders' rights and 3) shareholder democracy. In fact, the construction of this piece has been influenced by this pattern to a certain extent. Finally, Directive 2007 /36/EC , known as the Shareholders' Rights Directive, tends to the same problems. It has been recognised as the first attempt by the Commission to build direct standardised regulation in relation to shareholders' rights in listed companies, not simply piecemeal solutions. Its aim is to reinforce cross-border participation of shareholders at the general meeting and to bring transparency for investors- and the public for a more effective version of corporate governance.33

The next section will introduce some solutions introduced by EU legislation and Member States to tackle the issue of shareholders' rights-to information and transparency. It has been recommended to introduce collective board responsibility for financial disclosure, more disclosure of related party transactions and off-balance sheet transactions-. Therefore, minority shareholders have been given the opportunity to monitor suspicious behaviour of majority shareholders by gathering both public and private information.34

The Fourth Directive has introduced a requirement for the preparation of balance sheets-, profit and loss statements-, annual reports, to which the minority shareholders- have been given full access. However, it must be notes that the information given is not always accurate; some companies may even extend the adoption of annual accounts up to as- much as 13 months- which decreases its reliability. Furthermore, under IAS 24 the EU requires all listed companies or related parties to disclose the nature of the relationship between interested parties, following also the information about the trans action itself, any outstanding balances, including expenses and debts.35 Also, the Commission has made attempt s to improve the transparency of European Private Companies (SPEs) by an amendment to Seventh Directive, requiring companies to disclose all off-balance sheet activities which influence the company. The aim of the amendment is to introduce more transparency to the investors.

The concept of shareholder democracy within the European Union has been introduced by a recommendation of the High Level Group of Company Law Experts on takeover regulation in 2002.36 Having been inspired by the Sarbanes-Oxley Act, European legislation also aims at the creation of independent boards of directors and audit committees, that could certainly reflect the problematic concept of "democracy".

It has been proven, that in order to restrain majority shareholder opportunism it is necessary to create an independent board and give the power to non-executive directors in the areas of the conflict of interest, such as executive remuneration decisions and audit supervision. The Commission has proposed a set of non-binding minimum standards and recommendations for independence of the board and identification of conflicts of interests and also suggested that audit members shall be composed exclusively of non-executive, independent directors.37

Lastly, it must be noted that the development of corporate governance system at national level still remains very unclear. So far, there have been no developments in this area due to seemingly unbridgeable differences in languages and doctrines. The divergence had been clear as to give an example of the presence of block holder systems in France and Germany and a dispersed equity system in the UK and a hybrid system in the Netherlands.

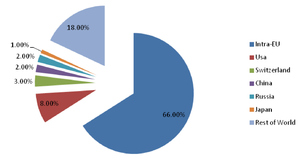

Within the corporate structures, the voting rights are not always divided equally among all holders of the same shares. Admittedly, it has been established that shareholders' voting rights shall be divided in relation to the capital commitment by all of them. In the US, most listed companies follow the aforementioned 'one-share one-vote rule'.38 However, in the EU this is not the case, as the power is concentrated in the hands of a minority of large shareholders, who control the majority of voting rights. It has been confirmed that one-third of EU companies do not follow the one-share one-vote principle. In 2005, a study, commissioned by the-Association of British Insurers (ABI), a group of large institutional shareholders, confirms the grave reality - 'in Europe ... shareholders count themselves lucky if they have a vote'.39 It shows further that:

'only two-thirds of the big European firms included in the FTSE Eurofirst 300 index operate a rule of one share, one vote. In the other third of firms, power tends to be concentrated in the hands of a minority of big shareholders who control a majority of the voting rights. Practice varies widely across Europe. A mere 14% of the firms in the sample from the Netherlands allow their owners one vote per share; 25% of the Swedish firms; and 31 % of the French companies. Things are far more democratic in Germany (97%) and Britain (88%). One-fifth of the companies issue shares with multiple voting rights, giving additional votes to selected shareholders. One in ten firms imposes a ceiling on the number of votes that can be exercised by any one shareholder, irrespective of how many shares he owns'.40

The European Commission seeks to discourage companies and states that hamper foreign investment through golden shares or unfair national laws. Charlie McCreevy, the EU Internal Market Commissioner, approved of the 'elimination of discriminatory treatment of shareholders by an introduction of one-share once vote principle across EU'.41 Certain deviations from that anticipated rule are as follows: multiple voting shares, priority and golden shares,42 voting rights ceiling,43 non-voting shares. It must be noted that the introduction of the one-share one-vote rule may encourage companies to transform into pyramid al structures, create "negative voting arbitrage", encourage value decreasing transactions or even become a takeover defence. The rule has proved to be more politically attractive than economically efficient.

Conclusively, there are few legislative alternatives. Firstly, EU policymakers may just leave the problem open and may not legislate on this issue at the EU-level and in the outcome focus on reinforcing the rules on nonexecutive directors in the areas on minority/majority conflict of interest, focusing also on disclosure standards . Secondly, they may create an optin/ opt-out provision for the Member States. This would allow companies to opt into a one-share one-vote statutory provision or opt out by either charter or by law provision. This could further be strengthened by harmonised transparency requirements and enforcement rules.44

This equal treatment rule concerns capital reductions and share repurchases. Article 42 of the Second Directive postulates that 'the laws of the member states shall ensure equal treatment to all shareholders who are in the same position'. Meanwhile, Article 19 of the Second Directive ensures that share purchases shall be conducted 'without prejudice to the principle of equal treatment of all shareholders who are in the same position'. However, the implementation of the rule differs greatly across Member States: first, the courts may fall back on general principles of fairness to adjudicate, as in the cases of Germany, Austria, and the Netherlands; secondly, the concept could be expressed as a prohibition that imposes criminal liability, dealing with capital reductions, capital redemption and share repurchases, if the shares must be cancelled, as in France and Belgium; thirdly, the unequal treatment of shareholders in share repurchases or capital reductions could also be allowed at large, but the minority shareholders at a disadvantage must confirm the general meeting's decision by a majority vote, as in Spain and Portugal.

The United Kingdom and Italy abstain from legislating in this area.45 All in all, the following observations come into light '( l) the European principle of equal treatment of shareholders- plays a small role, because EU member states must follow rules granting participation of minorities in the decision-making process-, and minorities have substantial protection devices against majorities' or directors' abuses; and (2) EU member states' implementation of the equal treatment rule is-not homogeneous. Thus, the advantages of a mandatory , but vague, equal treatment norm are not clear' .46

The EU is gradually awakening to the benefits behind bett er shareholders' protection. This piece has rnade it clear that both practically and theoretically such an initiative reflects the needs of the corporate entities and the current economic climate. Without making shareholders masters of their own fate, giving them free will and a voice and entrusting them with the necessary tools to make an informed choice, the capital markets will remain lacking in involved investors that can bring back the lost vitality of today's economy.47

The conventional methods employed in the EU to ensure minority shareholder protection at EU level are mandatory takeover bid, squeeze-out and sell-out, setting the price per share as well as the takeover defences (board neutrality, breakthrough, reciprocity).

The mandatory takeover bid is a mechanism designed to uphold the principle of equal treatment of shareholders and to prevent the majority shareholders from interfering directly with the bid. Directive 2004/25/EC, now widely applicable across continental Europe, was originally inspired by a piece of English legislation.

The aforementioned directive makes it compulsory for every owner of a third of the voting rights in the target company to place an offer on the table for the rest of the shareholdings of the business organisation (Article 4). The required percentage is usually 30, but it could be lowered or increased depending on the jurisdiction in question. The chosen source for reaching the set volume- or the legal capacity of the owner of the shares is immaterial. The subjective timing test of prospective fulfilment of possession is now substituted for the objective one which is actual ownership.

The purpose of the mandatory takeover bid is to protect the value of the shares as well as to ensure the "peace of mind" of the minority shareholders. Even thou gh they find themselves in dire straits at the mercy of the new shareholder, they are not to be taken advantage of. However, the mechanism is not without faults. It has been criticised for being too rigid and generally having an adverse effect It is also lacking in justifi cations for a mere partial bid. It has been criticised for being impractical, conditional and sketched in bulk, without any thought given to price restrictions or means of payment

Another option is the "squeeze-out" rule. In short, the majority shareholder is allowed to make an offer for all the rest of the shares and occupy the company once and for all The opportunity arises where the controlling shareholder is in possession of 90 to95 per cent (the percentage varies from one jurisdiction to another) or the shares. Prospective attainment of shares is also included, for no less than 90 per cent. The time limit allowed for the acceptance of the offer is three months. It depends on the Member States to ensure fair remuneration. It was justified in the following way: ,the presence of minority shareholders after a takeover bid leads to various costs and risks, the squeeze-out right makes takeover bids more attractive for potential bidders and may be viewed as a counterpart to the mandatory bid rule, and the squeeze-out right L'> more efficient than a delisting procedure. The Group notes that property rights are protected at national and international level, but observes that various courts in the Member States have ruled that the squeeze-out right is not to be regarded as incompatible with these protective provisions'.

At the same time the minority shareholders may require the majority to buy out their shares ("sell-out right"). Its existence is explained thus: 'the majority shareholder may be tempted to abuse his dominant position after a takeover bid, minority shareholders cannot obtain appropriate compensation by selling their shares in the market if it has become illiquid, the sell-out right is an appropriate mechanism to counter the pressure on shareholders to tender in the takeover bid, and finally the sell-out right is to be regarded as a counterpart for the squeeze-out right'.

The next problem is how to set the price per share. The whole point of any measures would be to provide a equitable payment that does not take advantage of the fact that minority shareholders are backed up in the corner. The Takeover Directive provides that shares should be bought at the highest price paid for the same securities by the person making the bid, over a period varying from one jurisdiction to another. It must be a minimum of six months and a maximum of twelve months prior to the launch of the bid. 'The justification for this method can be found in Winter Report, according to section 2.2 of which the highest price paid rule offers the double benefit of allowing the minority shareholders to fully share the premium paid by the acquirer at any time in the period under consideration, while at the same time giving the offer or the certainty that he will not have to pay more in the mandatory bid than he has been willing to pay in the preceding period and as a result permitting him to determine himself at which maximum price he is prepared to acquire all securities of the company'.

There are two alternative caveats: the post-bid defence (which diminishes the volume of shares the bidder may attain or attempt to increase the value of the bid) and pre-bid defence (which "gets in the way" of acquisition like share transfer restriction).

The board neutrality rule is a derivative of post-bid defences, and during the bid period ensures that approval is given from general meeting of shareholders before the board of the company dare to tread any further. Hence, this may provide a smoother transitional period for the takeover by placing certain restrictions on the board's power and assure the peaceful co-operation between the management and the shareholders.

The breakthrough rule is an antithesis for pre-bid defences during a takeover. It also aims at removing the hurdles in the way of the takeover, but through imposing limitations (share transfer and voting restrictions) throughout that authorise the bidder to alter the articles of association or even get rid of the board. Regulating the balance between capital and control, the concept allows superseding voting rights at the general meeting.

Reciprocity principle entitles Member States to give significant leeway to a company that applies the board neutrality rule and/or the breakthrough rule simultaneously to oppose the bidder who abides by different rules. This 'reciprocating power' can be only in case of an explicit permission by the Member State and the general meeting of the company.

BBC NEWS, 'Italian dairy boss gets 10 years'. BBC news (online), I8 December 2008. Available at: http: // news.bbc. eo.uk/go/pr / fr// l/hi/business/7790803.stm (Accessed 28 July 2012).

Buck, T. 'EU seeks-to end bias among shareholders'. Financial Times (online), 16 October 2005. Available at http ://www.ft.com /cms/ s/0/ae l 7a66e-3e6f- l l da-a2cb - 00000e25 I lc8.h tml#axzz21 vL9nllG (Accessed 28 July 2012).

Collyns, C. 'The Crisis though the Lens of History', Finance and Development A quarterly magazine of the IMF, 45. 4 (Dec 2008). Available at: http://www .imf.org!external/pu bs/ft/fandd/2008/12/co llyns.htm (Accessed 23 April 2012).

De Luca, N., 'Unequal Treatment and Shareholders' Welfare Growth: 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov2009). Available at: http ://papers .ssrn.com/so l3/pape rs.cfm?abstract id=l 503089 (Accessed 24 April 2012). pp. 853 - 920.

Holderness , C. G. and Sheehan, D. P. 'The Role of Majority Shareholders in Publicly Held Corporations, An Explanatory Analysis', Journal of Financial Economics20 (1988), pp. 317 - 346.

Hong, F. X. 'Protection of the Shareholders' Rights-at EU Level: How Far Does-It Go?', European Comp any Law 6. 3 (2009), pp. 124-130.

Kalss, S. 'Shareho lder Suits: Common Problems, Different Solutions and First Steps towards a Possible Harmonisation by Means-of a European Model Code', European Company and Financial Law Review6. 2 (2009), pp. 324-347.

Khachaturyan, A. 'The One-Share-One- Vote Controversy in the Elf, European Business Organization Law Review, 8 (2007) pp. 335-367.

Kim, KA., Kitsabunnarat, P. and Nofsin ger, J. R., 'Shareholder Protection Laws and Corporate Boards: Evidence from Europe', Working Paper. Published 1 February 2005. Available at http://fin ance.ba.ttu.e du/new / documents /r esearchSemina rs/ spring 2005 /L aw°/o20and%20Corp ora te%20Govern anc e.pd f (Accessed 23 April 2012).

Lee, J. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803- 830.

Levine, R. 'The Governance of Financial Regulation, Reform Lessons from the Recent Crisis', International Review of Finance 12.1 (2012), Available at http: //www.imf.org / external/n p/seminars /eng/2011/res2 /pdf /rl.pdf (Accessed 23 April 2012) pp. 39-56.

Levy, R. E. 'Freeze-out Transactions The Pure Way: Reconciling Judicial Asymmetry between Tender Offers and Negotiated Mergers', West Virgi.nia Law Review 106 (2004) pp. 305-357.

Masauros, P. E. 'Is the EU Taking Shareholder Rights Seriously?: An Essay on the Impotence of Shareholdership in Corporate Europe'. European Company Law7. 5 (2010), pp. 195-203.

McCahery, A. J and Vermeulen, P.M. E. 'Corporate Governance Crises and Related PartyTransactions: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hideki Kanda, and Harald Baum (eds) Corporate Governance in Context: Corporations, States, and Markets in Europe, Japan, and the US, Oxford; New York Oxford University Press, 2005, pp. 215-246.

Norg es Bank, 'Shareholders rights'. Norges Bank Investment Management (online), Available at http: //www.nbim .n o/en/p ress-and publications/ feature -artides /2006/Shareholde r-rights / (Accessed 02 July 2011).

Sacasa, N. 'Preventing Future Crises Priorities for Regulatory Reform After the Meltdown '. Finance and Development A quarterlymag-azine of the IMF 45.4 (2008) Available at http :/lwww.imf.org:/external/pubs/ft/fandd/2008/ 12/sacasa.htrn (Accessed 23 April 2012).

Szentkuti, D. Milwrity shareholder protection rules in Germany, France and in the UK-A Comparative Overview. Thesis submitted at Central European University. March 2007.

The Commission of the European Communities, 'Commission Recommendation of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board' . Official Journal of Europ ean Union, 25.2.2005. Available at: http:! /eurlex.europa .eu/LexUriServ/LexUriServ.do?uri =OT:L:2005:052:005 1:0063:EN:PDF (Accessed 01 July 2011).

The Economist, 'What Shareholder Democracy?' The Economist(online), 23 March 2005. Available at http://www.eco n omist.com/node/3 793305?story id=El PSTPPDV (Accessed20 June 2011).

The Economist, 'Europe's revolting shareholders' The Economist(online), 10 Mat 2001 Available at: htt p:/ /www.economist.com/no de/620394 (Accessed on 20 June 2011).

The Free Dictionary by Farlex, 'Majority Shareholder'. Available at: http://fi n ancial-dictionary .thefreedictionar y.com/ Majority+Shareho lder (Accessed 02 July 2011).

Wyckaer, M. and Geens, K 'Cross-border mergers and minority protection: An open-ended harmonization' , Utrecht Law Review 4.l.(M arch2008). pp. 45-52.

Authors: Angelika Gorak and Sofiya Kartalova

Angelika Gorak is a graduate of the Department of Law and Criminology, Aberystwyth University.

Sofiya Kartalova is currently pursuing a Bar Profes sional Training Course at BBP University College. She is also a graduate of the Department of Law and Criminology, Aberystwyth University.

- Collyns, C. 'The Crisis though the Lens of History', Finance and Development A quarterly magazine ofthe L.\1.F, 45. 4 (Dec 2008). Available at: http://www.imf.org/exte rnal/ pubs/ft/fan dd /2008/12/collyn s.htm (Accessed 23 April 2012).

- 'Po rtfolio di versification is not enough to manag e credit risk, and it cannot fully repla ce due diligence' quoted in Sacasa, N. 'Preventing Future Crises Prioritie s for Regulatory Reform After the Meltdovm '. Finance and Development A quarterly magazine of the L.\.1.4F5 .4. (2008) Available at http://wv.rw.imf.org/exte rn al/pub s/ft/fa ndd/200 8/12/sacasa .htm (Accessed 23 April 2012).

- Levine, R. 'The Governance of Financial Regulation, Reform Lessons from the Recent Crisis', International Review of Finance 12.1 (2012), Available at: http: II www.imf.org/ extern aVnp/ seminar s/ eng/2011/res2 /pdf /rl.pdf (Accessed 23 April 2012) pp. 39- 56.

- Lee, f. 'Four Models of Minority Shareholder Protection. in. Takeover s'. European Business Law Review. 16. 4. (2005) pp. 803 - 830 (p. 803) .

- 5 Szeutkuti. D. Minority shareholder protection rules ill Germany, France and in the UK-A Comparative Overview. Thesis submitt ed at Central European University. Mar ch 2007, p. 9.

- 6 The Free Dictionary by Farlex., 'Majority Shareholder'. A vailabk at: htt p://financi aldictionary. thefreedict ionary.com/Majorit;y+S hareholder (Accessed 02 July 2011 ).

- Szeutkuti. D. Minority shareholder protection rules ill Germany, France and in the UK-A Comparative Overvi ew. Thesis submitted at Cent ral Europ ean Univer sity. March 2007 , p. 9.

- Levy, R. E. 'Fr eeze-out Transactions The Pur e Way: Reconciling Judicial Asymmetry between Tender Offers and Negot iated Mergers' , West Virginia Law Review 106 (2004) pp . 305-357 (p. 320).

- Levy, R. E. 'Freeze-out Transa ctions The Pure Way: Reconciling Judicial Asymmetr y between Tender Offers and Negotiated Mergers', West Virginia Law Review 106 (2004) pp. 305-357 (p. 320).

- as cited in Levy, R. E. 'Fr eeze-out Transactions The Pure Way: Reconciling Judicial Asymmetry between Tender Offers and Negotiated Merger s', West Virginia Law Review 106 (2004) pp. 305-357 (p. 321 ).

- Lee, f. 'Four Models of Minori ty Shareh older Prot ection in Takeovers '. European Business Law Revi ew. 16. 4. (2005) pp . 803 ~ 830 (pp. 805-808).

- Wyckaer , M. and Geens, K. 'Cross-border mergers and minorit y protection: An open-ended harmonization ', Utrecht Law Review4.l.(March 2008). pp. 45-52. (pp. 45-47).

- Holdern ess, C. G. and Sheehan, D. P. 'The Role of Majority Shareholders in Publicly Held Corporations, An Explanatory Analysis' , Journal of Financial Economics 20 (1988), pp. 317 -346.

- McCahery, A. J and Vermeulen, P.M E. 'Corporate Governa nce Crises and Related Party Transactions: A Post -Parmalat Agenda' in Klaus f. Hopt, Eddy Wymeersch, HidekiKanda, and Harald Baum (eds) Corpo rate Governance in Context: Corporations , States, and 1vfarkets in Europe, Japan, and the US, Oxford ; New York: Oxford University Press, 2005, pp. 215-246 (p. 220).

- BBC NEW"S, 'Italian dairy boss gets 1 O years '. BBC news (on line), 18 December 2008. Available at: http://news.bbe.co . uk /go/pr/fr/ -fl/hi!bus incss/7790803. stm (Accessed 2 8 July 2012) .

- McCahery, A. J and Vermeu len, P.M E. 'Corporate Governance Cris.es and Related Party Transaction s: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wyrneersch , Hideki Kanda, and Harald Baum (eds) Corpora te Governance in Context: Corporations, States, and 1..\1.arketisn Europe, Japan, and the US, Oxford ; New York: Oxford University Press, 2005, pp. 215 - 246 (p.220) .

- McCahcry , A. J and V crmeu len , P.M E. 'Corporate Governance Crises and Related Party Transaction s: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wyrneersch , Hideki Kanda, and Harald Baum (eds) Corporate Governance in Context: Corporations, States, and Markets in Europe, Japan, and the US, Oxford; New York: Oxford University Press, 2005, pp. 215 - 246 (p.220) .

- Directive 2004/25/EC ofth_e European Parliarnentand of the Council of 21 april2 004 on takeover bids

- Lee, f. 'Four Mod els of Minori ty Sharehold er Prot ection in Takeovers '. European Busin ess Law Revi ew. 16. 4. (2005) pp . 803 ~ 830 (p. 803, p. 807)

- 20 Lee, f. 'Four Models of Minority Shareho lder Protection in. Takeovers' . European Business Law Review . 16. 4. (2005) pp. 803-830 (p. 809-813) .

- 21 For an. extend ed discu ssion of the EU' s prote ction of sharehold ers, see appendix .

- 22 ( 1843) 2 Hare 461.

- Lee, f. 'Four Models of Minority Shareholder Prot ectio n in Takeovers' . European Business Law Review. 16. 4. (2005) pp. 803-830 (p. 814).

- Kalss, S. 'Shareholder Suits: Common Problems, Differ ent Solutions and First Steps towards a Possible Harmonisation by Mean s of a European Model Cod e', European Company and Firnmcial Law Review 6. 2 (2009), pp. 324-347 (pp. 339-340) .

- Lee, f. 'Four Models of Minorit y Shareholder Protection in Takeovers' . European Business Law Review. 16. 4. (2005) pp. 803 - 830 (p. 815).

- Kim. K. A., Kitsabunnarat, P. and Nofsinger, J. R., 'Shareholder Prote ction Laws and Corporat e Boards: Evidence from Euro pe', Working Paper. Publi shed 1 Februa ry 2005. Available at: http ://finance.ba.tt u.edu /new/do cumcn ts/ researchSeminar s/spriug2005/Law%20and%20Corporate%20 Governance.pd f (Acces.sed 23 April2012) .

- Lee, f. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review . 16. 4. (2005) pp. 803-830 (p. 815).

- Lee, f. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803-830 (p. 817).

- Lee, f. 'Four Models of Minority Shareholder Prot ection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803-830 (pp. 817-818).

- The Economi st, 'Europe's revoltin g shareholder s' The Economist(on line), 10 Mat 2001 Available at: h ttp ://www .econmnist.co m/ nod e/620394 (Accessed on 20 June 2011).

- Hong, F. X. 'Protect ion of the Shareho lders ' Rights at EU Level: How Far Does It Go?', European Company Law 6 . 3 (2009) , pp. 124-130. (p. 124).

- Norges Bank, 'Shareho lders right s'. Norges Bank Investment Aianagement (onli ne), accessible at http: II www.nbim .no/ en/pr ess-and -pub lications/feature -articles/2006 /SharehoWer -rights/ ( Accessed 02 July 2011) .

- Hong, F. X. 'Protection of the Shar eholder s' Right s at EU Level: How Far Does It Go?' European Comp any Law6. 3 (2009), pp. 124-130 (p. 124-125).

- McCahery, A. J and Vermeulen , P.M E. 'Corpora te Govern ance Cris.es and Related Party Tra nsactions: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hideki Kand a, and Harald Baum (eds) Corporate Govern ance in Cont ext Corporation s, States, and Markets in Europ e, Japan, and the US', Oxford ; New York: Oxford University Press, 2005, pp. 215-246 (p.220).

- McCahcry, A. J and V crmeulen, P.M E. 'Corpora te Governan ce Crises and Related Party Tran sactions: A Post-Parm alat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hidek i Kand a, and Harald Baum (eds) Corporate Governanccin Cont ext: Corporatio ns, States, and Market s in Europe, Japan, and the US, Oxford; New York: Oxford University Press, 2005, pp. 215-246 (p. 220) .

- Khachatur yan, A. 'The One-Share-One-Vote Controversy in the EU', Europ ean Business Orga nization Law Review, 8 (2007) pp . 335 -367.

- The Commission of the European Communiti es, 'Commission Recommendation of 15 February 2005 011 the role of non-executive or supervisory dir ectors of listed companies and on the committees of the (supervisory) board '. Official Journal of European Union, 25.2.2005. Available at http:/lc urlcx.curopa .eu/LcxUr iServ/LexUriScrv.do?uri =Of:L:2005:052:0051:0063:EN:PDF (Accessed 01 fuly2011) .

- http:IIwww.nbim.no /en/ pre ss-and -publicat ions/fcature -articles/2006 /SharehoWer -rights/ ( Accessed 02 July2011).

- The Economist, 'What Sharehold er Democracy?' The Econ omist( onlinc), 23 March 2005. Available at http :l!www.econ.omist.com/nod e/3793305?story id=El PSTPPDV (Accessed 20 Tune 2011).

- The Economist, 'What Share hold er Demo cracy?' The Economist(online) , 23 March 2005. Available at htw://www. ecorromist. com/nod e/3793305?story id=El PSJPPDV(A ccessed 20 Jun e 2011).

- Buck, T. 'EU seeks to end bias among shar eholders'. Fin ancial Times (on line), 16 October 2005. Available at http :ffwww.ft.comfcms fs/Ofael7a66e-3e6f-ll da-a2cb--OOOOOe12l5c8 .html#axzz2 1vL9n llG (Accessed 28 July 2012).

- These grant special rights to the holder irrespective of his equity stake.

- A proh ibition to vote above certa in thr eshold , irrespective of the numb er of share s.

- Khachaturyan, A. 'The One-Share- One-Vote Contro versy in the EU', European Business Organi zation Law Review, 8 (2007) pp . 335-367 (p. 16).

- De Luca, N. 'Unequal Treatment and Shareholders' Welfure Growth : 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov 2009). Available at : http ://papers .ssrn .com/sol3/pape r s.din.?abstract i.d=l503089 (Accessed 24.April 2012). pp. 853-920 (pp. 871-873).

- De Luca, N. 'Unequal Treatment and Shareholders' Welfure Growth: 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov 2009). Available at :http:// papers.ssrn.com!soB/papcrs.cfm?abstractid=l503089 (Accessed 24 April 2012). pp. 853-920 (p.875).

- Masauro s, P. E. 'Is the EU Taking Shareholder Rights Seriously?: An Essay on the Impote nce of Shareholdersh ip in Corporate Europe ' Europea n Compa ny Law 7. 5 (2010), pp . 195-203 (p. 203).

BBC NEWS, 'Italian dairy boss gets 10 years'. BBC news (online), I8 December 2008. Available at: http: // news.bbc. eo.uk/go/pr / fr// l/hi/business/7790803.stm (Accessed 28 July 2012).

Buck, T. 'EU seeks-to end bias among shareholders'. Financial Times (online), 16 October 2005. Available at http ://www.ft.com /cms/ s/0/ae l 7a66e-3e6f- l l da-a2cb - 00000e25 I lc8.h tml#axzz21 vL9nllG (Accessed 28 July 2012).

Collyns, C. 'The Crisis though the Lens of History', Finance and Development A quarterly magazine of the IMF, 45. 4 (Dec 2008). Available at: http://www .imf.org!external/pu bs/ft/fandd/2008/12/co llyns.htm (Accessed 23 April 2012).

De Luca, N., 'Unequal Treatment and Shareholders' Welfare Growth: 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov2009). Available at: http ://papers .ssrn.com/so l3/pape rs.cfm?abstract id=l 503089 (Accessed 24 April 2012). pp. 853 - 920.

Holderness , C. G. and Sheehan, D. P. 'The Role of Majority Shareholders in Publicly Held Corporations, An Explanatory Analysis', Journal of Financial Economics20 (1988), pp. 317 - 346.

Hong, F. X. 'Protection of the Shareholders' Rights-at EU Level: How Far Does-It Go?', European Comp any Law 6. 3 (2009), pp. 124-130.

Kalss, S. 'Shareho lder Suits: Common Problems, Different Solutions and First Steps towards a Possible Harmonisation by Means-of a European Model Code', European Company and Financial Law Review6. 2 (2009), pp. 324-347.

Khachaturyan, A. 'The One-Share-One- Vote Controversy in the Elf, European Business Organization Law Review, 8 (2007) pp. 335-367.

Kim, KA., Kitsabunnarat, P. and Nofsin ger, J. R., 'Shareholder Protection Laws and Corporate Boards: Evidence from Europe', Working Paper. Published 1 February 2005. Available at http://fin ance.ba.ttu.e du/new / documents /r esearchSemina rs/ spring 2005 /L aw°/o20and%20Corp ora te%20Govern anc e.pd f (Accessed 23 April 2012).

Lee, J. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803- 830.

Levine, R. 'The Governance of Financial Regulation, Reform Lessons from the Recent Crisis', International Review of Finance 12.1 (2012), Available at http: //www.imf.org / external/n p/seminars /eng/2011/res2 /pdf /rl.pdf (Accessed 23 April 2012) pp. 39-56.

Levy, R. E. 'Freeze-out Transactions The Pure Way: Reconciling Judicial Asymmetry between Tender Offers and Negotiated Mergers', West Virgi.nia Law Review 106 (2004) pp. 305-357.

Masauros, P. E. 'Is the EU Taking Shareholder Rights Seriously?: An Essay on the Impotence of Shareholdership in Corporate Europe'. European Company Law7. 5 (2010), pp. 195-203.

McCahery, A. J and Vermeulen, P.M. E. 'Corporate Governance Crises and Related PartyTransactions: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hideki Kanda, and Harald Baum (eds) Corporate Governance in Context: Corporations, States, and Markets in Europe, Japan, and the US, Oxford; New York Oxford University Press, 2005, pp. 215-246.

Norg es Bank, 'Shareholders rights'. Norges Bank Investment Management (online), Available at http: //www.nbim .n o/en/p ress-and publications/ feature -artides /2006/Shareholde r-rights / (Accessed 02 July 2011).

Sacasa, N. 'Preventing Future Crises Priorities for Regulatory Reform After the Meltdown '. Finance and Development A quarterlymag-azine of the IMF 45.4 (2008) Available at http :/lwww.imf.org:/external/pubs/ft/fandd/2008/ 12/sacasa.htrn (Accessed 23 April 2012).

Szentkuti, D. Milwrity shareholder protection rules in Germany, France and in the UK-A Comparative Overview. Thesis submitted at Central European University. March 2007.

The Commission of the European Communities, 'Commission Recommendation of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board' . Official Journal of Europ ean Union, 25.2.2005. Available at: http:! /eurlex.europa .eu/LexUriServ/LexUriServ.do?uri =OT:L:2005:052:005 1:0063:EN:PDF (Accessed 01 July 2011).

The Economist, 'What Shareholder Democracy?' The Economist(online), 23 March 2005. Available at http://www.eco n omist.com/node/3 793305?story id=El PSTPPDV (Accessed20 June 2011).

The Economist, 'Europe's revolting shareholders' The Economist(online), 10 Mat 2001 Available at: htt p:/ /www.economist.com/no de/620394 (Accessed on 20 June 2011).

The Free Dictionary by Farlex, 'Majority Shareholder'. Available at: http://fi n ancial-dictionary .thefreedictionar y.com/ Majority+Shareho lder (Accessed 02 July 2011).

Wyckaer, M. and Geens, K 'Cross-border mergers and minority protection: An open-ended harmonization' , Utrecht Law Review 4.l.(M arch2008). pp. 45-52.

Acknowledgements

Authors: Angelika Gorak and Sofiya Kartalova

Angelika Gorak is a graduate of the Department of Law and Criminology, Aberystwyth University.

Sofiya Kartalova is currently pursuing a Bar Profes sional Training Course at BBP University College. She is also a graduate of the Department of Law and Criminology, Aberystwyth University.

Endnotes

- Collyns, C. 'The Crisis though the Lens of History', Finance and Development A quarterly magazine ofthe L.\1.F, 45. 4 (Dec 2008). Available at: http://www.imf.org/exte rnal/ pubs/ft/fan dd /2008/12/collyn s.htm (Accessed 23 April 2012).

- 'Po rtfolio di versification is not enough to manag e credit risk, and it cannot fully repla ce due diligence' quoted in Sacasa, N. 'Preventing Future Crises Prioritie s for Regulatory Reform After the Meltdovm '. Finance and Development A quarterly magazine of the L.\.1.4F5 .4. (2008) Available at http://wv.rw.imf.org/exte rn al/pub s/ft/fa ndd/200 8/12/sacasa .htm (Accessed 23 April 2012).

- Levine, R. 'The Governance of Financial Regulation, Reform Lessons from the Recent Crisis', International Review of Finance 12.1 (2012), Available at: http: II www.imf.org/ extern aVnp/ seminar s/ eng/2011/res2 /pdf /rl.pdf (Accessed 23 April 2012) pp. 39- 56.

- Lee, f. 'Four Models of Minority Shareholder Protection. in. Takeover s'. European Business Law Review. 16. 4. (2005) pp. 803 - 830 (p. 803) .

- 5 Szeutkuti. D. Minority shareholder protection rules ill Germany, France and in the UK-A Comparative Overview. Thesis submitt ed at Central European University. Mar ch 2007, p. 9.

- 6 The Free Dictionary by Farlex., 'Majority Shareholder'. A vailabk at: htt p://financi aldictionary. thefreedict ionary.com/Majorit;y+S hareholder (Accessed 02 July 2011 ).

- Szeutkuti. D. Minority shareholder protection rules ill Germany, France and in the UK-A Comparative Overvi ew. Thesis submitted at Cent ral Europ ean Univer sity. March 2007 , p. 9.

- Levy, R. E. 'Fr eeze-out Transactions The Pur e Way: Reconciling Judicial Asymmetry between Tender Offers and Negot iated Mergers' , West Virginia Law Review 106 (2004) pp . 305-357 (p. 320).

- Levy, R. E. 'Freeze-out Transa ctions The Pure Way: Reconciling Judicial Asymmetr y between Tender Offers and Negotiated Mergers', West Virginia Law Review 106 (2004) pp. 305-357 (p. 320).

- as cited in Levy, R. E. 'Fr eeze-out Transactions The Pure Way: Reconciling Judicial Asymmetry between Tender Offers and Negotiated Merger s', West Virginia Law Review 106 (2004) pp. 305-357 (p. 321 ).

- Lee, f. 'Four Models of Minori ty Shareh older Prot ection in Takeovers '. European Business Law Revi ew. 16. 4. (2005) pp . 803 ~ 830 (pp. 805-808).

- Wyckaer , M. and Geens, K. 'Cross-border mergers and minorit y protection: An open-ended harmonization ', Utrecht Law Review4.l.(March 2008). pp. 45-52. (pp. 45-47).

- Holdern ess, C. G. and Sheehan, D. P. 'The Role of Majority Shareholders in Publicly Held Corporations, An Explanatory Analysis' , Journal of Financial Economics 20 (1988), pp. 317 -346.

- McCahery, A. J and Vermeulen, P.M E. 'Corporate Governa nce Crises and Related Party Transactions: A Post -Parmalat Agenda' in Klaus f. Hopt, Eddy Wymeersch, HidekiKanda, and Harald Baum (eds) Corpo rate Governance in Context: Corporations , States, and 1vfarkets in Europe, Japan, and the US, Oxford ; New York: Oxford University Press, 2005, pp. 215-246 (p. 220).

- BBC NEW"S, 'Italian dairy boss gets 1 O years '. BBC news (on line), 18 December 2008. Available at: http://news.bbe.co . uk /go/pr/fr/ -fl/hi!bus incss/7790803. stm (Accessed 2 8 July 2012) .

- McCahery, A. J and Vermeu len, P.M E. 'Corporate Governance Cris.es and Related Party Transaction s: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wyrneersch , Hideki Kanda, and Harald Baum (eds) Corpora te Governance in Context: Corporations, States, and 1..\1.arketisn Europe, Japan, and the US, Oxford ; New York: Oxford University Press, 2005, pp. 215 - 246 (p.220) .

- McCahcry , A. J and V crmeu len , P.M E. 'Corporate Governance Crises and Related Party Transaction s: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wyrneersch , Hideki Kanda, and Harald Baum (eds) Corporate Governance in Context: Corporations, States, and Markets in Europe, Japan, and the US, Oxford; New York: Oxford University Press, 2005, pp. 215 - 246 (p.220) .

- Directive 2004/25/EC ofth_e European Parliarnentand of the Council of 21 april2 004 on takeover bids

- Lee, f. 'Four Mod els of Minori ty Sharehold er Prot ection in Takeovers '. European Busin ess Law Revi ew. 16. 4. (2005) pp . 803 ~ 830 (p. 803, p. 807)

- 20 Lee, f. 'Four Models of Minority Shareho lder Protection in. Takeovers' . European Business Law Review . 16. 4. (2005) pp. 803-830 (p. 809-813) .

- 21 For an. extend ed discu ssion of the EU' s prote ction of sharehold ers, see appendix .

- 22 ( 1843) 2 Hare 461.

- Lee, f. 'Four Models of Minority Shareholder Prot ectio n in Takeovers' . European Business Law Review. 16. 4. (2005) pp. 803-830 (p. 814).

- Kalss, S. 'Shareholder Suits: Common Problems, Differ ent Solutions and First Steps towards a Possible Harmonisation by Mean s of a European Model Cod e', European Company and Firnmcial Law Review 6. 2 (2009), pp. 324-347 (pp. 339-340) .

- Lee, f. 'Four Models of Minorit y Shareholder Protection in Takeovers' . European Business Law Review. 16. 4. (2005) pp. 803 - 830 (p. 815).

- Kim. K. A., Kitsabunnarat, P. and Nofsinger, J. R., 'Shareholder Prote ction Laws and Corporat e Boards: Evidence from Euro pe', Working Paper. Publi shed 1 Februa ry 2005. Available at: http ://finance.ba.tt u.edu /new/do cumcn ts/ researchSeminar s/spriug2005/Law%20and%20Corporate%20 Governance.pd f (Acces.sed 23 April2012) .

- Lee, f. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review . 16. 4. (2005) pp. 803-830 (p. 815).

- Lee, f. 'Four Models of Minority Shareholder Protection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803-830 (p. 817).

- Lee, f. 'Four Models of Minority Shareholder Prot ection in Takeovers'. European Business Law Review. 16. 4. (2005) pp. 803-830 (pp. 817-818).

- The Economi st, 'Europe's revoltin g shareholder s' The Economist(on line), 10 Mat 2001 Available at: h ttp ://www .econmnist.co m/ nod e/620394 (Accessed on 20 June 2011).

- Hong, F. X. 'Protect ion of the Shareho lders ' Rights at EU Level: How Far Does It Go?', European Company Law 6 . 3 (2009) , pp. 124-130. (p. 124).

- Norges Bank, 'Shareho lders right s'. Norges Bank Investment Aianagement (onli ne), accessible at http: II www.nbim .no/ en/pr ess-and -pub lications/feature -articles/2006 /SharehoWer -rights/ ( Accessed 02 July 2011) .

- Hong, F. X. 'Protection of the Shar eholder s' Right s at EU Level: How Far Does It Go?' European Comp any Law6. 3 (2009), pp. 124-130 (p. 124-125).

- McCahery, A. J and Vermeulen , P.M E. 'Corpora te Govern ance Cris.es and Related Party Tra nsactions: A Post-Parmalat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hideki Kand a, and Harald Baum (eds) Corporate Govern ance in Cont ext Corporation s, States, and Markets in Europ e, Japan, and the US', Oxford ; New York: Oxford University Press, 2005, pp. 215-246 (p.220).

- McCahcry, A. J and V crmeulen, P.M E. 'Corpora te Governan ce Crises and Related Party Tran sactions: A Post-Parm alat Agenda' in Klaus J. Hopt , Eddy Wymeersch, Hidek i Kand a, and Harald Baum (eds) Corporate Governanccin Cont ext: Corporatio ns, States, and Market s in Europe, Japan, and the US, Oxford; New York: Oxford University Press, 2005, pp. 215-246 (p. 220) .

- Khachatur yan, A. 'The One-Share-One-Vote Controversy in the EU', Europ ean Business Orga nization Law Review, 8 (2007) pp . 335 -367.

- The Commission of the European Communiti es, 'Commission Recommendation of 15 February 2005 011 the role of non-executive or supervisory dir ectors of listed companies and on the committees of the (supervisory) board '. Official Journal of European Union, 25.2.2005. Available at http:/lc urlcx.curopa .eu/LcxUr iServ/LexUriScrv.do?uri =Of:L:2005:052:0051:0063:EN:PDF (Accessed 01 fuly2011) .

- http:IIwww.nbim.no /en/ pre ss-and -publicat ions/fcature -articles/2006 /SharehoWer -rights/ ( Accessed 02 July2011).

- The Economist, 'What Sharehold er Democracy?' The Econ omist( onlinc), 23 March 2005. Available at http :l!www.econ.omist.com/nod e/3793305?story id=El PSTPPDV (Accessed 20 Tune 2011).

- The Economist, 'What Share hold er Demo cracy?' The Economist(online) , 23 March 2005. Available at htw://www. ecorromist. com/nod e/3793305?story id=El PSJPPDV(A ccessed 20 Jun e 2011).

- Buck, T. 'EU seeks to end bias among shar eholders'. Fin ancial Times (on line), 16 October 2005. Available at http :ffwww.ft.comfcms fs/Ofael7a66e-3e6f-ll da-a2cb--OOOOOe12l5c8 .html#axzz2 1vL9n llG (Accessed 28 July 2012).

- These grant special rights to the holder irrespective of his equity stake.

- A proh ibition to vote above certa in thr eshold , irrespective of the numb er of share s.

- Khachaturyan, A. 'The One-Share- One-Vote Contro versy in the EU', European Business Organi zation Law Review, 8 (2007) pp . 335-367 (p. 16).

- De Luca, N. 'Unequal Treatment and Shareholders' Welfure Growth : 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov 2009). Available at : http ://papers .ssrn .com/sol3/pape r s.din.?abstract i.d=l503089 (Accessed 24.April 2012). pp. 853-920 (pp. 871-873).

- De Luca, N. 'Unequal Treatment and Shareholders' Welfure Growth: 'Fairness' V. 'Precise Equality", Delaware Journal of Corporate Law (DJCL), 34. 3 (Nov 2009). Available at :http:// papers.ssrn.com!soB/papcrs.cfm?abstractid=l503089 (Accessed 24 April 2012). pp. 853-920 (p.875).

- Masauro s, P. E. 'Is the EU Taking Shareholder Rights Seriously?: An Essay on the Impote nce of Shareholdersh ip in Corporate Europe ' Europea n Compa ny Law 7. 5 (2010), pp . 195-203 (p. 203).

Suggested Reading from Inquiries Journal

In spite of the above-described traditional sentiment that the European Union (EU) was primarily an economic actor, with all other priorities seconded to that fact, trade policy has been inextricably linked with the EU’s international presence since the inception of the Common Commercial Policy (CCP) from the Treaty Establishing... MORE»

Does candidacy to the European Union (EU) increase a nation’s Trade Openness? A good way to begin examining this question is by asking, what is Trade Openness? Simply put, it is a nation’s imports plus its exports... MORE»

The Economic Monetary Union (EMU) is the end point of an ambitious and historic stage of integrated market changes1 that not only challenge the structure and foundation of modern-day liberal capitalism, but also offer – where successful – a wealth of opportunity in the goods, labour and service industries of the European Union. A fiscal extension to the principles of the Schengen Agreement2 of 1985 offered a financial breakthrough where... MORE»

The subject of European legal integration entered the spotlight of interdisciplinary studies in the mid-1990s and has continued to maintain, if not increase, its prominence in scholarly literature (Mattli and Slaughter,... MORE»

Latest in Economics

2020, Vol. 12 No. 09

Recent work with the Economic Complexity Index (ECI) has shown that a country’s productive structure constrains its level of economic growth and income inequality. Building on previous research that identified an increasing gap between Latin... Read Article »

2018, Vol. 10 No. 10

The value proposition in the commercial setting is the functional relationship of quality and price. It is held to be a utility maximizing function of the relationship between buyer and seller. Its proponents assert that translation of the value... Read Article »

2018, Vol. 10 No. 03

Devastated by an economic collapse at the end of the 20th century, Japan’s economy entered a decade long period of stagnation. Now, Japan has found stable leadership, but attempts at new economic growth have fallen through. A combination of... Read Article »

2014, Vol. 6 No. 10

In July 2012, Spain's unemployment rate was above 20%, its stock market was at its lowest point in a decade, and the government was borrowing at a rate of 7.6%. With domestic demand depleted and no sign of recovery in sight, President Mariano Rajoy... Read Article »

2017, Vol. 9 No. 10

During the periods of the Agrarian Revolt and the 1920s, farmers were unhappy with the economic conditions in which they found themselves. Both periods witnessed the ascent of political movements that endeavored to aid farmers in their economic... Read Article »

2017, Vol. 7 No. 2

In 2009, Brazil was in the path to become a superpower. Immune to the economic crises of 2008, the country's economy benefitted from the commodity boom, achieving a growth rate of 7.5 per cent in 2010, when Rousseff was elected. A few years later... Read Article »

2012, Vol. 2 No. 1

The research completed aimed to show that the idea of fair trade, using the example of goals for the chocolate industry of the Ivory Coast, can be described as an example of the economic ideal which Karl Marx imagined. By comparing specific topics... Read Article »

|