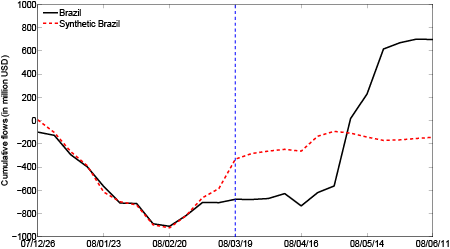

Featured Article:Capital Controls in Emerging Market Economies: Comparing Their Use and Effectiveness in Five CountriesAn Investigation into the Effectiveness of Using Capital Controls to Reduce VolatilityIn this study, I examined capital flows before and after the imposition of controls in the case study countries of Brazil, Chile, Thailand, Malaysia, and India. These countries are unique because they are emerging market economies that have been subject to high volume and volatile capital inflows in recent decades, especially in the past few years following the global financial crisis. Through comprehensive research and the compilation of results from various studies, I was able to analyze the use of capital account restrictions in these five countries under different circumstances and with varying levels of success. This quantitative case study helps reveal which types of controls may be more effective than others and under what limited circumstances it may be useful for countries to use capital controls among other policy measures. In order to conduct this study, I first narrowed down the time period for each of the case studies according to when the countries implemented capital controls and for how long they persisted in using these policy measures. Of the five case studies, the country that has made a significant use of episodic controls following the financial crisis is Brazil. The other country of the five case studies that has used episodic controls is Chile, which implemented its restrictions following the Latin American crises of the 1980s.The three other countries in this study—Thailand, Malaysia, and India—have all resorted to the use of long-standing capital controls over the years, although with varying levels of success. Accordingly, my examination of each case study involves different—but sometimes overlapping—time periods from the 1990s to present. After compiling and analyzing the various research that has been done on the use of capital controls in the five case study countries, I conclude whether the controls were effective or not in each situation and aim to explain why or why not they were useful. Next, I proceed to consider the implications of the IMF’s policy change on the appropriate use of capital account restrictions. The IMF’s shift in policy recommendation following the global financial crisis has far-reaching consequences that need to be carefully evaluated before other countries decide to institute controls of their own. Therefore, it is crucial that these implications be examined before I can make suggestions for future research. As this preceding research design demonstrates, my study is quantitative in nature. Findings from Case Studies in Latin American and AsiaThe five case studies involving emerging market economies—two from Latin America, two from East Asia, and one from South Asia—demonstrate different countries’ uses of controls in an attempt to stem capital volatility. The types and durations of these controls vary, as have their effectiveness. Most studies have found that capital controls on inflows, while generally ineffective, are also not as harmful as capital controls on outflows. The case studies in this paper reinforce this concept with one possible exception. The countries that imposed capital controls on inflows such as Brazil, Chile, and India did not benefit from these controls, but they also did not suffer extensive repercussions either. Of the two countries that imposed controls on capital outflows, Thailand suffered from a currency crisis following the imposition of its controls. One major distinction that can be made in duration is between long-standing capital controls and shorter, episodic ones. Long-standing controls are akin to walls that provide an almost permanent barrier against the volatility of international capital markets. However, these controls also tend to limit capital flows that could provide the countries that employ them with cheap capital, financial development, and ways to diversify risk. Meanwhile, episodic capital controls can be compared to gates that are expected to open when countries need to benefit from international capital flows and close when countries are faced with capital inflows that may cause unwanted appreciation or destabilizing growth in an asset market. Since episodic controls are temporary and generally more targeted toward asset classes, they tend to be less distortionary and ineffective compared to more indiscriminate, long-term controls (Klein, 2012, p. 319). A study of the effectiveness of capital controls in 44 countries conducted by Klein (2012) found that in countries with restrictions on capital inflows, it is countries that have long-standing controls that experience slower growth in GDP and other financial variables compared to countries with episodic controls. Moreover, countries that have implemented long-standing controls tend to have lower GDP per capita levels than the other countries in the study. Klein also found that while neither long-standing nor episodic controls are associated with slower growth in annual GDP or other financial variables, these controls also do not appear to lead to lower rates of currency appreciation (2012, p. 320). This finding is significant, since most emerging market economies—such as Brazil—have been imposing capital controls in an effort to combat the appreciation of their respective currencies in the international market. The five case studies selected for this paper provide a representative sample of the different types of controls that emerging markets institute: Brazil and Chile are examples of two countries that have resorted to using episodic capital controls, while Thailand, Malaysia, and India are countries that impose long-standing controls and leave their markets persistently closed (Klein, 2012, p. 331). Moreover, Brazil, Chile, and India imposed largely ineffective controls on capital inflows into their respective countries, while Thailand and Malaysia imposed controls on capital outflows with the former country suffering from a currency crisis in the years following its institution of capital controls. BrazilFigure 1.1 - Capital Flows When Fixed Income Investment is Taxed, March 2008 (Jinjarak, Noy, and Zheng 2013, 22)

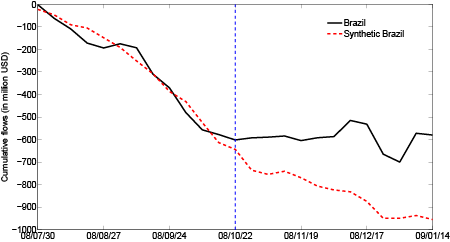

Figure 1.2 - Capital Flows When Fixed Income Tax is Removed, October 2008 (Jinjarak, Noy, and Zheng 2013, 23)

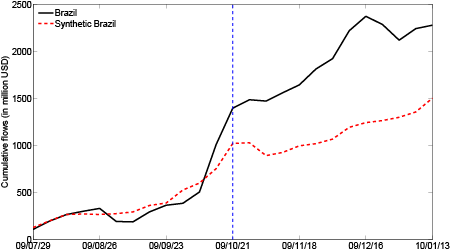

Figure 1.3 - Capital Flows When Stock and Bond Investment is Taxed at 2%, October 2009 (Jinjarak, Noy, and Zheng 2013, 24)

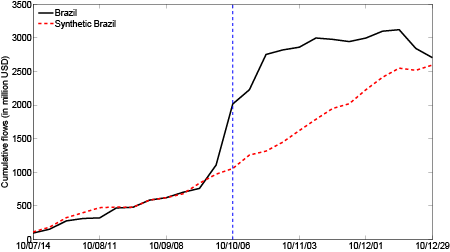

Figure 1.4 - Capital Flows When Taxes are Increased from 2% to 4%, October 2010 (Jinjarak, Noy, and Zheng 2013, 25)

Figure 1.5 - Capital Flows When Taxes are Reduced from 6% to 4%, January 2011 (Jinjarak, Noy, and Zheng 2013, 26)

Figure 1.6 - Brazilian Stock Market, the Bovespa, 2009-2011 (Baumann and Gallagher 2012, 7)

Figure 1.7 - Exchange Rate of the U.S. Dollar versus the Brazilian Real, 2009-2011 (Baumann and Gallagher 2012, 7)

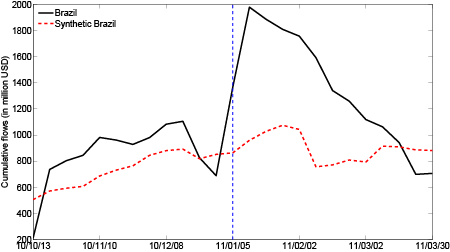

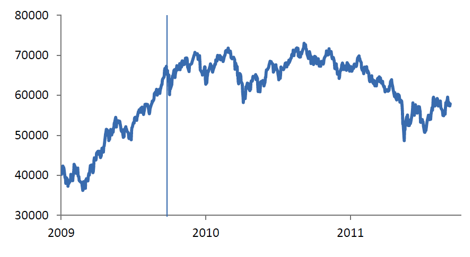

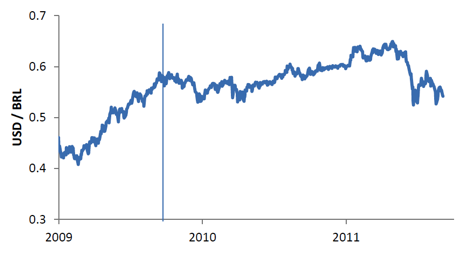

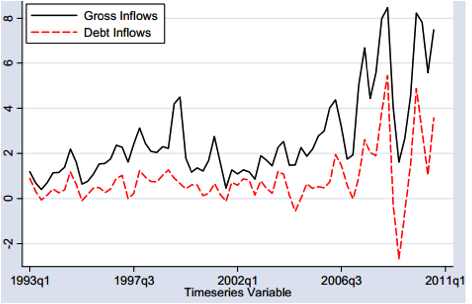

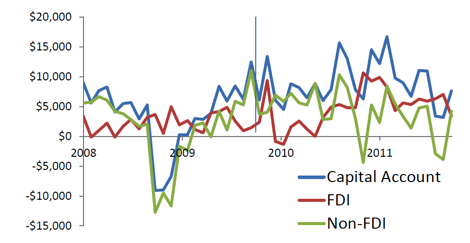

Figure 1.8 - Composition of Brazilian Net Inflows, 2008-2011 (Baumann and Gallagher 2012, 8) The use of capital controls in Brazil was for a stated purpose: government authorities imposed controls in an attempt to combat the appreciation of the Brazilian real. Accordingly, in order to evaluate the effectiveness of these controls, it would be useful to determine what developments occurred with respect to the exchange rate. Additionally, it is important to note that the Brazilian capital controls were imposed on capital inflows into the country. Most studies have found a lack of statistically significant effect on the exchange rate immediately after various measures were imposed in the country (Garcia, 2013; Coelho and Gallagher, 2010, p. 24; Klein, 2012). Therefore, it does not appear that the use of capital controls in Brazil was effective in efforts to prevent an appreciation of the real, which reached a level of 30 percent appreciation on the dollar in 2009 (Coelho and Gallagher, 2010, p. 2). In order to assess the effectiveness of the use of capital controls in Brazil, it is crucial to first separate the instances and types of changes that occurred in Brazil’s capital account policy following the onset of the global financial crisis. There existed five distinct phases of capital control institution and removal from the years 2008 to 2011. These five stages will each be analyzed in order to determine the effectiveness of controls in achieving their stated goal of reducing volatility in capital inflows. In March 2008, Brazil decided to implement a tax on fixed income alone. In the weeks leading up to the control being put in place, capital inflows did decline, but they soon rose again (see Figure 1.1). Therefore, the control in March 2008 only had a small and temporary impact on capital flows into the Brazilian markets. Next, in October 2008, Brazil decided to lift the fixed-income tax because capital inflows had been decreasing drastically in the pre-crisis months. As a result of this control being lifted, a slowdown in capital outflows occurred (see Figure 1.2). The following year in October 2009, Brazil instituted a two percent tax on stock and bond investment, which did not prove to be effective in stemming large volumes of capital inflows (see Figure 1.3). Brazil tried to use controls again in October 2010—this time raising the taxes from two percent to four percent—which had a similar lack of effect on the volume of inflows into Brazil (see Figure 1.4). Finally, in January 2011, when Brazil reduced the tax on equities from six percent to four percent (see Figure 1.5), there was short-run growth in equity investment in Brazilian funds (Jinjarak, Noy, and Zheng, 2013, p. 12-14). Most studies of Brazil’s use of capital controls following the financial crisis end in the year 2011 because Brazil—and most other emerging market economies—experienced a sudden cease in capital inflows from developed nations due to the onset of the Eurozone crisis (Baumann and Gallagher, 2012, p. 3). Due to the events that were occurring in the Eurozone at the time, investors became wary of the stability of the global financial system and this ensuing uncertainty resulted in large capital outflows from emerging market economies into countries that were deemed “safe havens,” such as the U.S., UK, and Japan. Investors were quick to move their funds to these three nations while waiting to see what would transpire in the Eurozone (Sivy, 2011). Therefore, emerging markets such as Brazil were adversely impacted by the sudden outflow of capital. In Baumann and Gallagher’s (2012) study of the effects of Brazil’s capital controls on the country’s equity market indices, exchange rate level and stability, and net capital inflow volume and composition, several key findings can be reported. With respect to the Brazilian national stock exchange, the Bovespa, it is evident that Brazil was experiencing a potential stock market bubble beginning in 2009 until the Eurozone crisis in 2011 finally caused a decline in the market (see Figure 1.6). Therefore, while the initial announcements about impending controls were effective in lowering asset prices, the controls themselves did not lower asset prices in the long-term and they were actually offset by regulations that encouraged investors to return to Brazil. Meanwhile, announcements of capital controls did have a small statistically significant impact on reducing the appreciation of the Brazilian real, but the actual controls themselves did not have a statistically significant impact on reducing exchange rate volatility (see Figure 1.7). As reported earlier, the institution of capital account restrictions actually resulted in an increase of capital inflows into Brazil, but one important fact to note is that the composition of these flows shifted from short-term to longer-term inflows. For a breakdown of Brazilian net inflows by capital account, FDI, and non-FDI, see Figure 1.8 (Baumann and Gallagher, 2012, p. 4 and 17). The preceding analysis of Brazil’s five phases of post-crisis capital account policy and breakdown of the effect of capital controls on three macroeconomic indicators—equity market indices, the exchange rate and capital inflows—provides evidence in support of capital account liberalization. Brazil’s relaxation of controls did have an effect on capital flows: an effect that was short-lived but still statistically and economically significant. There is no evidence to show that a tightening of capital controls was effective in decreasing the scale of inflows into Brazil. Meanwhile, there is support for the conclusion that Brazil was moderately successful in avoiding additional drops in inflows when the country lifted its capital controls (Jinjarak, Noy, and Zheng, 2013, p. 14). Nevertheless, it is important to consider the additional costs with which Brazil had to contend as a result of its capital controls. A major cost of the controls in Brazil that is not easily quantifiable involves implementing and maintaining the necessary administrative and institutional infrastructures to enforce the controls domestically (Ostry et al., 2010, p. 12). Additionally, since Brazil amended its controls several times during the post-crisis time period, there would have been significant costs associated with continuously extending, adjusting, and monitoring compliance with the controls (Ariyoshi et al., 2000, p. 17). Accordingly, these costs must also be considered when attempting to determine the effectiveness of the Brazilian capital controls. Since the controls did not seem to achieve their intended goals and Brazil still had to contend with their associated costs, it does not appear as though the use of capital account restrictions was advantageous in this particular case. ChileChile has used various measures to manage capital flows on numerous occasions, with the most recent incidence being in the wake of the financial crisis (Baumann and Gallagher, 2012, p. 3). During the Latin American financial crises of the 1980s, countries in the region lost access to international financial capital markets as foreign countries became wary of investing in the region. Even countries such as Chile, which had not tried to reschedule their debts, suffered from a loss of foreign capital due to the “neighborhood effect.” By the 1990s, however, Latin America was once again able to attract foreign capital; but by 1992, the countries in the region became worried about the potential repercussions from an overabundance of capital inflows that have continued to grow through 2011 (see Figure 2.1). This concern led many Latin American countries—including Chile—to institute capital controls in an effort to reduce capital inflows and minimize real exchange rate appreciation, among other goals (Edwards, 1998, p. 5-8). Similarly, following the recent global financial crisis, Chile intervened in its currency markets in order to combat a sharp appreciation in its exchange rates and substantial capital inflows (Baumann and Gallagher, 2012, p. 2). These two time periods are ones that will be examined in order to determine whether Chile was successful in its use of several policy measures to control capital flows. The use of capital controls in Chile in the 1990s is an often-cited example of a country using controls in an attempt to manage capital inflows. The three primary reasons for why Chile decided to use capital account restrictions from 1991 to 1998 are as follows: to deter potentially volatile inflows, to prevent financial destabilization, and to avoid real exchange rate appreciation. Chile believed that restricting capital inflows would enhance the macroeconomic stability of the country, since the amount of capital that would be allowed to leave the country in the event of a crisis would be considerably reduced. Additionally, Chile believed that using controls would allow it to restrict or alter the composition of international capital flows that have the potential to distort incentives significantly within the country. Finally, the country believed that by restricting capital inflows, it would be able to offset a real appreciation of its currency that would stem from a need for monetary expansion and an increase in domestic inflation (Neely, 1999, p. 16). The specific controls that Chile implemented on capital inflows involved changes to direct investment and portfolio flows. Direct investment was subject to a three-year stay requirement in 1991, which was decreased to a one-year stay in 1993. Meanwhile, Chilean authorities made a required fraction of capital inflows a necessary deposit in a non-interest bearing account at the central bank for a minimum of one year with a penalty of three percent for early withdrawal: a deposit known as the encaje or unremunerated reserve requirement (URR). While the encaje was set at 20 percent in 1991, it was raised to 30 percent in 1992 (Corden, 2002, p. 160-161; Neely, 1999, p. 25; Valdés-Prieto and Soto, 1998, p. 146) and even though trade credits were excluded from the URR, the inflows targeted were expanded over the years—first in 1992 and then again in 1995—to include foreign currency deposits and the earnings that result from issuing American depository receipts, or ADRs (Cowan and De Gregorio, 2007, p. 251). The resulting effect of this encaje was a type of tax on foreign capital inflows that taxed short-term flows more than long-term flows (Corden, 2002, p. 160). Figure 2.1 - Chile’s Gross Capital Inflows (Forbes and Warnock 2012, 30)

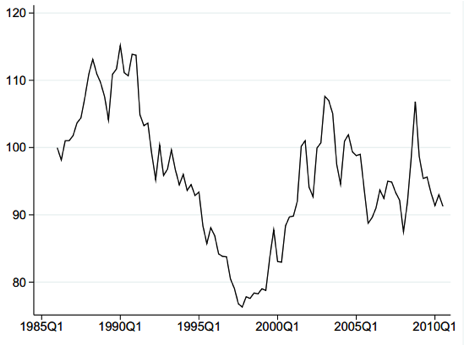

Figure 2.2 - Chilean Real Exchange Rate, 1986=100 (De Gregorio and Labbé 2011, 36) The effects of these Chilean controls have been widely researched and discussed by economists in the years following the implementation of the controls. In general, most findings have concluded that while the controls might have had an impact on the composition of the capital inflows—from the more severely taxed short-term flows to the less heavily taxed long-term flows—these controls did not alter the volumes of these inflows (Gallego, Hernández, and Schmidt-Hebbel, 1999, p. 23; Valdés-Prieto and Soto, 1998, p. 151-153). While the Chilean economy was the recipient of substantial capital inflows during the 1990s, there has been no concrete evidence that demonstrates that these inflows would have been at a considerably larger level if the encaje had not been implemented. (Cowan and De Gregorio, 2007, p. 253). In terms of financial destabilization, Chile’s encaje did not prove to be effective, as the country eventually experienced a recession in the late 1990s. The Chilean URR also had additional costs associated with its implementation, as it had the potential to lead to large quasi-fiscal losses, an inefficient allocation of resources, and costs related to firms trying to find loopholes in the regulations and the government’s responses in trying to close the loopholes. The quasi-fiscal losses would result from the encaje’s loss of effectiveness over time and its potential to prompt a rapid buildup of excess reserves that could cost about 0.5 percent of GDP annually for the Chilean government to fund. The Chilean URR had a tendency to increase short-term interest rates or lead to inefficient resource allocation resulting from banks that are more strictly monitored. The higher domestic interest rate that resulted from the URR caused a decrease in investment and long-term growth. Evidence has shown that without the Chilean URR, the country’s economy had the potential to grow by approximately half a percentage point more in the 1990s than it actually did (Gallego, Hernández, and Schmidt-Hebbel, 1999, p. 23-24). Additionally, the rigid exchange rate system in Chile actually contributed to an increase in capital inflows and studies have found that the Chilean controls of the 1990s were not able to effectively prevent a real appreciation of the currency’s exchange rate (Edwards, 1998; Gallego, Hernández, and Schmidt-Hebbel, 1999, p. 23; Valdés-Prieto and Soto, 1998, p. 151-153). In fact, between 1990 through late 1997, the real exchange rate in Chile appreciated constantly. The year in which the real exchange rate appreciated the most in the country was 1997: a year that net capital inflows—excluding reserves—were 9.1 percent of the Chilean GDP (see Figure 2.2) and the encaje was fully implemented (Cowan and De Gregorio, 2007, p. 254). Chile’s use of capital controls in the 1990s is widely considered to be a situation in which the authorities were unable to deter capital inflows, prevent financial destabilization, and avoid real exchange rate appreciation as they had hoped. As a result, capital controls were eventually eliminated because growing currency pressures in 1998 eventually contributed to a recession in 1999 (Cowan and De Gregorio, 2007, p. 242). Furthermore, the Chilean capital controls of the 1990s had additional costs for domestic firms, as they increased the cost of capital for small- and medium-sized Chilean firms that found it difficult—if not impossible—to evade the controls on inflows. For example, in 1996, the cost of capital for smaller Chilean firms was over 21 percent per year in U.S. dollars and in 1997, the cost of capital for small firms was over 19 percent per year in U.S. dollars (Edwards, 1999, p. 25). Therefore, it is important for countries that are considering the adoption of controls similar to those imposed in Chile to consider this higher cost of capital, especially for small- and medium-sized firms with the potential benefits of imposing controls. In spite of the general consensus that the Chilean capital controls of the 1990s were ineffective on the whole, Chile still elected to intervene in its currency markets following the 2008 financial crisis. The Chilean central bank participated in foreign exchange market intervention through purchases of dollars beginning in January 2011 onward. These currency interventions did not appear to have a lasting effect on the Chilean exchange rate as the government had hoped, however. Furthermore, the interventions did not impact asset prices in the long-term and they only had a slight effect following the initial announcement of the currency intervention by reducing the level of the real exchange rate—but not its volatility—and making the domestic stock market more independent compared to the rest of the region. As a result, Chile’s currency intervention did not have a statistically significant effect on the volume or composition of capital inflows, or the country’s ability to have an independent monetary policy. In this particular case, it was found that Chile’s currency market intervention had a weaker impact than the use of controls to influence capital flows (Baumann and Gallagher, 2012, p. 3 and 17). Overall, these two examples of Chile’s interventions in its capital markets—especially its controls on capital inflows—are ones that support the general consensus among economists that capital controls on inflows are largely ineffective, but are also on the whole harmless—notwithstanding the additional costs that often arise as a result of their implementation.Continued on Next Page » Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |