Chinese Economic Policy in the 21st Century: Growth, Imbalance, and Considerations for Australia

By

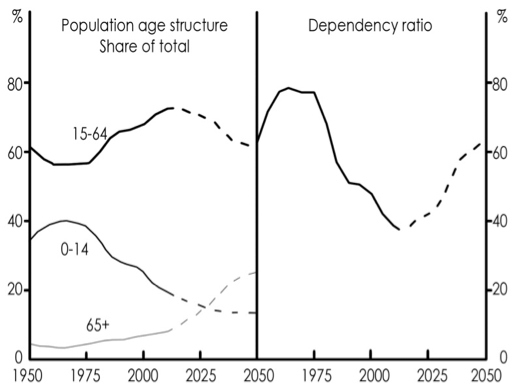

2013, Vol. 5 No. 08 | pg. 3/3 | « Prospects for Future GrowthThe rise of China as a leading exporter has further been linked to the rapid growth of supply chain networks in Asia that are centred on China contributing significantly to China’s increasing productivity in manufacturing (International Monetary Fund, 2012). East Asian economies and some European countries have managed to avoid significant competition with China by moving further up the value-added chain, where it is noted that greater vertical specialization has so far mitigated the impact of horizontal competition (European Commission: Enterprise and Industry, 2004, Jin and Li, 2007). Giovanni, et al, 2012, support this view by demonstrating that using a prospective simulation of ‘unbalanced’ productivity growth in disadvantaged Chinese economic sectors, a majority of countries in the world would experience large welfare gains. With Chinese trade surpluses exceeding 3 trillion USD, China has accumulated significant foreign-exchange denominated in USD. This large accumulation resulted in the net purchase of large quantities of American debt that has been cited by some to have contributed to the cheap credit that fuelled the 2008 US housing bubble. Following the bailout that ensued and in response to the GFC, the US government created large quantities of credit at the expense of its value. China has particular cause of concern regarding the value of its dollar denominated assets and has responded by both pushing for an alternatives to the US dollar and diversifying its holdings from US-reserves. As is, approximately 54% of Chinese foreign reserves are held in the form of US assets (down from 65% in 2010). This diversification from the dollar has however led to a replacement by euro and yen denominated bonds, in turn contributing to upward pressure against the dollar. Onset of the Euro-ciris however has further adversely affected the value of Chinese Euro holdings, forcing China to re-examine the sustainability of its large trade surpluses. An alternative to the diversification from the dollar would be the internationalisation of the RMB, for which, since 2008, the People’s Bank of China has signed bilateral RMB currency swaps with eight other central banks totalling more than 720 billion RMB. Offshore RMB deposits and trade settlements have increased since 2010 adding weigh to a HSBC prediction that by 2012 nearly $2 trillion of annual trade (over 40% of China’s total) could be settled in yuan, making it one of the top three currencies in global trade (The Economist, 2009). This internationalisation process is however complicated by the perceived undervaluation of the RMB which could subject it to sharp appreciation, limiting other countries’ willingness to hold liabilities denominated in RMBs.China should thus reform its financial system with the additional aim of reducing its current and capital account surpluses. If it cannot reduce its surpluses, it has to translate the surpluses into assets other than US Treasuries, which include increasing outbound FDI, engaging in mergers and acquisitions, selling panda bonds, engaging in currency swaps, and providing aid to developing countries.(The Economist, 2009, Yu, 2009) On a domestic level, issues regarding China’s economy exist and attempts at addressing imbalances in the Chinese system have been unsuccessful as previously demonstrated in the 2008 stimulus package which instead of increasing consumer demand, lead to an influx of capital into investments (The Economist, 2012e, Yu, 2009). While GDP growth was maintained, it was also partially achieved via increasing liquidity fuelling real estate prices and accelerating inflation bias as was shown by a strong divergence in broad money growth and GDP growth in 2009 (Guo and Li, 2011). Overinvestment in key sectors of China’s economy in tandem with relatively sluggish growth in domestic consumption has resulted in excess industrial capacity which if not addressed timely, could initiate an overproduction crisis characterised by at least the widespread bankruptcy of enterprises and massive unemployment (Liaowang, 2005). With regards to the long term prospects of Chinese economic development, China will have to address demographic trends, characterised by an ageing and declining population, that have been accelerated by its One-child Policy (figure 10). In this regards, China will have to anticipate falling economic growth due to a decline in labor input to the extent of anticipating deflation as a result (Iwata, 2004). The ageing process further entails the decline of household saving rates due to a greater dissaving by the retired elderly in turn affecting China’s ability to maintain its current monetary and fiscal policies (Iwata, 2004, Krugman, 1998). This trend will also likely be greatly dissimilar to other countries of similar ageing characteristics, as China will likely grow old before it grows rich, giving rise to profound financial and social consequences (The Economist, 2012a). Figure 10: China demographic factors (Reserve Bank of Australia, 2011).

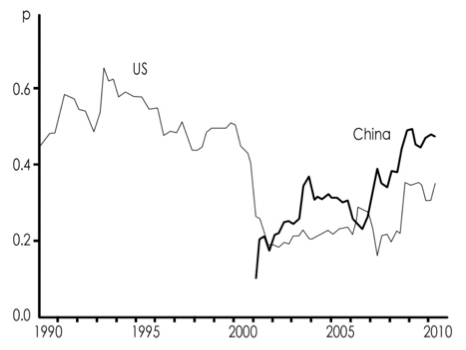

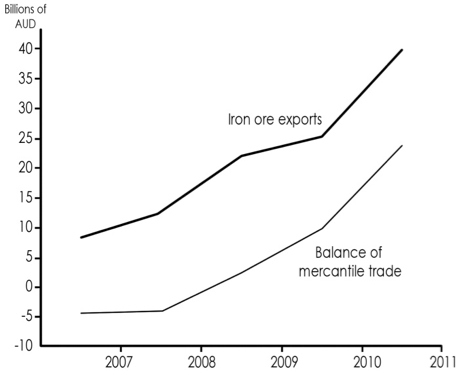

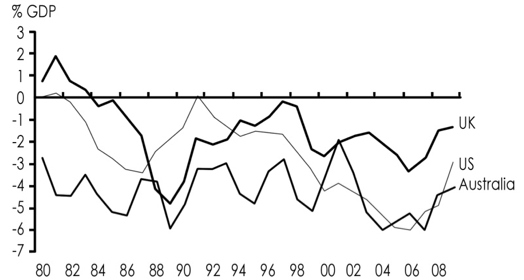

Implications for AustraliaWith the volume of trade between Australia and China increasing to $105.3bln in 2010, two-way trade has grown at 20.2% per annum since 2005. With Australia’s economy becoming increasingly intertwined with China’s economic performance (Figure 11), strong growth in China’s economy has lead to high demand for Australian resources in spite of high commodity prices. In particular, growth of iron exports from $8.35bln to $40.0bln from 2006 to 2011 represents the single most important factor in Australia’s trade surplus with China (Figure 12; Australian Government Department of Foreign Affairs and Trade, 2010). As a result, despite running a current account deficit (Figure 13), Australia’s economy has remained resilient through the global financial crisis with Australia’s terms of trade rising rapidly from the 1990’s (Lowe, 2010; figure 14). Figure 11: Australian GDP Growth: Correlation of real quarterly growth (Lowe, 2010).

Figure 12: Balance of merchandise trade with China and value of Iron ore &Concentrates exports(Australian Government Department of Foreign Affairs and Trade, 2010).

Figure 13: Current account balance (Cheung et al., 2010).

Figure 14: Terms of Trade, 2007/08= 100, quarterly (Annual dates prior to 1959; Lowe, 2010).

With regards to investments, Chinese outward direct investment (ODI) to Australia has generally outperformed ODI to other destinations averaging 31 to 40 percent of potential from 2000 to 2008 (Armstrong, 2011). Resistance to Chinese ODI also remains low as demonstrated by the high level of actual to potential FDI. As a result, Australia was the largest recipient of Chinese non-bond FDI in 2011, lending credibility to the notion that Australia’s current account deficit is largely as a result of high private-sector investments rather than low savings (Cheung et al., 2010). Australia should further be commended for being successful in maintaining a strong fiscal position and sound monetary policy framework to prevent foreign funds from building up excesses and distorting the financial system (Cheung et al., 2010, Huang and Wang, 2011). Sustained growth in exports has however partially fueled upward pressure on the Australian Dollar at the cost of the Australian manufacturing and service sectors. Australia should thus actively pursue measures to allow trade settlements to occur in RMB to limit the risk associated with a potentially over-valued AUD. The bilateral currency swaps valued at 30bln AUD or 200bln RMB signed in March 2012 was thus a step in the right direction (Reserve Bank of Australia, 2012). From a political perspective, assuming the continued expansion of the Chinese economy and increase in strategic importance, future Australian policy requires an examination based on Australian values within context of Chinese economic growth. On one hand, given China’s considerable appetite for primary resources, it is clear that Australia should aim to maintain its democratic values and rules-based order in the region whilst remaining free from coercion. On the other, policy that encompasses hybrid-engagement and enmeshment both diplomatically and economically is required with the aim of China developing long-term stakes in Australia's future (Medcalf, 2012). Such policy would have to consider the basis for Chinese expansion overseas, recognising especially the increasing competition within SOE’s and against private and foreign firms as the rationale for overseas investment. Populist reactions that have challenged the open investment regime (such as the ban on foreigners owning agricultural land) in Australia should thus be disregarded to avoid risk of tarnishing its reputation as a highly competitive mining and agricultural industry (Drysdale, 2011, Caixin Weekly, 2010, Huang and Wang, 2011). ConclusionChina maintained sustained economic growth largely via a mixture of favourable demographic factors and an export-orientated economy, by actively pursuing productivity growth while funneling wealth into investments at the expense of household consumption. Multiple factors pose challenges for China: principally its growing assymetry between household consumption and investments and its changing demographic composition. Should these factors be addressed, China's future economic growth would likely continue, with profound implications for Australia. Australia has benefited from the ‘Asian century’ with the rise of China contributing largely to Australia’s exports of mining products to China. Future Australian policy will need to continue engaging China to ensure a stable and beneficial relationship for both countries. ReferencesArmstrong, S. 2011. Assessing The Scale And Potential Of Chinese Investment Overseas- An Econometric Approach. China And World Economy, 19(4): 22-37. Australian Government Department Of Foreign Affairs And Trade 2010. Composition Of Trade 2010 Of Australia. Boltho, A. & Weber, M. 2009. Did China Follow The East Asian Development Model? The European Journal Of Comparative Economics, 6, 267-286. Branstetter, L. & Lardy, N. 2006. China's Embrace Of Globalization. Caixin Weekly 2010. Betting On Africa: How Sinsosteel Gambled And Won. Cheung, L., Wong, A., Fan, K. & Xiao, H. 2010. Current Account Deficits And Macroeconomic Stability: Lessons From Australia. Hong Kong: Hong Kong Monetary Authority. Cheung, Y.-W., Guonan, M. & Mccauley, R. N. 2011. Renminbising China's Foreign Assets. Pacific Economic Review, 16, 1-17. Deer, L. & Song, L. 2012. China's Approachto Rebalancing- A Conceptual And Policy Framework. China And World Economy, 20, 1-26. Downs, E. S. & Saunders, P. C. 1998. Legitimacy And The Limits Of Nationalism: China And The Diaoyu Islands. International Security, 23, 114-146. Drysdale, P. 2011. A New Look At Chinese Fdi In Australia. China And World Economy, 19, 54-73. Du, Y. & Qu, Y. 2009. Labor Compensation, Labor Productivity And Labor Cost Advantage- An Empirical Study Of Chinese Manufacturing Enterprises During 2000-2007. China Economist, 12, 25-35. European Commission: Enterprise And Industry 2004. The Challenge To The Eu Of A Rising Chinese Economy. European Competitiveness Report 2004. Luxembourg: European Communities. European Commission: Trade 2012. China-Eu Bilateral Trade And Trade With The World. Giovanni, J. D., Levchenko, A. A. & Zhang, J. 2012. The Global Welfare Impact Of China: Trade Integration And Technological Change. Imf Working Paper. Glen, C. M. & Murgo, R. C. 2007. Eu-China Relations: Balancing Political Challenges With Economic Opportunities. Asia Europe Journal, 5, 331-344. Green, M. J. 1999. Managing Chinese Power: The View From Japan. In: Johnston, A. I. & Ross, R. S. (Eds.) Engaging China: The Management Of An Emerging Power. New York: Routledge. Guo, S. & Li, C. 2011. Excess Liquidity, Housing Price Booms And Policy Challenges In China. China And World Economy, 19, 76-91. Huang, Y. & Wang, B. 2011. Chinese Outward Direct Investment: Is There A China Model. China And World Economy, 19, 1-21. Hufbauer, G. C., Wong, Y. & Sheth, K. 2006. United States-China Trade Disputes, Peterson Institute. Hung, H.-F. 2008. Rise Of China And The Global Overaccumulation Crisis. Review Of International Political Economy, 15, 149-179. International Monetary Fund 2011. People's Republic Of China 2011 Article Iv Consultation. Article Iv Consultation. International Monetary Fund 2012. Iv. Is China Rebalancing? Implications For Asia. World Economic And Financial Surveys: Regional Economic Outlook- Asia And Pacific: Managing Spillovers And Advancing Economic Rebalancing. Washington D.C.: International Monetary Fund. Iwata, K. 2004. Japan's Economy Under Demographic Changes [Online]. Available: Http://Www.Boj.Org.Jp/En/Announcements/Press/Koen_2004/Ko0412c.Htm. Jacques, M. 2009. When China Rules The World: The End Of The Western World And The Birth Of A New Global Power, United States Of America, Penguin Press. Jin, L. & Li, S. 2007. The Us-Chinatrade Deficit, Debunked. The Wall Street Journal Asia, 22 May 2007. Knight, J., Yao, Y. & Yueh, L. 2011. Economic Growth In China: Productivity And Policy. Oxford Bulletin Of Economics And Statistics, 73, 719-721. Krugman, P. 1998. It's Baaack! Japan's Slump And The Return Of The Liquidity Trap [Online]. Mit. Available: Web.Mit.Edu/Krugman/Www/Bpea_Jp.Pdf. Lam, W. 2009. China's Quasi-Superpower Diplomacy: Prospects And Pitfalls, Washington Dc, The Jamestown Foundation. Liaowang. 2005. 'Chan Neng Guo Sheng Jing Deng' (A Warning Signal Regarding Overcapacity) [Online]. Available: Http://News.Sohu.Com/20051210/N140927257.Shtml. Lowe, P. 2010. The Development Of Asia: Risk And Returns For Australia [Online]. Available: Http://Www.Rba.Gov.Au/Speeches/2010/Sp-Ag-160910.Html. Marsh, P. 2011. Us Set To Regain Industrial Crown [Online]. Financial Times. Available: Http://Www.Ft.Com/Intl/Cms/S/0/70ab5cba-7692-11e0-Bd5d-00144feabdc0.Html [Accessed 24 July 2012]. Medcalf, R. 2012. Rory Medcalf: Grand Stakes: Australia's Future Between China And India [Online]. Available: Http://Tv.Unsw.Edu.Au/Video/Rory-Medcalf-Grand-Stakes-Australia-S-Future-Between-China-And-India. Morrison, W. M. & Labonte, M. 2011. China's Currency Policy: An Analysis Of The Economic Issues. Congressional Research Service. National Bureau Of Statistics Of China. 2011a. China's Total Population And Structural Changes In 2011 [Online]. Available: Http://Www.Stats.Gov.Cn/English/Newsandcomingevents/T20120120_402780233.Htm. National Bureau Of Statistics Of China. 2011b. National Economy Maintained Steady And Fast Development In The Year Of 2011 [Online]. Available: Http://Www.Stats.Gov.Cn/English/Newsandcomingevents/T20120117_402779577.Htm. People's Daily. 2003. Foreign Trade Volume Likely To Hit $800 Bln In 2003 [Online]. Available: Http://English.Peopledaily.Com.Cn/200311/08/Eng20031108_127866.Shtml [Accessed 24 July 2012]. Pettis, M. 2011. The Contentious Debate Over China's Economic Transition [Online]. [Accessed 2 May 2012]. Reserve Bank Of Australia. 2010. Household Consumption Trends In China [Online]. Available: Http://Www.Rba.Gov.Au/Publications/Bulletin/2010/Mar/3.Html. Reserve Bank Of Australia. 2011. China's Labour Market [Online]. Available: Http://Www.Rba.Gov.Au/Publications/Bulletin/2011/Sep/4/Html. Reserve Bank Of Australia. 2012. Bilateral Local Currency Swap Agreement With The People's Bank Of China [Online]. Available: Http://Www.Rba.Gov.Au/Media-Releases/2012/Mr-12-08.Html 2012]. Richard, C. & Burdekin, K. 2008. China's Monetary Challenges, Cambridge University Press. The Economist 2009. Yuan Small Step: The Dollar’s Role As The World’s Main Reserve Currency Is Being Challenged. The Economist. Hong Kong: The Economist. The Economist. 2011. Asian Labour Markets [Online]. Available: Http://Www.Economist.Com/Node/21526944. The Economist. 2012a. China's Achilles Heel [Online]. Available: Http://Www.Economist.Com/Node/21553056. The Economist. 2012b. China's Labour Force: One Billion Workers [Online]. Available: Http://Www.Economist.Com/Blogs/Freeexchange/2012/01/Chinas-Labour-Force. The Economist. 2012c. Chinese Financial Reform: Free-Range Banks [Online]. Available: Http://Www.Economist.Com/Node.21556943?Fsrc=Scn/Tw/Te/Ar/Freerangebanks. The Economist. 2012d. Demography: The Vanishing Workforce [Online]. Available: Http://Www.Economist.Com/Blogs/Buttonwood/2012/02/Demography. The Economist. 2012e. The Slowing Economy: Stimulus Or Not? [Online]. Available: Http://Www.Economist/Node/21556308. The People's Bank Of China. 2012. China Monetary Policy Report, Various Issues [Online]. Available: Http://Www.Pbc.Gov.Cn:8080/Publish/English/982/Index.Html. The White House, Office Of The Press Secretary. 1999. Joint Press Conference Of President Clinton And Premier Zhu Rongji Of The People's Republic Of China, 1999 [Online]. Available: Http://China.Usc.Edu/(S(Ivfmlzuvquerbb45edthpbze)A(9klr2lurywekaaaaywqzzmnizgmtztbhnc00mdc1ltg5ztitogq4ogu4mgi0ntk3tk-Ud7uv4xbf0iup0b0vd2kc-Ew1))/Showarticle.Aspx?Articleid=742&Aspxautodetectcookiesupport=1 [Accessed 2 May 2012]. Times, I. B. 2012. China’s Foreign Exchange Shifts From Us To Eu [Online]. Available: Http://Au.Ibtimes.Com/Articles/308241/20120303/China-S-Foreign-Exchange-Shifts-Eu.Htm [Accessed 7 May 2012]. Trading Economics. 2012. China Gdp [Online]. Available: Http://Www.Tradingeconomics.Com/China/Gdp [Accessed 24 July 2012]. U.S. Census Bureau Of Foreign Trade. 2012. Trade In Goods With China [Online]. Available: Http://Www.Census.Gov/Foreign-Trade/Balance/C5700.Html [Accessed 5 May 2012]. Wilson, L. 2003. Investors Beware: The Wto Will Not Cure All Ills With China. Columbia Business Law Review, 3, 1007-1030. Yu, Y. 2009. China's Policy Responses To The Global Financial Crisis. Richard Snape Lecture. Melbourne: Reserve Bank Of Australia. Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |