|

From Cornell International Affairs Review VOL. 3 NO. 1 The G-20 Preempts the G-8: What Kind of World Economic Order?

Moreover, both countries have long demanded that the developed countries first commit to reducing their greenhouse gas emissions by at least 40 percent from 1990 levels by 2020, before they will consider any emissions caps. This demand is a non-starter as none of the rich countries will even come close to agreeing to such ambitious reductions. For example, even the ambitious American Clean Energy and Security Act of 2009 (or the Waxman-Markey Bill), passed by the U.S. House of Representatives on 28 June 2009, seeks to reduce greenhouse gas emissions over time to only 17 percent of 2005 levels by 2050.

To compound the challenges further, both China and India preemptively have declared illegal under World Trade Organization (WTO) rules any attempt by the United States and other advanced economies to levy a carbon tariff on their exports. No doubt, both China and India, among others, will find it difficult to make their paper promises a reality. Similarly, G-20 members such as Brazil and Indonesia also have their own concerns. Since the emissions problem in both these countries stem from deforestation, Brazil has offered “in principle” to reduce its deforestation rate by 70 percent over the next ten years, provided it receives sufficient compensation.

Indonesia has made similar demands. Yet, President Obama has set the bar high in making it abundantly clear that he expects the G-20 countries to set an example by reaching a bold agreement on global warming later this year (December 2009) at Copenhagen where the international community will try to forge an agreement to replace the Kyoto Protocol which expires in 2012. However, with the U.S. Congress deeply divided on this issue it remains to be seen if even the United States can deliver – that is, negotiate and ratify – its part of the bargain.

Pittsburgh was the third summit this year for the G-20. Undoubtedly, regular summitry has paid off its share of dividends. The G-20 countries surely deserve high marks for the estimated $5 trillion in stimulus they has collectively orchestrated into their economies to revive growth. Regular meetings and coordination among the various central banks have helped to ease the credit crunch and restore the flow of credit to consumers and businesses. Thus, President Obama’s oftmentioned statement that the actions taken by the G-20, “brought the global economy back from the brink,” has much validity. Yet, as noted earlier, much of the more difficult and important regulatory reform measures need to be put in place to revive growth and prevent a repeat of the crisis.

Moreover, the sad reality is that many of the commitments the G-20 members made earlier (such as not resorting to protectionism) remain unfulfilled. According to the World Bank, over the period spanning a few months (between the G-20 summit in Washington in November 2008 and the London summit in April 2009), seventeen of the G-20 countries had adopted measures that either imposed restrictions on imports or favored domestic products over imports. The great irony has been that it is the advanced economies like the United States and the EU (once the staunchest supporters of global economic integration) that have become more protectionist.

Indeed, the Obama administration has shown little enthusiasm for free trade – turning a blind eye to the NAFTA agreement by refusing to reject the Congress decision to close the border to Mexican trucks; failed to advance the three free-trade packages that are pending in Congress with Colombia, Panama and South Korea; the September 18 decision to slap punitive tariffs on Chinese made tires; and perhaps most egregious, failure to help revive the moribund Doha round of trade talks – all seem to confirm the view that many Democratic law-makers are more interested in wooing their key labor constituencies than support open global trade. Seen in this light, the G-20’s announcement to conclude a new global trade agreement by the end of 2010 seems overly optimistic. To the contrary, given recent experience, the best one can hope for is that the G-20 resists trade barriers and avoids the disastrous spiral of tit-for-tat retaliation when countries erect protectionist barriers.

Finally, will the world’s newest and the most exclusive of clubs behave like its predecessor? That is, despite its noble intentions, it may have trouble delivering on its promises. To long-time observers of economic summits, the Pittsburgh gathering seemed jarringly similar to the recent past, producing what used to come from the G-8: lofty goals, but few specifics. Indeed, since the agreements endorsed by the G-20 are mostly pledges rather than binding commitments (thus, there are no penalties if countries fail to comply), it remains to be seen when and if they are implemented.

Yet, the G-20, given its heterodox representation and broad legitimacy, has the opportunity to decisively break from its predecessor’s vain and hegemonic past. For starters, it can do this by meaningfully helping the world’s excluded (the G-172), especially the most forgotten and excluded amongst them – the poorest of the poor, the so-called “least developed countries.” It is important to reiterate that the G-172 countries had no role in starting the crisis, but have been disproportionately impacted by the virulent contagion. Unlike the G-20 and other developing countries, the low-income countries lack the resources to mount an effective fiscal response to the crisis. Not only have their revenues sharply declined, their ability to tap international capital markets has become exceedingly constrained. Without additional support many of these countries face the risk of reversing much of their recent hard-won gains in combating poverty and progress towards meeting the Millennium Development Goals (MDG). Stated more bluntly, without immediate assistance, millions of people face the risk of being forced back into extreme poverty.

Yet, despite the commitments made by the G-20 in their previous two summits, including the allocation of $250 billion worth of Special Drawing Rights (SDR) as part of an overall global stimulus plan, the sad reality is that not much assistance has been disbursed to alleviate the massive human and social costs of the crisis in these beleaguered countries. For starters, the G-20 can increase the low level of concessionary aid to the lowincome countries. It can do this relatively quickly by expanding resources in order to enable countries eligible for International Development Association loans to meet the MDG.

More broadly, even if the G-20 implements only modest measures to help these low-income countries, such as giving market access for their products and funds for a stimulus package designed to provide basic safety nets for their vulnerable populations, it will go a long way to underscore that real change has finally come to the world’s premier economic body – that will be change everyone can believe in.

Shalendra D. Sharma (Ph.D., University of Toronto, 1993) is Professor in the Department of Politics and teaches in the MA program in the Department of Economics. Sharma is the author of Democracy and Development in India (Lynne Rienner Publishers, 1999), which won the Choice Outstanding Academic Title for 1999; The Asian Financial Crisis: Meltdown, Reform and Recovery (Manchester University Press, 2003); and editor of Asia in the New Millennium: Geopolitics, Security and Foreign Policy (Institute of East Asian Studies, UC Berkeley, 2000); From Vision to Action: Strategies to Achieve the Millennium Development Goals. Sharma has published more than four dozenarticles in leading academic journals.

Sharma is also a consultant for the World Bank and the IMF. He received USF’s Universitywide Distinguished Teaching Award for 1996/1997 and the University-wide Distinguished Research Award for 2002/2003.

- “Leaders’ Statement: The Pittsburgh Summit,” September 24 – 25, 2009 http://www.pittsburghsummit.gov/mediacenter/129639.htm (accessed September 25, 2009).

- The G-7 was formed in 1976, when Canada became a member of the then Group of Six countries which included France, Germany, Italy, Japan, United Kingdom, and the United States. The G-7 provides a venue for each country to get together, sometimes several times a year to discuss and formulate macroeconomic policies. The G-8 is different in the sense it was created to allow the heads of governments of the G-7 plus Russia to meet annually and discuss pressing issues of the day.

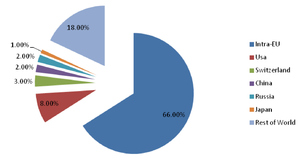

- The European Union is represented by the rotating Council presidency and the European Central Bank. In addition, the Managing Director of the IMF and the President of the World Bank, plus the chairs of the International Monetary and Financial Committee and Development Committee of the IMF and World Bank, also participate in G-20 meetings on an ex-officio basis.

- The review was actually due in 2013, but brought forward to 2011.

- The vote share of IMF member countries is reviewed every five years. Currently, the U.S. vote share is 16.77 percent, followed by Japan with 6.02 percent Amongst emerging economies, China’s is the biggest with 3.66 percent, followed by Saudi Arabia with 3.16 percent, Russia with 2.69 percent, India with 1.89 percent, Brazil with 1.38 percent, and South Korea with 1.33 percent. The IMF requires an 85 percent majority to approve all key decisions, including amending its Articles of Agreement.

- Guido Mantega, 2009. International Monetary and Financial Committee, International Monetary Fund (statement by the minister of finance of Brazil, April 25, 2009), p. 5. http://204.180.229.21/External/spring/2009/imfc/statement/eng/bra.pdf 7 The United States, with its 16.77 percent of cotes share enjoys an effective veto in the IMF. However, if the United States share falls below the 15-percent threshold, it will mark the end of its veto.

- The IMF has 186 members, represented by 24 executive board members

- Both before and during the meeting, there was a very public disagreement between the United States and France regarding on how best to clamp down on executive pay. Although, both agreed that executive bonuses contributed to the financial crisis by rewarding short-term performance without due regard to long-term risks, France preferred the imposition of specific caps on executive bonuses. On the other hand, the United States and Great Britain argued that placing specific caps were too punitive and suggested that bonuses should be deferred for several years to reduce market participants engaging in risky gambles. The American view prevailed.

- Although Chinese President Hu Jintao, for the first time pledged to reduce “by a notable margin” its carbon pollution growth rate as measured against economic growth, he did not provide specific targets.

- It is important to note that over the objections of President Obama, the U.S. Congress (both the House and especially the Senate) has great reservations on his plans to combat global warming. The United States rejected the Kyoto Protocol because it exempted countries like India and China from certain obligations.

Photos Courtesey of:

- “SBY in Pittsburgh, 26Sept09 .” Wikimedia. 29 Oct 2009. http://upload.wikimedia.org/wikipedia/commons/4/44/SBY_inPittsburgh%2C_26Sept09.jpg

- “Pittsburgh Summit 2009.” Wikimedia. 29 Oct 2009. http://upload.wikimedia.org/wikipedia/commons/0/0d/2009_G-20_Pittsburgh_summit.jpg Professor Sharma can be contacted at sharmas@usfca.edu

Author

Shalendra D. Sharma (Ph.D., University of Toronto, 1993) is Professor in the Department of Politics and teaches in the MA program in the Department of Economics. Sharma is the author of Democracy and Development in India (Lynne Rienner Publishers, 1999), which won the Choice Outstanding Academic Title for 1999; The Asian Financial Crisis: Meltdown, Reform and Recovery (Manchester University Press, 2003); and editor of Asia in the New Millennium: Geopolitics, Security and Foreign Policy (Institute of East Asian Studies, UC Berkeley, 2000); From Vision to Action: Strategies to Achieve the Millennium Development Goals. Sharma has published more than four dozenarticles in leading academic journals.

Sharma is also a consultant for the World Bank and the IMF. He received USF’s Universitywide Distinguished Teaching Award for 1996/1997 and the University-wide Distinguished Research Award for 2002/2003.

Endnotes

- “Leaders’ Statement: The Pittsburgh Summit,” September 24 – 25, 2009 http://www.pittsburghsummit.gov/mediacenter/129639.htm (accessed September 25, 2009).

- The G-7 was formed in 1976, when Canada became a member of the then Group of Six countries which included France, Germany, Italy, Japan, United Kingdom, and the United States. The G-7 provides a venue for each country to get together, sometimes several times a year to discuss and formulate macroeconomic policies. The G-8 is different in the sense it was created to allow the heads of governments of the G-7 plus Russia to meet annually and discuss pressing issues of the day.

- The European Union is represented by the rotating Council presidency and the European Central Bank. In addition, the Managing Director of the IMF and the President of the World Bank, plus the chairs of the International Monetary and Financial Committee and Development Committee of the IMF and World Bank, also participate in G-20 meetings on an ex-officio basis.

- The review was actually due in 2013, but brought forward to 2011.

- The vote share of IMF member countries is reviewed every five years. Currently, the U.S. vote share is 16.77 percent, followed by Japan with 6.02 percent Amongst emerging economies, China’s is the biggest with 3.66 percent, followed by Saudi Arabia with 3.16 percent, Russia with 2.69 percent, India with 1.89 percent, Brazil with 1.38 percent, and South Korea with 1.33 percent. The IMF requires an 85 percent majority to approve all key decisions, including amending its Articles of Agreement.

- Guido Mantega, 2009. International Monetary and Financial Committee, International Monetary Fund (statement by the minister of finance of Brazil, April 25, 2009), p. 5. http://204.180.229.21/External/spring/2009/imfc/statement/eng/bra.pdf 7 The United States, with its 16.77 percent of cotes share enjoys an effective veto in the IMF. However, if the United States share falls below the 15-percent threshold, it will mark the end of its veto.

- The IMF has 186 members, represented by 24 executive board members

- Both before and during the meeting, there was a very public disagreement between the United States and France regarding on how best to clamp down on executive pay. Although, both agreed that executive bonuses contributed to the financial crisis by rewarding short-term performance without due regard to long-term risks, France preferred the imposition of specific caps on executive bonuses. On the other hand, the United States and Great Britain argued that placing specific caps were too punitive and suggested that bonuses should be deferred for several years to reduce market participants engaging in risky gambles. The American view prevailed.

- Although Chinese President Hu Jintao, for the first time pledged to reduce “by a notable margin” its carbon pollution growth rate as measured against economic growth, he did not provide specific targets.

- It is important to note that over the objections of President Obama, the U.S. Congress (both the House and especially the Senate) has great reservations on his plans to combat global warming. The United States rejected the Kyoto Protocol because it exempted countries like India and China from certain obligations.

Photos Courtesey of:

- “SBY in Pittsburgh, 26Sept09 .” Wikimedia. 29 Oct 2009. http://upload.wikimedia.org/wikipedia/commons/4/44/SBY_inPittsburgh%2C_26Sept09.jpg

- “Pittsburgh Summit 2009.” Wikimedia. 29 Oct 2009. http://upload.wikimedia.org/wikipedia/commons/0/0d/2009_G-20_Pittsburgh_summit.jpg Professor Sharma can be contacted at sharmas@usfca.edu

Suggested Reading from Inquiries Journal

The Obama presidency will largely be defined by the administration’s ability to respond to the unique and historic challenge facing the country at the time of his inauguration: the Great Recession. This paper evaluates the president’s success throughout both of his terms in enacting an economic policy, which was largely... MORE»

The COVID-19 crisis has exacerbated current global challenges. However, this article argues that this time of crisis can also be a unique opportunity for the existing global economic institutions - G20, WTO, IMF, and World... MORE»

Since the financial crisis of 2007, regulators have recognized the necessity for global governance in an increasingly interconnected global economy. Many have praised the extent to which regulators have already minimized... MORE»

In spite of the above-described traditional sentiment that the European Union (EU) was primarily an economic actor, with all other priorities seconded to that fact, trade policy has been inextricably linked with the EU’s international presence since the inception of the Common Commercial Policy (CCP) from the Treaty Establishing... MORE»

Latest in Economics

2020, Vol. 12 No. 09

Recent work with the Economic Complexity Index (ECI) has shown that a country’s productive structure constrains its level of economic growth and income inequality. Building on previous research that identified an increasing gap between Latin... Read Article »

2018, Vol. 10 No. 10

The value proposition in the commercial setting is the functional relationship of quality and price. It is held to be a utility maximizing function of the relationship between buyer and seller. Its proponents assert that translation of the value... Read Article »

2018, Vol. 10 No. 03

Devastated by an economic collapse at the end of the 20th century, Japan’s economy entered a decade long period of stagnation. Now, Japan has found stable leadership, but attempts at new economic growth have fallen through. A combination of... Read Article »

2014, Vol. 6 No. 10

In July 2012, Spain's unemployment rate was above 20%, its stock market was at its lowest point in a decade, and the government was borrowing at a rate of 7.6%. With domestic demand depleted and no sign of recovery in sight, President Mariano Rajoy... Read Article »

2017, Vol. 9 No. 10

During the periods of the Agrarian Revolt and the 1920s, farmers were unhappy with the economic conditions in which they found themselves. Both periods witnessed the ascent of political movements that endeavored to aid farmers in their economic... Read Article »

2017, Vol. 7 No. 2

In 2009, Brazil was in the path to become a superpower. Immune to the economic crises of 2008, the country's economy benefitted from the commodity boom, achieving a growth rate of 7.5 per cent in 2010, when Rousseff was elected. A few years later... Read Article »

2012, Vol. 2 No. 1

The research completed aimed to show that the idea of fair trade, using the example of goals for the chocolate industry of the Ivory Coast, can be described as an example of the economic ideal which Karl Marx imagined. By comparing specific topics... Read Article »

|