|

From The Developing Economist VOL. 2 NO. 1 China and India in Africa: Implications of New Private Sector Actors on Bribe Paying Incidence

By Sankalp Gowda

The Developing Economist

2015, Vol. 2 No. 1 | pg. 3/3 | «

The rise of India and China as global powers has changed the status quo in the private sectors of several key African economies. The Western response has been acute and critical; Secretary Clinton's stark words in 2012 leave no confusion surrounding the West's protectionist not to be confused for altruistic attitude. However, despite the West's preferences, the sheer volume and trends in Indian and Chinese trade and investment in the continent show that they will remain major actors in the region for the foreseeable future. A 2014 report by McKinsey & Company predicts that Africa will become the fastest growing region in the next few decades and shows that Indian and Chinese involvement will be instrumental in leading that growth.

That said, Western concerns that imported Indian and Chinese management techniques will weaken governance are not entirely off the mark. Anecdotal evidence presented in this paper shows that even the "cleanest" Indian and Chinese firms have been caught up in corruption allegations at home, if not in Africa. Although these cases are far more common for large Chinese state owned enterprises with fewer accountability and transparency checks, Indian firms have had their own issues in recent years. However, it is important to remember that despite Western anti-corruption legislation, Western firms have also been found guilty of their own share of questionable deals in Africa. Legislation or not, bribe paying (and taking) remains a part of the business environment in virtually every African country. The empirical results support the idea that corruption is primarily driven by demand-side institutional factors that are met by supply-side firm practices.

The surprising finding that firms in countries with heavy Indian and Chinese involvement are 30% less likely to pay a bribe is, however, promising preliminary evidence that these new actors are not worsening the situation. Contrary to Western claims of a "race to the bottom" scenario, this might actually indicate an opposite trend in which an increased supply of investment funds gives African governments more bargaining power to strike better deals with more responsible corporate actors. Understandably, this process also creates greater opportunities for bribe taking, and anti-corruption efforts will need to continue at the country level.

Notably, these results include the caveat that the Enterprise Surveys do not include data from firms operating in extractive industries, where much of the criticism regarding the corrupt practices of Indian and Chinese firms has been focused. Functionally, this means that the findings of this paper could be skewed toward a more favorable representation of Indian and Chinese involvement on the African continent. However, as I note in the literature review, firms operating in these extractive industries have increasingly become the minority among Indian and Chinese companies interested in doing business in Africa. As business opportunities become more widespread in a larger variety of industries, the trends highlighted by this paper will likely become even more relevant.

Additionally, efforts to promote strong corporate governance should be undertaken at the firm level in order to solve the collective action problem of ending corruption in the private sector. Because refusing to pay a bribe can put a firm at a disadvantage to a direct competitor, it is difficult to convince its managers to maintain their anti-corruption position. Coordinated efforts like the UN Global Compact (which includes several Indian and Chinese firms) and the IFC's Africa Corporate Governance Network represent promising first steps and should continue to be supported (United Nations, 2010; IFC, 2013).

As the Indian and Chinese presence in Africa continues to grow, there is room for further research regarding its impact on governance and corruption. The World Bank Enterprise Surveys have provided a good starting point, but a more detailed firm level dataset will be required to draw convincing conclusions in one direction or the other. Too much emphasis has been placed on the new East-West rivalry in Africa and the discussion has been colored by platitudes rather than by hard empirical evidence. However, as this data becomes increasingly available, firms whether Indian, Chinese, European, or American and African government officials alike will hopefully be held more accountable for positive governance outcomes.

- Africa Corporate Governance Network Launches. (2013, October 16). Retrieved December 12, 2014, from http://www.ifc.org/wps/wcm/connect/topicsextconte nt/ifcexternalcorporatesite/corporategovernanc e/news/featurestories/africacorporategovernancenetwork launches

- African Economic Outlook Measuring the pulse of Africa. (2014, August 29). Retrieved December 12, 2014, from http://www.africaneconomicoutlook.org/en/

- Alaimo, V., & Fajnzylber, P. (2009). Behind the Investment Climate: Back to Basics Determinants of Corruption. In Does the investment climate matter? microeconomic foundations of growth in Latin America. Washington, DC: World Bank ;.

- Alessi, C., Hanson, S. (2012, February 8). Expanding China-Africa Oil Ties. Retrieved December 12, 2014, from http://www.cfr.org/china/expanding-chinaafricaoil-ties/p9557

- Broadman, H. (2008, April 1). China and India Go to Africa. Retrieved December 12, 2014.

- Cai, H., Fang, H., Xu, L. (2011). Eat, Drink, Firms, Government: An Investigation of Corruption from the Entertainment and Travel Costs of Chinese Firms. Journal of Law and Economics, 54, 55-78.

- Caulderwood, K. (2014, May 15). Chinese Money In Africa Directed Away From Oil, Toward Other Sectors. Retrieved December 12, 2014, from http://www.ibtimes.com/chinese-money-africa-directed-away-oil-toward-other-sectors-1584805

- Chen, Y., Ya'ar, M., Rejesus, R. (2008). Factors Influencing the Incidence of Bribery Payouts by Firms: A CrossCountry Analysis. Journal of Business Ethics, 77(2), 231244.

- China and India Rivals in Africa — Asia — DW.DE — 09.10.2012. (2012, September 10). Retrieved December 12, 2014, from http://www.dw.de/china-and-india-rivalsinafrica/a-16277724

- Dahman-Sa˜adi, M. (2013, November 3). Chinese investment in Africa (part 1). Retrieved December 12, 2014, from http://www.bsi-economics.org/219-chinese-investment-in-africa-part-1

- Dipietro, B. (2014, July 23). FCPA Fears Hinder U.S. Companies Considering Africa. Retrieved December 12, 2014, from http://blogs.wsj.com/riskandcompliance/2014/07/23/fcpa-fears-hinder-u-s-companies-considering-africa/

- Elephants and tigers. (2013, October 26). Retrieved December 12, 2014, from http://www.economist.com/news/middle-east-and-africa/21588378-chinese-businessmen-africa-get-attention-indians-are-not-far/

- Fairclough, G., Childress, S., Champion, M. (2009, July 22). Probes Involve Firm Linked to China Leader's Son. Retrieved December 12, 2014, from http://www.wsj.com/articles/SB124820142767869383

- For African business, ending corruption is 'priority number one' — Africa Renewal Online. (2010, August 1). Retrieved December 12, 2014, from http://www.un.org/africarenewal/magazine/august2010/african-business-ending-corruption-?prioritynumberone?

- Fortin, J. (2013, June 27). Creeping Tiger: India's Presence In Africa Grows, Even As China Steals The Spotlight. Retrieved December 12, 2014, from http://www.ibtimes.com/creeping-tiger-indias-pr esenceafricagrows-even-china-steals-spotlight-1324989

- Gayathri, A. (2013, October 7). Indian Companies Most Transparent Among Their BRICS Peers, While Chinese Firms Rank Last: Transparency International. Retrieved December 12, 2014, from http://www.ibtimes.com/indiancompaniesmost-transparent-among-their-brics-peerswhilechinese-firms-rank-last-transparency

- How corrupt is your country? (2014, January 1). Retrieved December 12, 2014, from http://www.transparency.org/cpi2014/results

- Indo-African Business. (2011, January 1). Retrieved December 12, 2014, from http://www.indoafricanbusiness.com/companieslisting.php

- Jacobs, S. (2013, January 1). India-Africa trade: A unique relationship. Retrieved December 12, 2014, from http://www.global-briefing.org/2012/10/india-africatradea-unique-relationship/

- Joining hands to unlock Africa's potential: A new Indian industry-led approach to Africa. (2014, March 1). Retrieved December 12, 2014, from http://www.mckinsey.com/˜/media/McKinsey Offices/ India/PDFs/Joining hands to unlock Africas poten tial.ashx

- Khare, V. (2013, August 4). The scramble for business in Africa. Retrieved December 12, 2014, from http://www.bbc.com/news/business-23225998

- Klerman, D., Mahoney, P., Spamann, H., Weinstein, M. (2012). Legal Origin or Colonial History? Journal of Legal Analysis, 379-409.

- Kushner, J. (2013, October 3). Corruption in the Congo: How China Learnt from the West. Retrieved December 12, 2014, from http://thinkafricapress.com/drc/corruptioncongohow-china-learnt-west

- Leung, D., Zhou, L. (2014, May 15). Where Are Chinese Investments in Africa Headed? Retrieved December 12, 2014, from http://www.wri.org/blog/2014/05/where-arechineseinvestments-africa-headed

- More than minerals. (2013, March 23). Retrieved December 12, 2014, from http://www.economist.com/news/middle-east-andafrica/21574012-chinese-trade-africa-keeps-growing-fearsneocolonialismare-overdone-more

- Nayyar, R., Aggarwal, P. (2014). AFRICA-INDIA'S NEW TRADE AND INVESTMENT PARTNER. International Journal of Scientific and Research Publications, 4(3). Retrieved December 12, 2014, from http://www.ijsrp.org/research-paper-0314/ijsrpp2784.pdf

- Rankin, J. (2013, October 9). Vedanta shares tumble on downgrade. Retrieved December 12, 2014, from http://www.theguardian.com/business/2013/oct/09/vedanta-shares-tumble-downgrade-mining-energy

- Rautray, S. (2014, November 27). 2G case: Bharti Airtel chairman Sunil Mittal urges SC to set aside court summons. Retrieved December 12, 2014, from http://articles.economictimes.indiatimes.com/2014-1127/news/565156891sterling-cellular-excess-spectrumcaseasim-ghosh

- Survey Methodology. (n.d.). Retrieved December 12, 2014, from http://www.enterprisesurveys.org/methodology

- Svensson, J. (2003). Who Must Pay Bribes and How Much? Evidence from a Cross Section of Firms. The Quarterly Journal of Economics, 118(1), 207-230.

- Trying to pull together. (2011, April 23). Retrieved December 12, 2014, from http://www.economist.com/node/18586448

- Vanham, P. (2014, November 5). Big dreams of IndiaAfrica trade at Delhi forum. Retrieved December 12, 2014, from http://blogs.ft.com/beyond-brics/2014/11/05/bigdreamsof-india-africa-trade-at-delhi-forum/?

- Vedanta to buy miner at centre of probe FT.com. (2011, August 8). Retrieved December 12, 2014, from http://www.ft.com/intl/cms/s/0/027bd136-c1bd-11e0acb3-00144feabdc0.htmlaxzz3LWLUYrFU

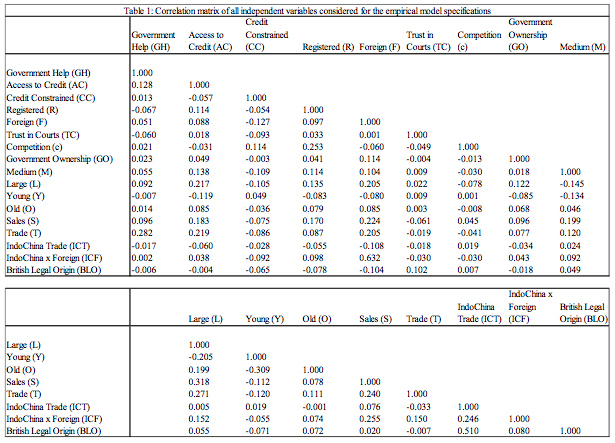

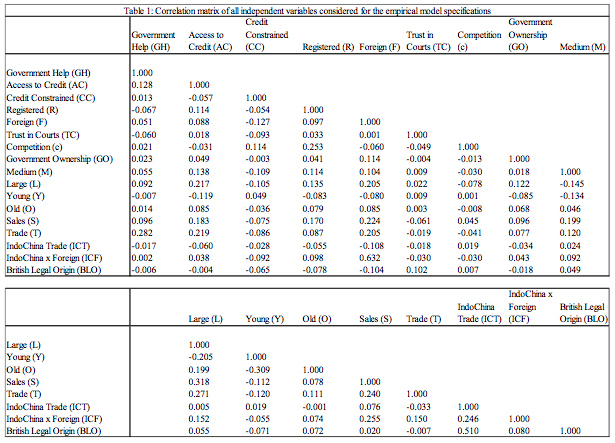

Table 1: Correlation matrix of all independent variables considered for the empirical model specifications

![Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]](/imgs/640/scale/article-images/j17/i74/a1459540500/a3fa80.jpg)

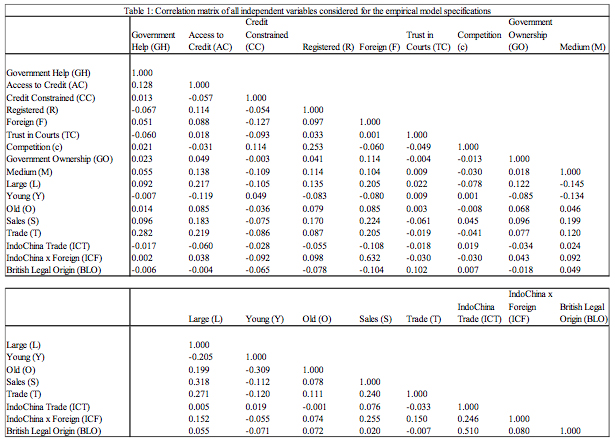

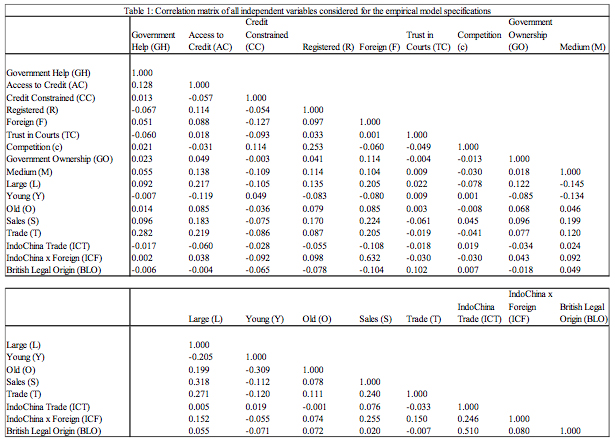

Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]

- Africa Corporate Governance Network Launches. (2013, October 16). Retrieved December 12, 2014, from http://www.ifc.org/wps/wcm/connect/topicsextconte nt/ifcexternalcorporatesite/corporategovernanc e/news/featurestories/africacorporategovernancenetwork launches

- African Economic Outlook Measuring the pulse of Africa. (2014, August 29). Retrieved December 12, 2014, from http://www.africaneconomicoutlook.org/en/

- Alaimo, V., & Fajnzylber, P. (2009). Behind the Investment Climate: Back to Basics Determinants of Corruption. In Does the investment climate matter? microeconomic foundations of growth in Latin America. Washington, DC: World Bank ;.

- Alessi, C., Hanson, S. (2012, February 8). Expanding China-Africa Oil Ties. Retrieved December 12, 2014, from http://www.cfr.org/china/expanding-chinaafricaoil-ties/p9557

- Broadman, H. (2008, April 1). China and India Go to Africa. Retrieved December 12, 2014.

- Cai, H., Fang, H., Xu, L. (2011). Eat, Drink, Firms, Government: An Investigation of Corruption from the Entertainment and Travel Costs of Chinese Firms. Journal of Law and Economics, 54, 55-78.

- Caulderwood, K. (2014, May 15). Chinese Money In Africa Directed Away From Oil, Toward Other Sectors. Retrieved December 12, 2014, from http://www.ibtimes.com/chinese-money-africa-directed-away-oil-toward-other-sectors-1584805

- Chen, Y., Ya'ar, M., Rejesus, R. (2008). Factors Influencing the Incidence of Bribery Payouts by Firms: A CrossCountry Analysis. Journal of Business Ethics, 77(2), 231244.

- China and India Rivals in Africa — Asia — DW.DE — 09.10.2012. (2012, September 10). Retrieved December 12, 2014, from http://www.dw.de/china-and-india-rivalsinafrica/a-16277724

- Dahman-Sa˜adi, M. (2013, November 3). Chinese investment in Africa (part 1). Retrieved December 12, 2014, from http://www.bsi-economics.org/219-chinese-investment-in-africa-part-1

- Dipietro, B. (2014, July 23). FCPA Fears Hinder U.S. Companies Considering Africa. Retrieved December 12, 2014, from http://blogs.wsj.com/riskandcompliance/2014/07/23/fcpa-fears-hinder-u-s-companies-considering-africa/

- Elephants and tigers. (2013, October 26). Retrieved December 12, 2014, from http://www.economist.com/news/middle-east-and-africa/21588378-chinese-businessmen-africa-get-attention-indians-are-not-far/

- Fairclough, G., Childress, S., Champion, M. (2009, July 22). Probes Involve Firm Linked to China Leader's Son. Retrieved December 12, 2014, from http://www.wsj.com/articles/SB124820142767869383

- For African business, ending corruption is 'priority number one' — Africa Renewal Online. (2010, August 1). Retrieved December 12, 2014, from http://www.un.org/africarenewal/magazine/august2010/african-business-ending-corruption-?prioritynumberone?

- Fortin, J. (2013, June 27). Creeping Tiger: India's Presence In Africa Grows, Even As China Steals The Spotlight. Retrieved December 12, 2014, from http://www.ibtimes.com/creeping-tiger-indias-pr esenceafricagrows-even-china-steals-spotlight-1324989

- Gayathri, A. (2013, October 7). Indian Companies Most Transparent Among Their BRICS Peers, While Chinese Firms Rank Last: Transparency International. Retrieved December 12, 2014, from http://www.ibtimes.com/indiancompaniesmost-transparent-among-their-brics-peerswhilechinese-firms-rank-last-transparency

- How corrupt is your country? (2014, January 1). Retrieved December 12, 2014, from http://www.transparency.org/cpi2014/results

- Indo-African Business. (2011, January 1). Retrieved December 12, 2014, from http://www.indoafricanbusiness.com/companieslisting.php

- Jacobs, S. (2013, January 1). India-Africa trade: A unique relationship. Retrieved December 12, 2014, from http://www.global-briefing.org/2012/10/india-africatradea-unique-relationship/

- Joining hands to unlock Africa's potential: A new Indian industry-led approach to Africa. (2014, March 1). Retrieved December 12, 2014, from http://www.mckinsey.com/˜/media/McKinsey Offices/ India/PDFs/Joining hands to unlock Africas poten tial.ashx

- Khare, V. (2013, August 4). The scramble for business in Africa. Retrieved December 12, 2014, from http://www.bbc.com/news/business-23225998

- Klerman, D., Mahoney, P., Spamann, H., Weinstein, M. (2012). Legal Origin or Colonial History? Journal of Legal Analysis, 379-409.

- Kushner, J. (2013, October 3). Corruption in the Congo: How China Learnt from the West. Retrieved December 12, 2014, from http://thinkafricapress.com/drc/corruptioncongohow-china-learnt-west

- Leung, D., Zhou, L. (2014, May 15). Where Are Chinese Investments in Africa Headed? Retrieved December 12, 2014, from http://www.wri.org/blog/2014/05/where-arechineseinvestments-africa-headed

- More than minerals. (2013, March 23). Retrieved December 12, 2014, from http://www.economist.com/news/middle-east-andafrica/21574012-chinese-trade-africa-keeps-growing-fearsneocolonialismare-overdone-more

- Nayyar, R., Aggarwal, P. (2014). AFRICA-INDIA'S NEW TRADE AND INVESTMENT PARTNER. International Journal of Scientific and Research Publications, 4(3). Retrieved December 12, 2014, from http://www.ijsrp.org/research-paper-0314/ijsrpp2784.pdf

- Rankin, J. (2013, October 9). Vedanta shares tumble on downgrade. Retrieved December 12, 2014, from http://www.theguardian.com/business/2013/oct/09/vedanta-shares-tumble-downgrade-mining-energy

- Rautray, S. (2014, November 27). 2G case: Bharti Airtel chairman Sunil Mittal urges SC to set aside court summons. Retrieved December 12, 2014, from http://articles.economictimes.indiatimes.com/2014-1127/news/565156891sterling-cellular-excess-spectrumcaseasim-ghosh

- Survey Methodology. (n.d.). Retrieved December 12, 2014, from http://www.enterprisesurveys.org/methodology

- Svensson, J. (2003). Who Must Pay Bribes and How Much? Evidence from a Cross Section of Firms. The Quarterly Journal of Economics, 118(1), 207-230.

- Trying to pull together. (2011, April 23). Retrieved December 12, 2014, from http://www.economist.com/node/18586448

- Vanham, P. (2014, November 5). Big dreams of IndiaAfrica trade at Delhi forum. Retrieved December 12, 2014, from http://blogs.ft.com/beyond-brics/2014/11/05/bigdreamsof-india-africa-trade-at-delhi-forum/?

- Vedanta to buy miner at centre of probe FT.com. (2011, August 8). Retrieved December 12, 2014, from http://www.ft.com/intl/cms/s/0/027bd136-c1bd-11e0acb3-00144feabdc0.htmlaxzz3LWLUYrFU

Appendix

Table 1: Correlation matrix of all independent variables considered for the empirical model specifications

![Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]](http://www.inquiriesjournal.com/article-images/j17/i74/a1459540500/a3fa80.jpg)

Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]

Suggested Reading from Inquiries Journal

China’s emergence as a key player in Africa, the impact of its presence and its challenges to traditional Western pre-eminence in African economies are among the hallmarks of the changing economic scenario in the twenty-first century. Beijing’s present-day engagement in Africa is not new: it has its roots in policies... MORE»

The study examines the degree to which Xi Jinping has brought about a strategic shift to the Chinese outward investment pattern and how this may present significant political leverage and military advantages for China in... MORE»

Angola today is framed by a history of violent conflict that has left the population far behind on all major indicators. Lacking a democratic culture, the country faces two significant challenges: first, the challenge of... MORE»

The formation and expansion of the U.S. Africa Command (USAFRICOM) signals the increasing strategic importance of Africa to U.S. security interests, especially in light of the 2014 U.S.-Africa Leaders Summit on strategic... MORE»

Latest in Economics

2020, Vol. 12 No. 09

Recent work with the Economic Complexity Index (ECI) has shown that a country’s productive structure constrains its level of economic growth and income inequality. Building on previous research that identified an increasing gap between Latin... Read Article »

2018, Vol. 10 No. 10

The value proposition in the commercial setting is the functional relationship of quality and price. It is held to be a utility maximizing function of the relationship between buyer and seller. Its proponents assert that translation of the value... Read Article »

2018, Vol. 10 No. 03

Devastated by an economic collapse at the end of the 20th century, Japan’s economy entered a decade long period of stagnation. Now, Japan has found stable leadership, but attempts at new economic growth have fallen through. A combination of... Read Article »

2014, Vol. 6 No. 10

In July 2012, Spain's unemployment rate was above 20%, its stock market was at its lowest point in a decade, and the government was borrowing at a rate of 7.6%. With domestic demand depleted and no sign of recovery in sight, President Mariano Rajoy... Read Article »

2017, Vol. 9 No. 10

During the periods of the Agrarian Revolt and the 1920s, farmers were unhappy with the economic conditions in which they found themselves. Both periods witnessed the ascent of political movements that endeavored to aid farmers in their economic... Read Article »

2017, Vol. 7 No. 2

In 2009, Brazil was in the path to become a superpower. Immune to the economic crises of 2008, the country's economy benefitted from the commodity boom, achieving a growth rate of 7.5 per cent in 2010, when Rousseff was elected. A few years later... Read Article »

2012, Vol. 2 No. 1

The research completed aimed to show that the idea of fair trade, using the example of goals for the chocolate industry of the Ivory Coast, can be described as an example of the economic ideal which Karl Marx imagined. By comparing specific topics... Read Article »

|

![Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]](/imgs/640/scale/article-images/j17/i74/a1459540500/a3fa80.jpg)

![Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]](http://www.inquiriesjournal.com/article-images/j17/i74/a1459540500/a3fa80.jpg)