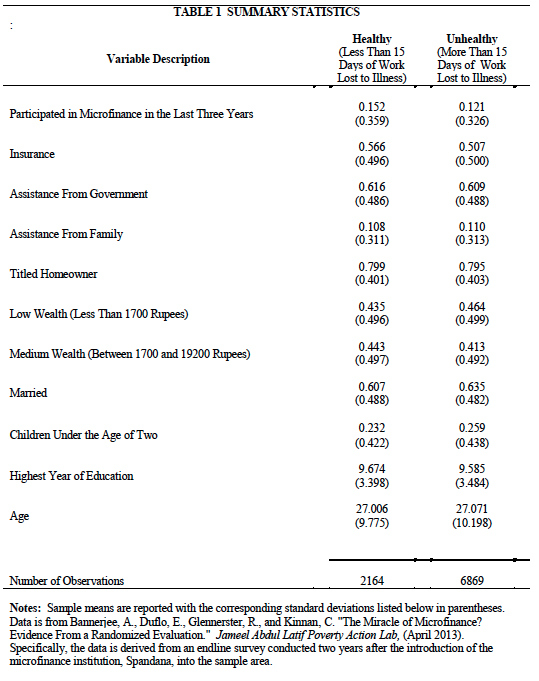

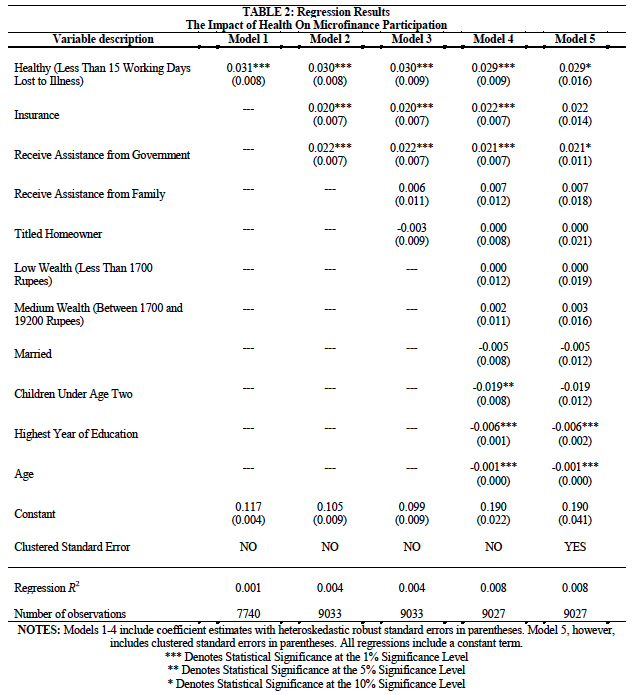

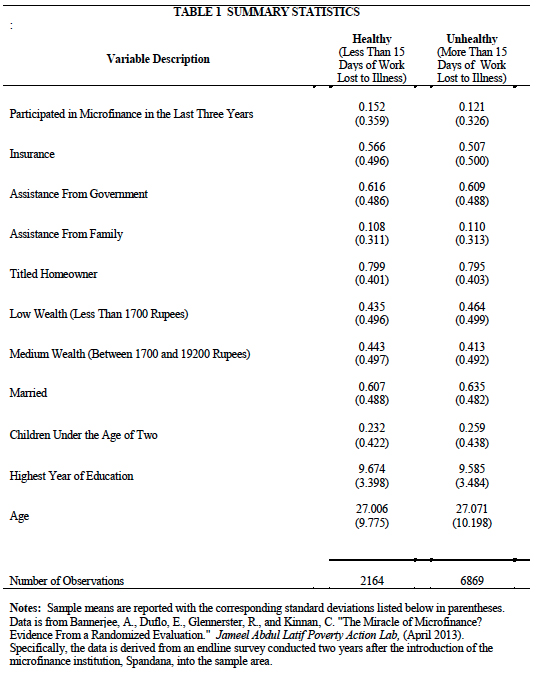

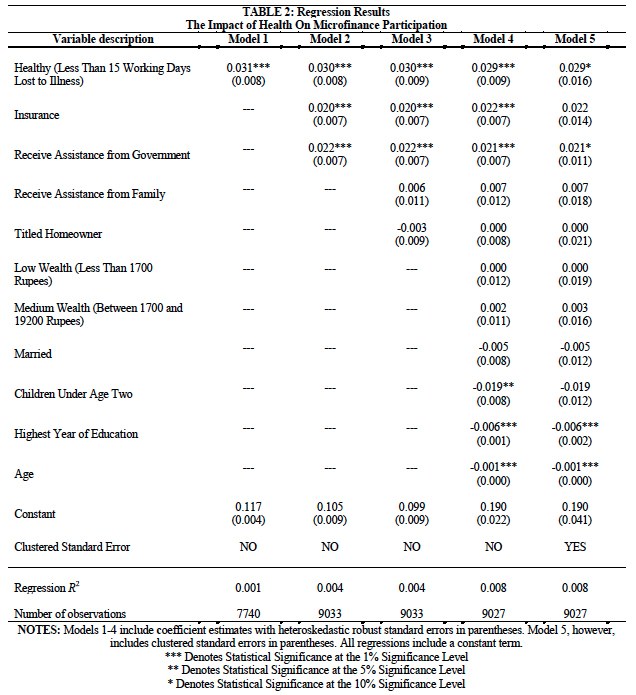

From The Developing Economist VOL. 1 NO. 1Don't Fear the Reaper: Analyzing the Effect of Health on Microfinance ParticipationIV. Empirical ModelUtilizing the econometric model depicted below, I empirically analyze the relationship between health and an individual's willingness to participate in microfinance. Accounting for both formal and informal risk mitigation tactics, I include ownership of an insurance policy (be it life, health, or property) and the receipt of government or family assistance as additional explanatory variables. Additionally, I incorporate a variety of controls into the model to minimize disparities in individual characteristics and economic circumstances thus isolating variation in the aforementioned explanatory variables. This being a linear probability model, the outcome of interest, Micro, is a binary variable indicating whether an individual has taken a microloan in the past three years. The primary explanatory variable, Health, is also a binary variable answering affirmative if an individual has lost fewer than 15 working days to illness in the past year. The three insurance network variables, Insure, Govassist, and Famassist, are again binary variables indicating whether an individual has any insurance policy, receives any type of assistance from the government or from their family, respectively. As discussed in the above literature review, both objective and subjective risk —such as crop price fluctuations or fear—influence household production decisions. Assuming rational economic actors, individual decisions are made on the margin. Therefore, such complex vulnerability affects choice by distorting perceived marginal cost and benefit. This model coincides with the overarching economic theory in that health is the culmination of a broad range of risk factors, the severity of which could shift marginal analysis away from long-run investment and towards more immediate gratification. The presence of both formal and informal insurance networks work to mitigate the risk of poor health and should therefore be included in the model as indicators of the long run decision to participate in microfinance. To isolate variation in the key explanatory variable, this model includes controls for such factors as wealth, education, age, marital status, and the presence of children under age two. Given the intangible nature of perceived risk, it is important to consider these factors, as, for example, married individuals or those with children might be inherently risk averse. Also, the conspicuous absence of a gender variable is worth noting. Embracing a traditional microfinance model, Spandana solely issues loans to small groups of women. Despite this, the individuals compiling the data set collected a holistic census including both men and women. To better isolate the decision making process of the eligible females, I drop all male variables and solely analyze these factors among the female sample. Potential shortfalls of this econometric model stem both from its being a linear probability model and from specification error in the form of omitted variable bias. While later testing of the parameter estimates addresses a common shortcoming of such models by verifying that no individuals have predicted probabilities of microfinance participation above one hundred or below zero percent, all linear probability models are inherently heteroskedastic. While this poses no threat of biased estimators, I am forced to include heteroskadisticityrobust standard errors in later regression analysis to preserve my ability to infer causality. Additionally, to better isolate the effect of microfinance introduction, JPAL formed treatment and control groups at the neighborhood level based on similarities in myriad controls. As such, Model 5 incorporates clustered standard errors in order to address the potential for intra-neighborhood correlation. The prominent reduction in statistical significance suggests that the previous models wrongfully attribute willingness to invest entirely to personal characteristics while ignoring peer-group effects within one's village. Just as Moulton's Problem suggests that students' test scores are correlated with the composition of their classroom,13 residents' propensities to invest are correlated with the composition of their community. In this way, an improved model for neighborhood characteristics is necessary to avoid under-specification. Furthermore, while a randomized controlled trial would typically function to minimize disparities in individual characteristics (or at least ensure their random distribution), the original treatment and control groups were differentiated by the introduction of microfinance, not health characteristics. Consequently, despite my controlling for a variety of contributing factors, the convoluted nature of any health metric means that the model is likely underspecified. In this way, potential correlation between my unobserved error term and my key explanatory variable prompts omitted variable bias and threatens the assumption of exogenous variation. That being said, JPAL and Spandana's initial selection of neighborhoods was based on a common set of criteria defining ideal candidates for microfinance. In this way, while JPAL's experimental design of treatment and control groups is not directly beneficial to the question of health, the selection of neighborhoods based on similar criteria and the subsequent randomized introduction of Spandana within said sample help preserve the exogeneity of the health variable. Even still, health being an inherently convoluted notion, the selection of such a proxy variable as the number of days lost to illness poses an obstacle to causal inference. Coupling the endogeniety posed by this health metric with the under-specification of neighborhood composition, I am unable to establish direct causality between health and willingness to invest. Despite this, a comparison between Models 4 and 5 provides insight as to the influence of peergroup effects on microfinance participation. V. ResultsOverall, both my summary statistics and early regression analysis allude to a significant relationship between health and an individual's willingness to borrow. As may be referenced in Appendix A, there is a three percentage point increase in microfinance participation among those individuals deemed healthy. Regression analysis, in turn, reaffirms the trend suggested in the summary statistics as healthy women are 2.9 percent more likely to take a microloan. That being said, the incorporation of clustered standard errors reduces the explanatory variables' statistical significance. In this way, correlation within neighborhoods accounts for some of the perceived variation between health and microfinance participation. First analyzing the summary statistics to determine whether the key explanatory variable is sufficiently exogenous and that the data generally coincides with underlying theory, the basic study proves valid and worthy of further regression analysis. Health being the primary explanatory variable, the disparity in participation between healthy and unhealthy demographics coincides with the notion that risk impedes the pursuit of long term goals. Hoping to isolate health as a source of exogenous variation, other variables should ideally remain fairly constant across the healthy and unhealthy groups. While there is some variation in the risk mitigating variables, the other covariates remain largely consistent between said groups, thus reinforcing the validity of the experimental design. A noticeable exception, however, is the prominent increase in the percentage owning insurance among healthier individuals. As with the outcome of interest, the increase in insurance among the healthy may be partially attributed to a longer term marginal analysis. If an individual is healthy, perhaps he or she is more likely to have hope for the future and therefore consider the long term benefits of an insurance policy. While such correlation between explanatory variables hinders my ability to fully establish exogenous variation, it is better to include insurance in the model so as to empirically account for such a significant factor and thereby avoid the more damning effect of correlation between the unobserved term and the independent variable. The remaining two factors in which there are slight disparities in healthy and unhealthy samples are low wealth and medium wealth. Determined by the value of household assets, the demarcation between low and medium was based on the percentiles within the larger sample. Specifically, those individuals with household assets below the 50th percentile are deemed "low wealth," while those between the 90th and 50th percentile are "medium wealth." Despite the logical, positive effect of wealth on health, the disparity is relatively small and should not significantly skew the results. Beyond the factors discussed above, the "constant" variables remain consistent between the healthy and unhealthy groups, thereby more effectively isolating health as an exogenous explanatory variable. Thus able to largely isolate variation in health ceteris paribus, regression analysis poses the next step in quantifying the proposed relationship between this comprehensive risk factor and microfinance participation. As illustrated in Appendix B, the na¨ıve regression (Model 1) of health on microcredit history yields a 3.1 percent increase in the likelihood of having paid off a microloan within the past three years for those individuals deemed "healthy." This parameter estimate is valid at the 1 percent significance level; therefore, we have significant evidence to reject the null hypothesis that there is no relationship between health and microfinance participation. Model 2 incorporates formal risk mitigating systems such as insurance and government assistance as additional explanatory variables. In this regression, the parameter estimate for health decreases only slightly to 3.0 percent while both government assistance and insurance pose similarly significant factors at the 1 percent significance level. Prompting a 2.0 and 2.2 percent increase in the likelihood of microfinance participation, the inclusion of an insurance policy or government welfare program (respectively) pose economically significant forms of formal risk mitigation. I include more informal risk mitigation in Model 3 through binary variables indicating titled home ownership and the receipt of family assistance. While these may be underestimated due to social desirability bias in survey responses, neither of these variables bears statistical or economic significance. Despite including an additional two variables, health and the two formal risk mitigating factors remain extremely stable between Models 2 and 3. Model 4 incorporates all controlling factors (wealth measured in the value of household assets, marital status, children under age two, age, and education) and thereby constitutes my fully specified model. Both health and government assistance remain stable across the latter two regressions whereas the return to insurance increases slightly (2.0 to 2.2 percent) upon the inclusion of the controls. Finally, Model 5 mirrors the fully specified regression but includes clustered standard error as a means to account for intra-neighborhood correlation. While the parameter estimates are the same as those in Model 4, an increase in standard error proves detrimental to the model's statistical significance. Despite the consequent inability to infer causality between health and propensity to invest, the disparity between Models 4 and 5 remains telling in terms of the need to craft localized aid initiatives that consider neighborhood composition. Fundamentally, my regression analysis suggests that being "healthy" is correlated with a 2.9 percent increase in willingness to participate in microfinance. This parameter estimate remains stable throughout all five models in economic significance. While an increase in participation probability of only 2.9 percent may appear inconsequential, the underlying economic theory suggests that health is but a singular aspect of a multi-faceted vulnerability network impeding long-term investment. All five models' remarkably low correlation coefficients reaffirm this notion. Even when including all controls, the model only explains 0.6 percent of the variation in microfinance participation. That being said, when aid initiatives bolster health in conjunction with insurance and more general government assistance, the effect compounds to a 6.5 percent increase in willingness to participate. In this way, more risk factors must be empirically identified in order to account for more variation in microfinance uptake. VI. Interpretation and ConclusionPursuing a more holistic model for developmental aid, this study addresses the broader effect of risk mitigation on the willingness of an individual to forego short term "happiness" in pursuit of long term goals. As discussed above and illustrated in Appendix B, this model suggests a 2.9 percent increase in willingness to take a microloan among "healthy" individuals (valid initially at the 1 percent significance level and later at 10 percent). Despite the economic significance of this result, I hesitate to infer causality due to the threat of omitted variable bias inherent both in using the number of working days lost to illness as a singular proxy for the convoluted notion of health and in neglecting to model peer-group effects. The reduction in statistical significance stemming from the incorporation of clustered standard error suggests the correlation between such peer-groups and propensity to invest. By failing to account for the Moulton Problem of intra-group correlation, I overestimate the reliability of group-level parameter estimates. Be it through informal insurance networks or a psychological "bandwagon effect," the intricacies inherent in quantifying individual motivation within a neighborhood hamper one's ability to isolate health as an exogenous, causal factor. Rather, while this study specifically analyzes the effect of health on microfinance participation, it constitutes a limited step in establishing a broader causal relationship between myriad risk factors and the exploitation of existing aid initiatives. In this way, while the complexity of one's willingness to participate relegates these findings to a state between correlation and causation, the policy implications remain profound. A positive relationship between health and willingness to participate should influence the structure of developmental programs by incorporating such risk mitigating components as insurance to supplement traditional capital inflows. Additionally, the prominence of intra-neighborhood correlation affirms the need for a nuanced understanding of village composition so as to increase aid efficacy through more localized programs. This model's extremely low correlation coefficient elucidates the need for a multi-faceted approach to explaining variability in microfinance participation. Further research should be conducted to identify significant risk factors impeding long-run marginal analysis. Furthermore, the complex nature of local vulnerability networks asserts the need for replication within different communities, for geographic disparities may alter the relative importance of certain risk factors. With thus localized models of risk, the international aid community must develop a more holistic developmental package by which to mitigate community risk and thereby augment participation in (and the consequent efficacy of ) conventional aid programs like microfinance. To foster grassroots economic development, companies like Spandana must move beyond a paltry 27 percent participation rate among eligible borrowers by alleviating risk that otherwise relegates the impoverished to short-run marginal analysis. First improving the health of rural residents in Hyderabad, India, Spandana and the Abdul Latif Jameel Poverty Action Lab must continue to develop a holistic model of risk so as to facilitate localized growth. References

Endnotes

Appendix A: Summary StatisticsAppendix B: Regression ResultsSuggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |