From Interstate - Journal of International Affairs VOL. 2011/2012 NO. 1What are the Benefits and Challenges of the Economic and Monetary Union?

By

Interstate - Journal of International Affairs 2011, Vol. 2011/2012 No. 1 | pg. 1/1

KEYWORDS:

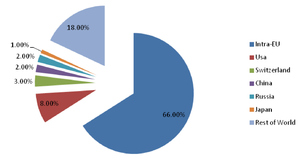

The Economic Monetary Union (EMU) is the end point of an ambitious and historic stage of integrated market changes1 that not only challenge the structure and foundation of modern-day liberal capitalism, but also offer – where successful – a wealth of opportunity in the goods, labour and service industries of the European Union. A fiscal extension to the principles of the Schengen Agreement2 of 1985 offered a financial breakthrough where multiple crises during the midand late-1980s offered physical deficit in the sense that unemployment was on the rise and inflation was at a post-war high. This long-winded process required widespread policy integration over a span of 40 years in order to achieve such monetary union, bringing Europe to both political strains at times and a decade of growth and success. What started as a Single Market led to an unseen level of economic cooperation in its second stage, which was then followed by full single currency implementation. It has been seen by many, including the former British Chancellor of the Exchequer and Prime Minister, Gordon Brown, as Europe’s greatest political and economic achievement.3 EMU would mean that not only the European Community (EC) would be recognised as a global actor4 in financial markets, but that the single currency would have a major international impact as an anchor for exchange rate stability in a 21st Century global market desperate for growth, employment and low levels of inflation. This exciting and somewhat ambitious project5 prides itself globally as a watershed in how union economics and fiscal federalism as a framework operates.6 This is the first time in modern history that such a big convergence of monetary policy has taken place and it has come with many successes and advantages for its vibrant and dynamic economies. However, this has come at a cost and, especially since 2008,7 a great amount of suffering for some. The aim of this essay is to outline in economic and political terms the benefits and challenges of the EMU, analyzing its impact on specific states, both domestically and internationally, as well as at an EU and Eurozone levels. The EMU in Europe has seen consistent and significant progress since its establishment as nothing more than a European Community goal in 1969. The most symbolic of these was its full validity into the international system via the setup of the Exchange Rate Mechanism (ERM) in 1979 through the first stage of the European Monetary System (EMS), and the Maastricht Treaty of 1992/1993. The treaty set down the criteria and final timetabling for a full EMU in Europe by 1999/2002 as already proposed by the 1988 Delors Commission Report.8 This process had already begun its first stage on 1 July 1990, when exchange controls in the EEC were abolished, leading to capital movements being completely liberalised throughout the community. This prepared the community and its members’ differing economies for the finalised technicalities9 of the second and third stages set down in the treaties, the most important of which being the strict convergence criteria explained further on in this essay. The second stage, lasting for over 4 years, began on 1 Jan 1994 with the establishment of the European Monetary Institute, the predecessor to the European Central Bank (ECB). This institute would enforce the original provisions of the ERM, set up ERM II for the states that wished to join the single currency after its adoption and establish the Growth and Stability Pact (GSP), which set down the strict convergence criteria required for full membership to the single currency and entry into stage 3 of the project. Finally, in this second stage came the establishment of the European Central Bank in 1998. Its function was to reduce exchange rate variability and achieve monetary stability in Europe,10 as well as setting common interest rates and being the lender of last resort to the Eurozone states.11 The third and final stage began in 1999 with the adoption of the Single Currency through the irrevocable fixing of conversion rates amongst the first wave states (11 out of the 17) of the Eurozone. This meant that most Eurozone member currencies including the strong Deutschemark, the French Franc, Italian Lira, and the weaker Greek Drachma would cease to exist, with the introduction of Euro notes and coinage becoming the norm in the Eurozone.12 The economic benefits of the EMU are plentiful, and definitely outweigh the challenges in number. However, the risk factor of the EMU on a general scale is what this piece is trying to assess and the first relevant benefit of the EMU would be its optimistic but also responsible13 convergence criteria for full EMU membership. This is seen by many14 as setting a fantastic example of monetary discipline with penalties of up to 0.5 per cent of members’ GDP available to the Commission and the Central Bank for their use against violating states. Whilst this convergence criteria anchors its legitimacy on the integrity of the German Deutschemark as a pre-Euro currency, it only began as a strict guideline. It is only since the economic crisis of 2008 that a revised GSP is being proposed that makes these criterion binding. Under these rules, government debt cannot exceed 60 per cent of gross domestic product (GDP), and a government’s current account deficit cannot exceed 3 per cent in any fiscal year. The rigid planning and implementation of this can be interpreted as responsible budget economics.15 Average nominal interest paid cannot exceed 2 per cent above the average of the top 3 financially performing states; this indicator is also used for price stability, where inflation is limited to 1.5 per cent above average of the top 3.16 These rules, set down and audited by the ECB make good ground for the second benefit of the EMU. The European Central Bank, as said before, has a very rigid and ordered system of governance similar to that of the Bundesbank. This means that when it comes to its implementation of the common interest rate and price stability, every provision of the GSP is taken into consideration and the bank works for the benefit of all 17 Eurozone states. This model proved successful in Germany in the 1990s and had similar results in the Euro’s first decade.17 Further success includes the reduction in transaction costs between member states because of the same exchange rate and Rate of Interest (ROI). This, if the UK were to be a member of the EMU, could have saved between £50-100 per annum to its average citizen.18 This successful thinking is mirrored throughout Europe, with the European Commission suggesting that elimination of transaction costs could boost the GDP of the countries concerned by an average of 0.4 per cent by 2015,19 and the cost of transporting goods and services within the common market using the single currency have been significantly lower since 2001. This also allows for a great deal of price transparency for large business from Europe and around the world which, in conjunction with the reduced uncertainty of exchange rates and the increase in Foreign Direct Investment, has allowed for more business to come and invest in Europe. This not only gives the Eurozone states an incentive to compete with each other for a healthier domestic private sector but it also provides an incentive for strengthened intra-EMU trade, meaning states, whilst competing with each other, also trade with each other much more easily. In this respect, the EMU has removed the possibility of devaluation of the single currency, which countries have used in the past, and has increased inflationary pressure. The ECB prides itself in its policy of keeping interest rates low on average. This would cater for an economy capable of expanding rapidly in the global markets because of its flexibility through a lower ROI. The EMU’s economic challenges, however, make for much harder reading, especially since the Eurozone crisis emerged from the ashes of the global downturn.20 Firstly, the Eurozone states have seen a loss of power to choose different short-term inflation vs. unemployment trade-offs to the ECB; this is one of a long string of national sovereignty issues.21 In the long-term there is no trade-off between inflation and unemployment, but in the short-term the ECB can choose an interest rate which reduces inflation slowly, giving time for the unemployed to find jobs. This, however, results in the realisation that countries that join the Single Currency will lose the ability to make these choices independently. This also affects member states’ autonomy in reacting to sudden economic shocks. This is mostly apparent now in the case of states such as Portugal, Ireland, Italy, Greece and Spain where unemployment is a direct factor of this challenge. A reduction in demand is likely to lead to a reduction in prices, but this in turn means redundancies and businesses filing for administration. The ECB is unlikely to dictate drastic changes to the GSP unless all the states are affected equally. This means that Germany and France would have to suffer the same deep recession as Greece for changes such as an alternation of the 3 per cent deficit threshold.22 Furthermore, the ECB is made up of representatives from all 17 national Central Banks, all with different systems of governance and they are not all as rigid in their auditing of monetary affairs as the ECB is. This has led to decisions coming down to the last few votes on European monetary affairs and, since 2007, has led to the ECB not publishing minutes from committee meetings because of the risk of market destabilisation and loss of confidence in the single currency.23 This market shake up might also be at further risk because of the impact of a generic ROI in all 17 states. This “one size fits all” policy may work for the stronger economies but the weaker ones have major problems of the teething stage as can be seen in states such as Greece who is currently having to pay a 17.9 per cent ROI on its standard 10- year bond.24 The ECB’s target inflation rate of 2 per cent may also be deemed as too deflationary, adding to the tragic rise of unemployment to numbers of over 20 per cent in states like Spain and Greece.25 The sad reality is that this rigidity may instil a disciplined, sustainable and organised mechanism for the implementation of a full EMU in the European and world markets but some nations require longer to catch up to this programmes many benefits. This, since 2008 has begun to lead to a two-tiered Eurozone within an ever-emerging two-tiered European Union. The strong members would have their own system, and the emerging would run off another, more flexible framework to suit their needs. The political benefits of the EMU mirror the aspirations and pride of the European dream. The EMU has united Europe,26 but it has also shown to the world how this unity can be achieved.27 The European Union is now recognised as a single, joint source of GDP in calculated global income, scoring 4th place with a 21 per cent share in global nominal GDP.28 There is much more transparency between states not only on the obvious monetary affairs side, but also on the political – with political allegiances becoming ever more strengthened by EU monetary policy.29 States have to work together on common policy regardless of party and ideology affiliations. This shared capitalism through fiscal federalism has proved that political relationships and diplomacy are much more subject to flexibility for the advantage of the wider community than they are for domestic, national interest. The assumption is that in the long-term, this scheme will help all participants. But the challenges of this political and economic union dictate that in order for this plan to be realised in the near future, states have to cede sovereignty and fiscal independence to some extent. Whilst this may be for the good of the common market and the currency in general, historical and cultural icons of European history such as the Drachma have been scrapped entirely, simply to move forward with the implementation of the EMU. When a state goes through financial and asymmetric shock in its economy, it relies on the governance of the ECB to take the necessary course of action. This may sometimes mean leaving the state to weather the storm,30 and this principle has seen various bailouts offered over the past 5 years to states that simply cannot take the rigidity and pressure any longer. In political circles, this has led to increased resentment of the European project; states are willing to participate as much as ever but there is now frustration at the fact that this crisis is lasting so long in some countries as opposed to its current state in others. To conclude, the EMU has its advantageous benefits as well as its – sometimes crippling – challenges, and it is important to remember that the Euro, as a result of the stages of the EMU such as ERM and the GSP, is still fledgling. It is a young currency and most of the issues concerning the EMU revolve around the flexibility of the ECB in dealing with situations such as the current Eurozone Crisis. Any Eurosceptic could argue that the EMU may damage the national sovereignty and integrity of a national currency, however, denying the astonishing growth in government GDP and foreign investment paired with impressive drops in unemployment from 2000-2009, is difficult.31 And this, in many respects, has small influences such as the Athens Olympic Games in 2004 and the Green Energy Directives of 2001 to thank for.32 Countries involved in the EMU are ever-investing in this multilateral venture, its successes could be greater than those seen in its first decade and its progress to date is more than admirable. However, speedy and effective reforms to the structure and workings of the ECB and the GSP are vital after this recession is over in order for the Euro to remain single, sustainable and worthy of international trust and praise, because after such a tumultuous period in its history, it seems to be overcoming the first few hurdles and is on the path to a very successful future in the global markets. Endnotes

Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |