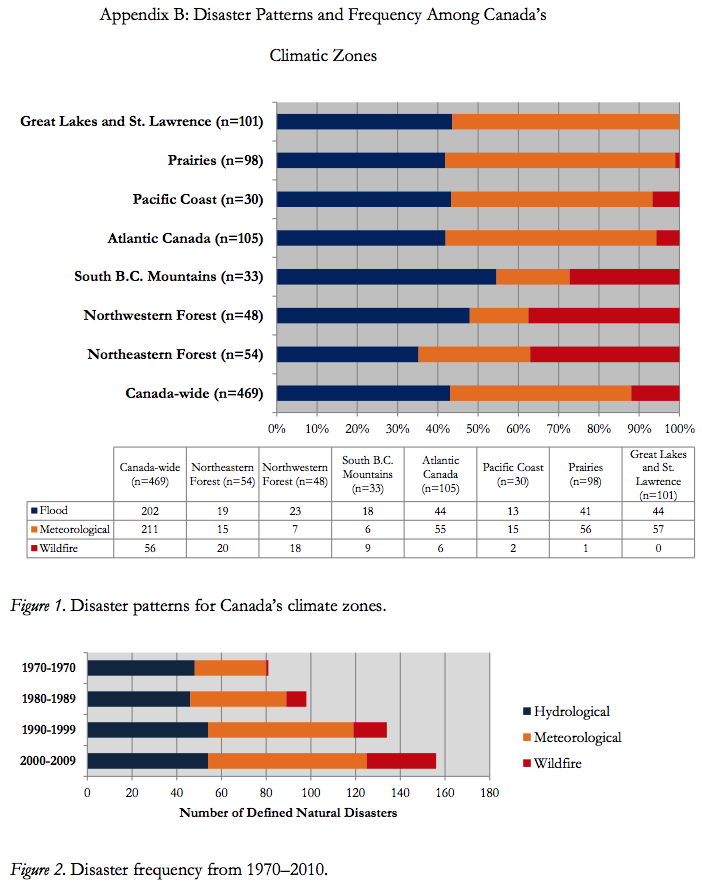

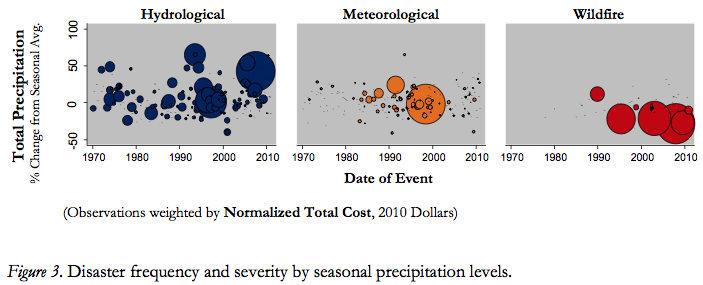

From Earth Common Journal VOL. 3 NO. 2Competing on Climate Change: An Interprovincial, Longitudinal Review of Emerging Environmental Risks to Canadian HomeownersThis option would work particularly well in the interior forests of British Columbia, Alberta, Saskatchewan, Ontario, and Quebec, where the financial loss (but not the incidence) of wildfire continues to grow exponentially. For example, insurers could lobby the federal government to institute a government insurance program to re-insure the growing costs of catastrophic wildfires within these provinces. Planning to insure catastrophic wildfires requires extensive re-insurance, which may be prohibitively expensive within the private market. In exchange for this government protection, insurers would be able to offer broader and more predictable protection to consumers. Storm surge protection is one additional coverage option that consumers in Canada’s interior forests would benefit from. Cooperating with consumers to co-insure frequent events. Given substantial climatic shifts, it is inevitable that some financial losses will be absorbed by the consumer. There is the argument, however, that self-insurance for catastrophic events exposes even wealthy individuals to disadvantageous economic loss (Lee, 2010, p. 170). The inferior nature of self-insurance as a risk-management strategy for major losses is apparent. That being said, homeowners in Atlantic Canada will require some level of self- insurance to cope with the growing incidence and severity of coastal storms. As the level of self-insurance rises, however, the remaining pool of applicants generally report uninsurable background risks (Crocker & Snow, 2008, p. 159). For example, hurricane damage is currently covered within most homeowner’s contracts but not resulting water damage from the storm. Adverse selection pressures are expected to grow within the Atlantic Canadian market place as less vulnerable homeowners seek greater amounts of self-insurance for hurricane risks. . The Atlantic Canadian climate zone will most likely encounter adverse selection pressures following hydrological disasters. That is, homeowners living near low-lying coastal areas will inevitably desire comprehensive coverage for storm surges and floods. Those in high elevation areas, however, will likely reject the high cost of insurance for such coverage. In this instance, the cross-subsidization of risks can be avoided through the careful application of hurricane deductibles (Crocker & Snow, 2008, p. 138; Petrolia, Landry, & Coble, 2013, p. 242). ConclusionSignificant variation in natural disaster incidence and severity exists across Canada with one consistent finding: natural disasters have become more common and more severe across all climatic zones since the early 1970s. Each climatic zone, however, yields vastly different disaster incidence patterns over time. While discussing the fiscal impact of emerging environmental risks, one industry report states: “This changing climate will profoundly alter insurers’ business landscape, affecting the industry’s ability to price physical perils, creating potentially vast new liabilities and threatening the performance of insurers’ vast investment portfolios” (Leurig, 2011, p. 9). This study has adopted a similar viewpoint. Canada’s insurance industry, as it exists today, will soon undoubtedly face profound pressures to custom-tailor currently standardized policies, based in large part on where an insured homeowner lives. Change is perhaps the only constant for Canada’s property insurance market. In this study, the researcher has briefly examined four strategies to cope with climate-related changes in catastrophic events. This strategy was designed by the researcher to reflect a more consultative, participative approach to environment risk management. By focussing on local consumers and communities, the four-part strategy can help insurers to develop stronger community partnerships while addressing the problem of climate change. A “4-C” environmental risk management strategy is a sustainable solution that can help Canadian insurers weather the coming storm. AcknowledgementsI would like to express thanks to Professor Teresa Costouros, Curriculum Coordinator for Insurance Programs at MacEwan University for her encouragement while exploring emerging insurance issues. ReferencesAtmospheric Environment Service (2012, July 12). [Graph illustration of climatic zones in Canada]. 2012 Climate trends and variations bulletin for Canada: Summary. Ottawa: Environment Canada. Retrieved from http://www.ec.gc.ca/adsc- cmda/default.asp?lang=En&n=77842065-1 Baranoff, D. (2005). Shaped by risk: The American fire insurance industry, 1790-1920. Enterprise & Society, 6(4), 561-570. doi:10.1093/es/khi091 Boustan, L. P., Kahn, M. E., & Rhode, P. W. (2012). Moving to higher ground: Migration response to natural disasters in the early twentieth century. American Economic Review, 102(3), 238–244. doi:10.1257/aer.102.3.238 Cameron, T. A. (2005). Updating subjective risks in the presence of conflicting information: An application to climate change. Journal of Risk & Uncertainty, 30(1), 63–97. doi:10.1007/s11166-005-5833-8 Canadian Department of Public Safety (2013a). Canadian Disaster Database, English Version [CSV File with Data Definitions, 1970-2011]. Retrieved from http://cdd.publicsafety.gc.ca/ Canadian Department of Public Safety (2013b, July). Reference table for symbols and definitions. Canadian Disaster Database, English Version. Retrieved from http://www.publicsafety.gc.ca/prg/em/cdd/cdd-symb-eng.aspx Chawla, R. K. (2011). The distribution of mortgage debt in Canada. Ottawa: Statistics Canada. Retrieved from http://www.statcan.gc.ca/ Crocker, K. J., & Snow, A. (2008). Background risk and the performance of insurance markets under adverse selection. Geneva Risk and Insurance Review, 33(2), 137–160. Retrieved from http://www.palgrave-journals.com/grir/index.html Emergency Management Policy Directorate (2011). In Ministers Responsible for Emergency Management (Ed.), An emergency management framework for Canada: Second edition (2nd ed.). Ottawa: Public Safety Canada. Golden, L. L., Wang, M., & Yang, C. (2007). Handling weather related risks through the financial markets: Considerations of credit risk, basis risk, and hedging. Journal of Risk & Insurance, 74(2), 319–346. doi:10.1111/j.1539-6975.2007.00215.x Institute for Catastrophic Loss Reduction. (2012, June). Telling the weather story: A joint report. Insurance Bureau of Canada. Retrieved from http://www.ibc.ca/en/natural_disasters/documents/mcbean_report.pdf. Insurance Act, Revised Statutes of Alberta. (2000, c I-3). Retrieved from http://canlii.ca/t/51v9w InsuranceWest (2013, January). Seeking ways to mitigate the challenges of climate change. (2013, January 2013). InsuranceWest, 18, 28–29. Kousky, C. (2010). Learning from extreme events: Risk perceptions after the flood. Land Economics, 86(3), 395–422. Kousky, C., Luttmer, E. F., & Zeckhauser, R. J. (2006). Private investment and government protection. Journal of Risk & Uncertainty, 33(1), 73–100. doi:10.1007/s11166-006-0172-y Lee, K. (2010). Wealth effects on self-insurance. Geneva Risk and Insurance Review, 35(2), 160–171. Leurig, S. (2011, September). Climate risk disclosure by insurers—Evaluating insurer responses to the NAIC Climate Disclosure Survey. A CERES report. Retrieved from http://www.ceres.org/resources/reports/naic-climate-disclosure Mekis, É, & Vincent, L. A. (2011). An overview of the second generation adjusted daily precipitation dataset for trend analysis in Canada. Atmosphere-Ocean, 49(2), 163–177. doi: 10.1080/07055900.2011.583910 Mills, E. (2012). The greening of insurance. Science, 338(12), 1424–1425. doi: 10.1126/science.1229351 Petrolia, D. R., Landry, C. E., & Coble, K. H. (2013). Risk preferences, risk perceptions, and flood insurance. Land Economics, 89(2), 227–245. SCM Group Limited (2004, September). Fire Underwriters Survey (FUS) and the importance of insurance gradings. Risk Tech, 1(3), 1-4. Retrieved from: http://www.fireunderwriters.ca/articles/RiskTechVolume1Issue3_FUS.pdf StataCorp LP. (2011). STATA 12 (1st ed.). Texas, USA. Statistics Canada. (2013). Table 326-0021: Consumer Price Index (CPI), 2010 basket, annual. [Pivot Table, National Data, 1970-2010]. CANSIM (database). Retrieved from http://www5.statcan.gc.ca/cansim/ Tennyson, S. (2010). Incentive effects of community rating in insurance markets: Evidence from Massachusetts Automobile insurance. Geneva Risk and Insurance Review, 35(1), 19–46. Zhang, X., Vincent, L.A., Hogg, W.D. and Niitsoo, A. (2000). Temperature and precipitation trends in Canada during the 20th Century. Atmosphere-Ocean, 38(3), 395–429. doi:10.1080/07055900.2000.9649654 Endnotes1.) All reported financial data are normalized to Canadian 2010 dollars via Statistics Canada Consumer Price Index (CPI) tables.

Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Environmental Studies |