From Interstate - Journal of International Affairs VOL. 2011/2012 NO. 2'We Need to Talk About Lisbon': The Capacity of the European Union as a Global Trade Actor

IN THIS ARTICLE

KEYWORDS

“Trade first; foreign policy last.” - Traditional EU Adage "[Trade] was one of only two among the more than two dozen Commission posts with responsibilities and powers… [but the Lisbon Treaty] was leading to a weakening of the EU as a whole." - Peter Mandelson1 In spite of the above-described traditional sentiment that the European Union (EU) was primarily an economic actor, with all other priorities seconded to that fact, trade policy has been inextricably linked with the EU’s international presence since the inception of the Common Commercial Policy (CCP) from the Treaty Establishing the European Community (TEC, 1957).2 The European Commission’s (EC) Directorate-General Trade is one of several that have been subsumed into the remit of ‘external relations’ by the Lisbon Treaty. The effect of the construction of the European Single Market on trade throughout the latter half of the twentieth century has helped define the EU as a significant actor in international relations;3 but to what extent has the Lisbon Treaty, which came into effect in 2009, strengthened or weakened the “actorness” of the EU? This question is particularly difficult to answer with any brevity or parsimony; with that in mind, this article describes merely the changes to the CCP that the Lisbon Treaty amendments have made, and categorises the effect on the capacity of the EU to act according to Bretherton and Vogler’s fourpart model.4 In doing this, a foundation is laid for further analysis of the impact of the EU’s newly-amended capacities to capitalise upon its international presence, and take advantage of structural opportunities in international trade relations. This article is split into two sections. The first outlines Bretherton and Vogler’s model of a global actor, with brief examples of the EU’s pre-Lisbon “actorness” as an illustration. The second details the changes made to the capacity of the EU to take action under the CCP, along with any rationales and commentary upon each of these changes. Section 1: Developing ActornessIn Bretherton and Vogler’s model, there are three elements necessary to construct ‘actorness’:5

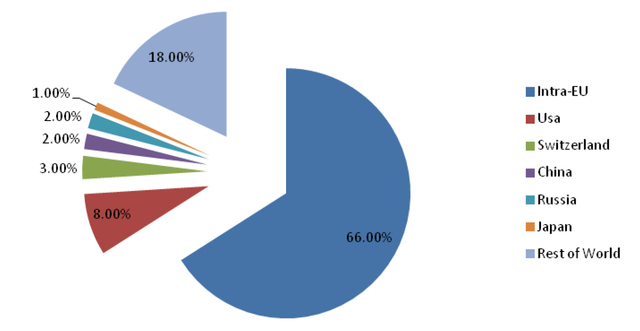

This section describes each of these functional elements and provides an illustrative example from the development of the EU as a global trade actor; this should construct a foundation from which to describe and comment upon the amendments made to the CCP by the Lisbon Treaty. PresenceThe “presence” of an actor is an indication of its structural power6 with regard to the consequences of internal priorities and policies upon the wider external context in which it exists.7 By virtue of an actor simply existing, it shapes the perceptions, expectations and behaviour of other actors.8 The pursuit of international common economic relations played a significant role in developing the EU as an actor9 with development of the Single Market and Economic and Monetary Union (EMU) being key developments which transformed Europe’s presence in the world. Figures 1 and 2 highlight the considerable presence of the European Union in international trade. After the completion of the Single Market, trade between EU partners massively increased to outweigh trade with non-EU countries.10 In the Single Market, most obstacles to inter-state trade are significantly weaker than when the EU integration project commenced, and those which continue to exist between non-EU nation states.11 The presence of the Single Market has the effect of both attracting the outside world12 and inducing apprehension in other actors over their exclusion from the lucrative European markets.13 Instruments used to preserve the Single Market also bolstered the EU’s presence in the world. The Common Commercial tariff, which levied a single tariff on externally- imported goods, had significant trade diversionary effects14 (bringing EU partners closer together) while the Common Competition Policy confirmed that overseas corporations would be subject to EU antitrust laws, and not the laws of their home state.15 Newer policy areas within the single market contributed to the EU’s presence; the Common Agricultural Policy developed and exported further trade distortions in international agricultural markets by applying protectionist countermeasures to intra- and inter-European agricultural trade.16 Figure 1: Member State Export Partners as % Share of EU Total 2004 (Young 2007, p. 389) EMU, developed to “complete” the Single Market by isolating its members from damaging intra-EU currency fluctuations,17 also served to strengthen the EU’s economic presence in the world;18 the Euro was used in 37 per cent of all extra-Eurozone transactions by 2004, with it also being hailed as an alternative reserve to the US Dollar. In fact, the Euro is second only to the US Dollar as a reserve currency and accounts for over 20 per cent of foreign exchange reserves.19 “Actorness” was induced as a result of the Union’s significant economic presence as other actors sought to negotiate upon the effects the European Union Customs Union (EUCU) would have upon their own economies.20 Capability“Capability” referred to the internal context of EU action; 21 by which is meant the ability for the EU to capitalise upon its presence and take advantage of opportunities presented to it by the wider context of international relations. There are four key features which define the capability of an actor:22

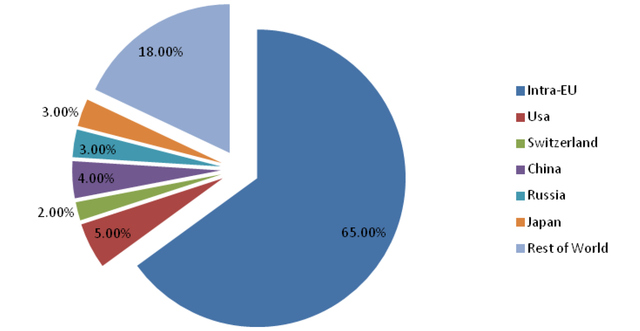

A commitment to overarching values was set out in the common provisions of the 1992 Treaty on European Union (TEU, also called the Maastricht Treaty),25 albeit vaguely. However, the institutional setup undermined the shared commitment to specific EU values: a decentralised set of budgetary and fiscal policies limited EU “actorness” in international financial institutions; while the EU’s position was further weakened by the disastrous results brought about by the eventual adoption of a single currency (the Euro) without rectifying the lack of fiscal accountability in the stability pact.26 Nevertheless, the EU’s external action with regard to trade was often directly linked to normative ideals. An EU commitment to multilateralism27 was adopted so as to expand regulatory practices and European values and benefit the EU member states in international trade.28 This was crystallised further by the mutual structuration of CCP developments, understandings and practices with General Agreement on Tariffs & Trade (GATT)/ World Trade Organisation (WTO) structures,29 with both the EU and GATT/WTO moulding their practices around one another. This process was so apparent that it was remarked that the ‘rules that run the global economy are largely Brussels’ rules’.30 Figure 2: Member State Imports as % Share of EU Total 2004 (Young 2007, p. 389) More linkages between the CCP and the normative values of the EU exist, such as the promotion of the “Singapore Issues” in the WTO by the EU.31 The EU sought to promote several features it felt beneficial for the global economy, such as:

Adoption of these issues by the EU was largely a result of new developments in global trade, and a shift in sectoral trade growth of EU member states, as we shall discuss later. Regarding the domestic legitimation of the CCP, this occurred via ratification of outcomes in the Council (in consultation with the European Parliament, or EP) and national parliaments, with some consultation of civil society to engender further legitimacy of CCP outcomes. The Council ratified CCP negotiating outcomes through the use of qualified majority voting (QMV),32 though in practice votes often passed through unanimity, with the Luxembourg Accord providing a veto for issues of national interest; this served to construct a strong consensus around CCP outcomes.33 National parliaments were the final hurdle for CCP agreements, and could ratify or refuse outcomes with impunity, further preserving the power of member states over the CCP.34 The role of the European Parliament was relatively limited before the passage of the Lisbon Treaty, with it having no major, formalised role in the policy area.35 However, extensive informal practices existed, such as consultation with related committees during CCP negotiations. In a similar vein, while the EU sought to involve civil society in CCP policy formation, it also had no formalised role. However, the EU was keen to increase its input, especially after the anti-globalisation protests that struck the various international trade negotiations in the early 21st century.36 Having the ability to identify priorities and formulate policies meant that the EU had to be both consistent and coherent, as the successful formation of common priorities and policies varied across the policy areas of the EU as a result of tension generated by divergent understandings of national interest between member states.37 To deal with the consistency of EU priorities and policies between the EU and its member states, a “principal-agent” structure was adopted.38 The member states, as the source of political authority, delegated CCP negotiating functions to the European Commission DG Trade officials who act quasi-autonomously depending on the nature of their mandate and the external negotiating context. Negotiations were conducted with the member states retaining control via the Article 133 Committee (renamed the Trade Policy Committee (TPC) since the passage of the Lisbon Treaty). Control was maintained in three ways: ex ante control, at locum control and ex post control. Ex ante control was manifested through the granting of a mandate for the Commission to act, along with any negotiating directives necessary.39 At locum control occurred through the construction of common positions to pressure the Commission towards specific outcomes during negotiations, and through the monitoring of negotiations via the TPC.40 Ex post control was conducted via ratification; the Commission would have to keep in mind that any outcomes it creates must pass ratification, ensuring that any proposals remained within the limits of member states’ desires.41 As long as the Commission remained within set or perceived limits, they could act with relative impunity in CCP negotiations.42 The coherency of the EU’s “actorness” related to the ability for the EU to formulate coherent policies across discrete areas of competence. The CCP was limited in this respect with regard to the opening quote of this article. While it was ostensibly a part of EU external relations, it was broadly a sui generis policy which usurped much of the EU’s foreign policy priorities. There was often tension between DGs Trade and Relex (now merged into the External Action Service, or EAS) over specific functions and remits,43 further compounded by the disparate fiscal policies of member states44 and the lack of a specific Council configuration.45 The obtuse intergovernmental nature of the EU’s internal policy-making also served to weaken their negotiating partners’ ability to discuss and negotiate issues effectively.46 With regard to the availability of policy instruments for the EU to use to implement policies, the Treaty establishing the European Communities in 1957 granted exclusive competence to the then EC over trade in goods, with the European Commission gaining the exclusive right to policy proposal.47 A similar development in the capacity to regulate on trade in services never developed over the lifetime of the EU, though there were limited provisions under the Treaty of Amsterdam (1999).48 A European Court of Justice (ECJ) ruling underlined this fact by supporting the mixed competence over trade in services in the aftermath of the Amsterdam Treaty.49 There were multiple instruments available for the EU under the terms of the CCP:50

OpportunitiesThe presence of the EU in the global economy had a clear effect on the structural context in which the EU resided. The reassessment of the value of a state’s foreign currency reserves, prompted by EMU and the Euro, is one way in which new opportunities for the EU to act materialised;55 so, also, was the replication of institutional values from the EU to the WTO.56 The power status of the EU also served to affect the structural context in which it acted. The EU was regarded as being one corner of a “trilateral” perception of global economic power, with the USA/NAFTA and Asia forming the other two corners,57 together with a “web” of bilateral links with other states.58Enlargement of the EU brought with it new opportunities through the importation of the new member states’ international trade presences and preferences.59 For example, the close links between the UK and its Commonwealth led to a greater impetus for liberalisation-based stances in CCP negotiations60 as they lobbied for particular policy outcomes during EC-conducted trade negotiations. By far the greatest transformative effect on the structural context of EU action occurred through the changing nature of trade in the final decades of the twentieth century and the first decade of the twenty-first. The primary locus of EU economic production shifted from the manufacturing sector to the services sector,61 having the effect of shifting EU priorities in CCP negotiations towards greater liberal market access for EU services in its partners’ markets. The emergence of new sectors also challenged the exclusive competence of member states over such issues – such as aviation and product standards. 62 As a result of the changed structural context of international trade, the EU formulated the Lisbon Agenda.63 The Lisbon Agenda sought to establish the EU as a competitive, dynamic, knowledge-based economy capable of sustainable growth and more, “better” jobs, and provided a partial rationale for the development of the Treaty of Lisbon in 2007.Continued on Next Page » Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |