Exchanging Oil Sands Expansion for Renewable Energy Growth in Canada

By

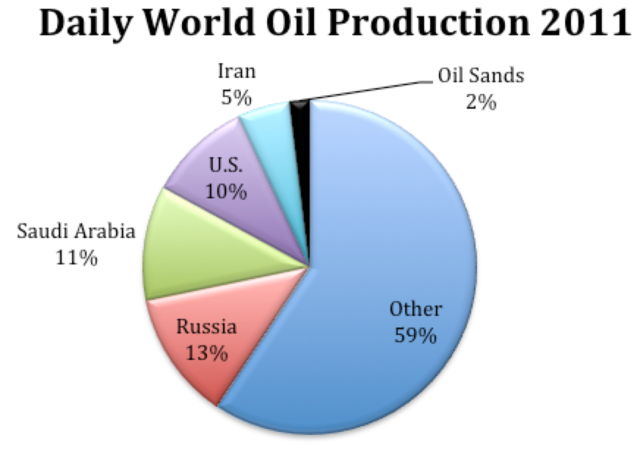

2015, Vol. 7 No. 01 | pg. 2/2 | « Oil Sand ControversyIt is easy to find support for oil sands expansion in government policy, corporate websites, and newspapers. Officials have proclaimed that the oil sands help keep gas prices low, or that the oil sands are an enormous economic benefit to Canadians, or that the water pollution in the area is naturally occurring, and not related to extraction. The federal government’s website claims that Canada is the United States’ most secure supplier of oil, and the oil sands helps the US reduce its dependence on foreign oil.19 Canadian officials appear to be concerned for the US. However, importing oil from Alberta is still foreign oil for Americans. Canada is a stable, democratic society. However, oil prices are not steady or secure. In fact, history shows that oil prices are volatile and unpredictable. The Alberta oil sands are dependent upon a certain price range for production and profitability. Production begins to be profitable at prices around $65-$95 a barrel.20 However, if prices rise beyond $120-$150, what follows is known as a “demand destroying scenario.” This occurs when the market price for a certain commodity becomes too expensive and demand is reduced. This can expose oil prices to a gradual unpredictable fall.21 Meanwhile, if oil prices drop below $65, production is no longer profitable. With reduced demand comes the gradual slide in prices. Therefore, oil prices must remain between these figures for profitable production. Relying on stable oil prices is a risky financial investment for oil companies, and a government that has committed itself to such adventures is demonstrating questionable leadership. A common misconception in Canada is that oil sand production keeps gasoline prices low. Gas prices are dependent upon world oil prices, and world oil prices are determined by global supply and demand. There are few oil producing countries, if any, (excluding Saudi Arabia) which have the ability to affect the world price of oil on their own. Alberta oil sands production does not affect the global price of oil since it supplies less than 2% of daily world output.22 Therefore, a rise or fall in oil sands production in Alberta has relatively no effect on gasoline prices at the pump. Politicians and oil sands supporters often try to score political points with voters, but the reality is, gas prices are not a domestically controlled commodity, (unless oil subsidies exist, for example: Venezuela) and oil sands output is insufficient to affect world prices.The most worrisome find comes from the government’s apparent disregard for regional health and safety issues among residents. Recently, a collection of worrisome findings has been uncovered, including deformed fish from waters near oil sands facilities, leakage from tailing ponds into the groundwater, and suspiciously high cancer rates in Fort Chipewyan, a community downriver from the developments.24 Perhaps more disturbing is that the industry-funded Regional Aquatic Monitoring Program (RAMP), which is entrusted to determine the effects of oil sand development, have routinely reported no evidence of pollution other than from natural sources.25 To date, a number of recent studies have shown RAMP to be not only incorrect, but also incompetent.26 RAMP claim to be a science based environmental program but they have repeatedly changed their sampling methods, and often their findings are not divulged to the public.27 The government has done little to help, and appears to be allowing the oil sands industry to advance unchecked. The lack of transparency makes it difficult for independent studies to be conducted and demonstrates a lack of professional ethics. Economic implicationsIn 2010, the Alberta oil sands were responsible for approximately 2% of the Canadian GDP.28 Of this figure, over 90% of the Canadian economic benefits remained in Alberta.29 That means the rest of Canada receives little, if any, economic benefit from oil sands activity. Obviously employment figures follow the same trend, with the majority of work inside Alberta. In 2010, direct employment figures from the oil sands were close to 75,000 direct (approximately 144,000 gross employment). These figures may sound significant, but even gross employment represents less than 1% of the Canadian workforce.30 The Canadian economy is not dependent upon the oil sands, as politicians and industry officials claim. At 2% of GDP, less than 1% of the Canadian work force, and between 5 and 6.5% of Canada’s total greenhouse gas emissions, the oil sands is an underachieving industry. Economically speaking, Non-Albertans may be negatively affected by the expanding oil sands. Economists have now sounded the alarm that the oil sands are helping to create a kind of “Dutch Disease” in the Canadian economy.31 Dutch Disease refers to a situation where a substantial increase in natural resource exploitation is responsible for a declining manufacturing sector. As more resources are extracted and sold abroad, the home currency becomes stronger in value, rendering domestic manufacturing uncompetitive in the world market. Evidence of this emerged in 2011, when the Canadian dollar traded, on average above the U.S. dollar for the first time since 1976. Some experts point to several factors behind this. However a study that demonstrates a close correlation between the price of oil and the exchange rate is an interesting find.32 It is probable that Canada has its own version of a petro-dollar that rises and falls with the price of oil. Energy AlternativesIt is estimated that between 2010 and 2025, over $379 billion will be invested into the expanding oil sands.33 What would be the impact of such an investment if it were diverted to the renewable energy or low carbon emissions projects? Currently in the US, there is a drive to have 20% of total electric power come from wind energy. Experts believe this is possible. It would require approximately 251GW of additional installed capacity (300GW total). An investment of $379 billion would meet the total construction cost for the 251GW of onshore wind power needed to meet the target, and in the time leading up to 2030, the US would provide 150,000 direct jobs and support another 500,000 jobs.34 The emissions normally generated by non-renewables, would be substantially reduced. This energy would be produced and used in the US by Americans, helping to reduce its dependency on foreign oil, such as the Alberta oil sands. In Europe, there is an ambitious project to connect the solar energy from the North African desert, known as the Desertec solar supergrid. This project will link new concentrated solar plants into a supergrid covering Europe, and North Africa. $379 billion could pay for the Desertec Industrial Initiative, and by 2050, it would supply approximately 15% of Europe’s total electricity needs.35 It would also supply electricity to the host countries. If Europe completes renewable energy projects such as this, it will lead the way to producing over 50% of its energy needs from renewable sources. Europe’s green energy projects require responsible government, cooperation, and a commitment to future generations. New Policy DirectionOn the world stage, Canada is no longer perceived as an environmentally conscious nation. In fact, it has earned a reputation for quite the opposite. In 2011, Canada formally announced it was quitting the Kyoto protocol,36 and in 2013 the federal government quietly opted out of the UN anti-drought convention.37 Recently Canada has acquired the uncomfortable title of “fossil nation.” This title, a satirical yet highly prestigious prize, was given to Canada at the UN climate talks in Copenhagen for its continual blockage of progress on climate change talks.38 The Climate Network International awards the “Fossil of the year” annually. Canada has won the award 5 years in a row. Perhaps it is time for Canada to join the world, and commit itself to progressive sustainable energy. In order to do this, new policy must be aimed at reducing the use of fossil fuels and encourage renewable energy development. Policy recommendations for Canada should be focused on removing Canada from the list of top CO2 emitters per capita in the world. Canada needs to recommit itself to the Kyoto protocol, and other international obligations that focus on climate change. At this point, due in large part to development and future expansion of the oil sands, it is nearly impossible for Canada to meet its Kyoto targets. For any meaningful progress to take place, expansion of the oil sands needs to be halted, and production reduced. This does not mean a losing situation for oil sand companies. With proper policy and planning, the government can include oil sand companies in large-scale projects to “green” Canada’s economy. By awarding first bidding rights, or partial ownership of these projects, the government can essentially bring the companies to work for Canadians. Examples of green policy initiatives can be found everywhere, but perhaps none more successful than in Europe. The EU policy of “20-20-20” is a binding policy roadmap that encourages progressive energy policy.39 Europe has demonstrated remarkable progress, and is a world leader in alternative energy. This policy initiative could be adopted in Canada. Like the EU initiative, this could include a 20% reduction in greenhouse gas emissions from 1990 levels, raising the share of energy consumption produced from renewable resources to 20% and leading to a 20% improvement in the energy efficiency. Job creation is important for the economy, but policy should not rely on industries such as the oil sands to produce employment. For example, gross employment in Germany’s renewable energy sector was around 340,000 in 2009 and is expected to be around 500,000 and 600,000 thousand by 2030.40 Germany is a leading example of the economic benefit of investing in renewable energy and technology. It is evidence of what is achievable in a short period of time with the successful policy initiatives. In Germany it was the “feed in tariffs” that allowed small and medium size business to thrive in a renewable energy market.41 Furthermore, this is a globally growing sector that Canada can benefit from. Technology and innovation are constantly evolving, creating new opportunities and long-term employment. Employment in German Renewable Energy Sector vs. Alberta Oil SandsThere is no shortage of green investment opportunities in Canada. The government can encourage projects such as a nation wide expansion of urban transit. It would require approximately $77 billion of investment, to make this dream into a reality. The expansion would be urban transit, mostly rail, across Canada; as well as new high-speed intercity train systems for Québec City–Windsor, Edmonton–Calgary and Vancouver– Seattle.42 There is further potential in the wind and solar sector. Ontario recently signed a $7 billion deal with a consortium led by Samsung to develop 2,000 MW of wind power and 500 MW of solar power in the province. The projects will triple Ontario’s renewable wind and solar power, providing electricity to more than 580,000 households. Some 16,000 new green energy jobs will be created.43 With the encouragement of the federal government, projects such as these can become a reality. ConclusionCurrently Canada is on track to create the biggest energy blunder in its history. Nearly 400 billion dollars will likely be invested in Canadian energy in the next 20 years, and none of it in renewable energy. The oil sands will continue to expand into the future until Canada changes its policy, or until the outside world intervenes. Canada will likely be left with a host of new problems and current difficulties will only be intensified. If a fraction of this money was invested in renewable energy, not only would Canada create employment, but the new energy harnessed could increase Canada’s energy potential for the long-term. Canada could help green its economy and become a green energy leader in the world. The ideas and examples are plenty, from the European Union to the United States and even within Canada. The potential to harness more renewable energy and reduce CO2 emissions exists. With effective policy, Canada can increase its energy supply and reduce its environmental footprint simultaneously. ReferencesAl Jazeera witness. Available at: http://www.youtube.com/watch?v=nQrWZzBOCoc/ [Assessed on 02/05/2013]. Alberta Oil Sands Industry Quarterly Update. (2013) reporting on the period: Jan. 18, 2013, to Mar. 14. Available at: http://www.albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Spring2013.pdf/ [Assessed on: 19/04/2013]. Alok, J. (2010). Sun, wind and wave-powered: Europe unites to build renewable energy supergrid. The Guardian, 03 January. Available at: http://www.guardian.co.uk/environment/2010/jan/03/european-unites-renewable-energy-supergrid/ [Assessed on: 05/05/2013]. American Wind Energy Association. (2008). 20% wind energy by 2030: Increasing Wind Energy’sContribution toU.S electricitysupply. Available at: http://www.nrel.gov/docs/fy08osti/41869.pdf/ [Assessed on 05/05/2013]. Chana, G. Reilly, J. Paltsev, Chenbn, H. (2012). The Canadian oil sands industry under carbon constraints. Energy Policy 50 540–550. Climate leadership, economic prosperity (2009). Pembina Institute and David Suzuki Foundation. Available at: http://davidsuzuki.org/publications/reports/2009/climate-leadership-economic-prosperity/ [Assessed on 05/05/2013]. David Suzuki Foundation. Available at: http://www.davidsuzuki.org/blogs/climate-blog/2009/12/a-first-day-fossil-for-canada/ [Assessed on 05/05/2013]. Davidson, D. & Andrews, J. (2013). Not All About Consumption. Science AAAS. 339, pp1286-1287. Economic Impacts of New Oil Sands Projects in Alberta (2010-2035). May 2011. Canadian Energy Research Institute. Study No. 124. Available at: http://www.api.org/aboutoilgas/oilsands/upload/economic_impacts_of_new_oil_sands_projects_alberta.pdf/ [Assessed on 02/05/2013]. Encyclopedia of nations: http://www.nationsencyclopedia.com/economies/Europe/United-Kingdom.html/ European Commission. Climate Action. http://ec.europa.eu/clima/policies/package/index_en.htm Government of Alberta; Oil Sands Royalties, (2010-2011) Available at: http://www.oilsands.alberta.ca/economicinvestment.html/ [Assessed on 19/04/2013] Government of Alberta. Alberta Energy, Facts and Statistics. Available at: http://www.energy.alberta.ca/oilsands/791.asp/ [Assessed on: 04/05/2013]. Government of Canada, (2011). Oil Sands; A strategic resource for Canada, North America and the global market. Available at: http://www.nrcan.gc.ca/energy/sites/www.nrcan.gc.ca.energy/files/files/OilSands-EnergySecurityEconomicBenefits_e.pdf/ [Assessed on: 19/04/2013]. International Energy Agency (IEA) and Energy Technology Systems Analysis Programme (ETSAP). (2010). Technology Brief. Available at: http://www.iea-etsap.org/web/E-TechDS/PDF/P02-Uncon%20oil&gas-GS-gct.pdf/ [Assessed on 04/05/2013]. Joe Oliver slams scientist's oilsands claims as 'nonsense'. (2013). CBC News. 24 April. Available at: http://www.cbc.ca/news/politics/story/2013/04/24/joe-oliver-keystone-pipeline-hassen.html?ref=rss/ [Assessed on 29/04/2013]. Jordaan, S. (2012) Land and Water Impacts of Oil Sands Production in Alberta Environmental Science and Technology, 46, 3611−3617. Jordaan, S. M.; Keith, D. W.; Stelfox, B. (2009). Quantifying land use of oil sands production: A life cycle perspective. Environmental Research Letters, 4 024004. Kelly, E. N.; Schindler, D. W.; Hodson, P. V.; Short, J. W.; Radmanovich, R.; Nielson, C. C. (2010) Oil sands development contributes elements toxic at low concentrations to the Athabasca and its tributaries. Proceedings of the National Academy of Science. 2010, 107:16178−16183. Kelly, E., Short, J., Schindler, D., Hodson, P., Maaf, M., Kwana, A., and Fortin, B., (2009). Oil sands development contributes polycyclic aromatic compounds to the Athabasca River and its tributaries. National Academy of Sciences. 106 (52), pp. 22346-22351. Kennedy, M. (2011). Canada pulling out of Kyoto accord. The National Post. 12 December. Available at: http://news.nationalpost.com/2011/12/12/canada-formally-withdrawig-from-kyoto-protocol/ [Assessed on 05/05/2013]. Kureka, J., Kirkb, J., Derek, G., Wangb, X., Marlene S. Evansc, & Smola, J. (2013). Legacy of a half century of Athabasca oil sands development recorded by lake ecosystems. PNAS, 110(5), pp. 1761–1766. National Energy Board, (2011). Canada’s Energy Future: Energy supply and demand projects to 2035. Available at: http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyftr/2011/nrgsppldmndprjctn2035-eng.pdf [Assessed on 19/04/2013]. Parks, N. (2010). Oil sands debate heats up in Alberta. Frontiers in Ecology and the Environment, 8(9), pp. 452. Pembina Institute. Oil Sands. Available at: http://www.pembina.org/oil-sands/os101/alberta/ [Assessed on: 02/05/2013]. Price, M. (2013). Canadian Jobs lost to the tar sands. Huffington Post, May 1 2013. Available at http://www.huffingtonpost.ca/matt-price/canadian-oil_b_1180255.html/ [Assessed on: 02/05/2013]. Renewable Energy World. (2010) Available at: http://www.renewableenergyworld.com/rea/news/article/2010/01/samsung-invests-can-7b-in-ontario-wind-and-solar/ [Assessed on 05/05/2013]. Rubin, J. (2013). Globe and Mail. How big is Canada’s oil subsidy to the U.S.? 7 January 2013, Available at: http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/how-big-is-canadas-oil-subsidy-to-the-us/article6994747/ [Assessed on 26/04/2013]. Statistics Canada. (2011) Population and dwelling counts; Population breakdown of northern Alberta. Available at: http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/hlt-fst/index.cfm?Lang=E/ [Assessed on 02/05/2013]. The Impacts of Canadian Oil Sands Development on the United States’ Economy. (2009) Canadian Energy Research Institute. October 2009. Available at: http://www.scribd.com/doc/21296235/CERI-The-Impacts-of-Canadian-Oil-Sands-Development-on-the-United-States%E2%80%99-Economy/ [Assessed on 05/05/2013]. Ulrike, L., Lutz, C., & Edler, D. (2012). Green jobs? Economic impacts of renewable energy in Germany. Energy Policy, 47, pp 358–364. UNDP (2008). Human Development Report 2007/08 p145, available at: http://hdr.undp.org/en/media/HDR_20072008_EN_Complete.pdf/ [Assessed on 19/04/2013]. Weinhold, B. (2011). Alberta’s Oil Sands Hard Evidence, Missing Data, New Promises. Environmental Health Perspectives. 119(3), pp 126-131. Wells, P. & McMahon, T. (2012). How Ottawa runs on oil; Suddenly western money and influence are driving everything that happens in the nation’s capital. Macleans, 23 March. Available from: http://www2.macleans.ca/2012/03/23/oil-power/ [Assessed April 15 2013]. World Energy Outlook (2008). International Energy Agency. Available at: http://www.worldenergyoutlook.org/media/weowebsite/2008-1994/weo2008.pdf/ [Assessed on 29/04/2013]. Wustenhagen, R. & Bilharz, M. (2006). Green energy market development in Germany: effective public policy and emerging customer demand. Energy Policy 34, pp 1681–1696. WWF & The Co-operative Bank Insurance Investments (2008). Unconventional Oil; Scraping the bottom of the barrel. World Wildlife Federation report: Available at: http://wwf.panda.org/?unewsid=142161#/ [Assessed on 02/02/2013]. Yergin, D. & Burkhard, J. (2008). Break Point Revisited: CERA's $120-$150 Oil Scenario. IHS CERA. Available at: http://www.ihs.com/products/cera/energy-report.aspx?id=106591829/ [Assessed on: 19/04/2013]. Yergin, D., Burkhard, J., & Kadakia, R. (2008) Ratcheting Down: Oil and the Global Credit Crisis. HIS CERA. Available at: http://www.ihs.com/products/cera/energy-report.aspx?ID=106591844&pu=1&rd=cera_com/ [Assessed on: 19/04/2013]. Endnotes1.) The Impacts of Canadian Oil Sands Development on the United States’ Economy. (2009) Canadian Energy Research Institute. Pp. vii. 2.) Government of Alberta. Alberta Energy, Facts and Statistics. Available at: http://www.energy.alberta.ca/oilsands/791.asp/ [Assessed on: 04/05/2013]. 3.) Jordaan, S. M.; Keith, D. W.; Stelfox, B. (2009). Quantifying land use of oil sands production: A life cycle perspective. Environmental Research Letters, 4 024004. 4.) Encyclopedia of nations: Available at: http://www.nationsencyclopedia.com/economies/Europe/United-Kingdom.html/ 5.) Statistics Canada. (2011) Population and dwelling counts; Population breakdown of northern Alberta. Available at: http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/hlt-fst/index.cfm?Lang=E/ 6.) Government of Alberta. Alberta Energy, Oil Sands. Available at: http://www.energy.alberta.ca/ourbusiness/oilsands.asp. 7.) International Energy Agency (IEA) and Energy Technology Systems Analysis Programme (ETSAP) May 2010. Technology Brief. Available at: http://www.iea-etsap.org/web/E-TechDS/PDF/P02-Uncon%20oil&gas-GS-gct.pdf/ 8.) WWF & The Co-operative Bank Insurance Investments (2008). Unconventional Oil; Scraping the bottom of the barrel. P21. Available at: http://wwf.panda.org/?unewsid=142161#/ 9.) Chana, G. Reilly, J. Paltsev, Chenbn, H. (2012). The Canadian oil sands industry under carbon constraints. Energy Policy 50, p541. 10.) Alberta’s total greenhouse gas emissions in 2008 were 244 megatonnes of CO2 equivalent. (Environment Canada, “National Inventory Report -Part 3 1990-2008 Greenhouse Gas Sources and Sinks in Canada”) Alberta’s population in 2008 was estimated to be 3.51 million people. (Alberta Finance, Alberta Population Report, 2008). 11.) Government of Alberta. 2013. Alberta Energy: Facts and Statistics. http://www.energy.alberta.ca/OilSands/791.asp 12.) WWF & The Co-operative Bank Insurance Investments (2008). Unconventional Oil; Scraping the bottom of the barrel. World Wildlife Federation report. p31 13.) Al Jazeera witness. Available at: http://www.youtube.com/watch?v=nQrWZzBOCoc/ 14.) Yergin, D., Burkhard, J., & Kadakia, R. (2008) Ratcheting Down: Oil and the Global Credit Crisis. HIS CERA. Available at: http://www.ihs.com/products/cera/energy-report.aspx?ID=106591844&pu=1&rd=cera_com/ 15.) Government of Alberta. 2013. Alberta Energy: Facts and Statistics .http://www.energy.alberta.ca/oilsands/791.asp 16.) Joe Oliver slams scientist's oilsands claims as 'nonsense'. (2013). CBC News. 24 April. Available at: http://www.cbc.ca/news/politics/story/2013/04/24/joe-oliver-keystone-pipeline-hassen.html?ref=rss/ 17.) World Energy Outlook (2008). International Energy Agency. Pp198. Available at: http://www.worldenergyoutlook.org/media/weowebsite/2008-1994/weo2008.pdf/ 18.) 1100 billion barrels of oil used to date (World Energy Outlook) & 170 billion barrels in Oil Sands multiplied by 3 (Oil sands releases 3 times the CO2 emissions) = CO2 emission from 510 billion barrels of oil. (changed to a %, 510/1100 = 45%) 19.) Government of Canada, (2011). Oil Sands; A strategic resource for Canada, North America and the global market. Available at: http://www.nrcan.gc.ca/energy/sites/www.nrcan.gc.ca.energy/files/files/OilSands-EnergySecurityEconomicBenefits_e.pdf/ 20.) National Energy Board, (2011). Canada’s Energy Future: Energy supply and demand projects to 2035. Available at: http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyftr/2011/nrgsppldmndprjctn2035-eng.pdf/ 21.) Yergin, D. & Burkhard, J. (2008). Break Point Revisited: CERA's $120-$150 Oil Scenario. IHS CERA. Available at: http://www.ihs.com/products/cera/energy-report.aspx?id=106591829/ 22.) 1.6 million barrels a day (Alberta Government: http://www.energy.alberta.ca/ourbusiness/oilsands.asp) divided by 89 million barrels of global production per day International Energy Agency: http://www.iea.org/aboutus/faqs/oil/ 23.) CIA Fact book (2011 Figures). Country Comparison: Crude Oil - Production (translated into a percentage). Oil Sands figure based on 1.6 million barrels a day. (Alberta Government) 24.) Parks, N. (2010). Oil sands debate heats up in Alberta. Frontiers in Ecology and the Environment, 8(9), pp. 452. 25.) Ibid. pp 452. 26.) See: Kelly, E., Short, J., Schindler, D., Hodson, P., Maaf, M., Kwana, A., and Fortin, B., (2009). Oil sands development contributes polycyclic aromatic compounds to the Athabasca River and its tributaries. National Academy of Sciences. 106 (52), pp. 22346-22351 & Kureka, J., Kirkb, J., Derek, G., Wangb, X., Marlene S. Evansc, & Smola, J. (2013). Legacy of a half century of Athabasca oil sands development recorded by lake ecosystems. PNAS, 110(5), pp. 1761–1766. 27.) Parks, N. (2010). Oil sands debate heats up in Alberta. Frontiers in Ecology and the Environment, 8(9), pp. 452. 28.) Canadian GDP 1,762,432 million (Statistics Canada (2011). divided by 37,000 million (Government of Alberta; Oil Sands Royalties, (2010-2011) = 2% 29.) Economic Impacts of New Oil Sands Projects in Alberta (2010-2035). May 2011. Canadian Energy Research Institute. Study No. 124. Pp9 Available at: http://www.api.org/aboutoilgas/oilsands/upload/economic_impacts_of_new_oil_sands_projects_alberta.pdf/ 30.) 144,000 thousand gross employment (Government of Alberta: http://www.oilsands.alberta.ca/economicinvestment.html) divided by Canadian working population 17.5 million in 2012 (Statistics Canada) 31.) Price, M. (2013). Canadian jobs lost to the tar sands. Huffington Post, May 1 2013. Available at:http://www.huffingtonpost.ca/matt-price/canadian-oil_b_1180255.html/ 32.) Ibid. 33.) The Impacts of Canadian Oil Sands Development on the United States’ Economy. (2009) Canadian Energy Research Institute. Pp. vii. 34.) American Wind Energy Association. (2008). 20% wind energy by 2030: Increasing WindEnergy’scontribution toU.S electricitysupply. Available at: http://www.nrel.gov/docs/fy08osti/41869.pdf/ 35.) Alok, J. (2010). Sun, wind and wave-powered: Europe unites to build renewable energy supergrid. The Guardian, 03 January. Available at: http://www.guardian.co.uk/environment/2010/jan/03/european-unites-renewable-energy-supergrid/ 36.) CBC News (2011). Available at: http://www.cbc.ca/news/politics/story/2011/12/12/pol-kent-kyoto-pullout.html/ 37.) CBC News (2011). Available at: http://www.cbc.ca/news/canada/story/2013/03/27/un-droughts-deserts-convention-canada.html 38.) CBC News ( 2009) Canada tagged as fossil of the year. Available at: http://www.cbc.ca/news/world/story/2009/12/18/climate-canada-award.html 39.) European Commission. Climate Action. Available at: http://ec.europa.eu/clima/policies/package/index_en.htm 40.) Ulrike, L., Lutz, C., & Edler, D. (2012). Green jobs? Economic impacts of renewable energy in Germany. Energy Policy, 47, pp358 41.) Wustenhagen, R. & Bilharz, M. (2006). Green energy market development in Germany: effective public policy and emerging customer demand. Energy Policy 34, pp 1681–1696. 42.) Climate leadership, economic prosperity (2009). Pembina Institute and David Suzuki Foundation. Pp12. Available at: http://davidsuzuki.org/publications/reports/2009/climate-leadership-economic-prosperity/ 43.) Renewable Energy World. (2010) Available at: http://www.renewableenergyworld.com/rea/news/article/2010/01/samsung-invests-can-7b-in-ontario-wind-and-solar/ Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |