As a result, China possesses an absolute advantages in manufacturing vis-à-vis other regions. Thus, while the proportion of the working age-population declined by 0.1% in 2011, China still possesses a relatively large pool of labour it can draw upon. Some concerns are however raised by recent statistics indicating a slowdown in the number of migrant workers, causing average migrant worker income to increase by 21.2% versus 14.1% per annum over 2005-2010 (National Bureau of Statistics of China, 2011a, The Economist, 2012b, The Economist, 2012d, National Bureau of Statistics of China, 2011b).

With regard to productivity, modern Chinese economic policy is partly characterised by China’s relatively early dismantling of tariff barriers leading to acceptance of large quantities of foreign direct investment (FDI) and earlier engagement in international trade (Boltho and Weber, 2009). Net effects of this international engagement have allowed Chinese companies to take advantage of large flows of foreign capital whilst resulting in a transfer of foreign technologies and management practices (European Commission: Enterprise and Industry, 2004).

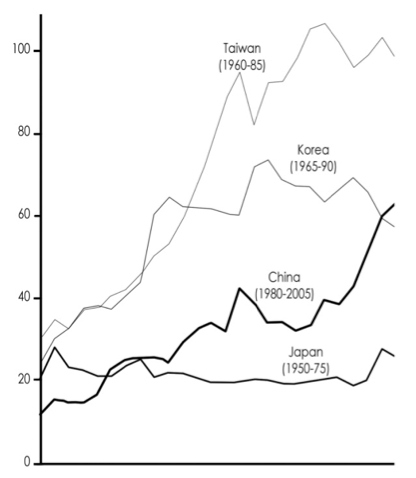

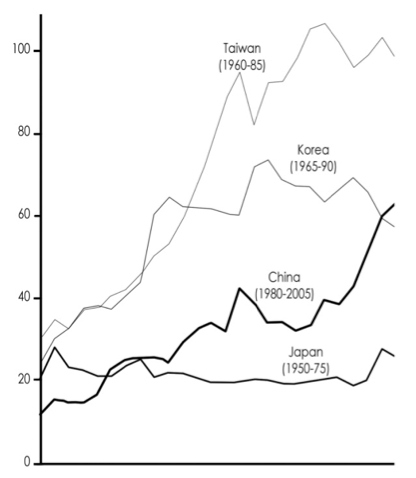

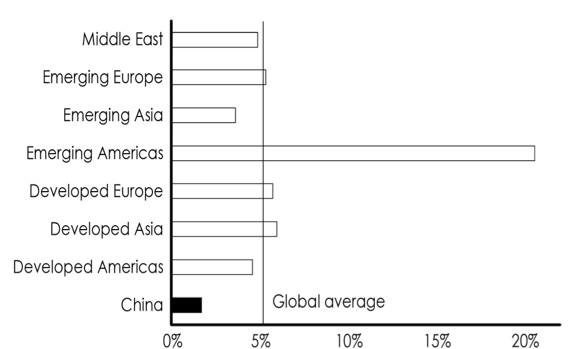

Branstetter and Lardy (2006) further reinforce this, stating that this relative openness to FDI has resulted in an earlier expansion of China’s service industry, representing a sharp contrast to other East Asian economies during their respective ages in development (Figure 3).

Figure 3: Foreign Trade GDP ratios (ratio of exports and imports of goods and services to GDP at current prices) (Boltho and Weber, 2009).

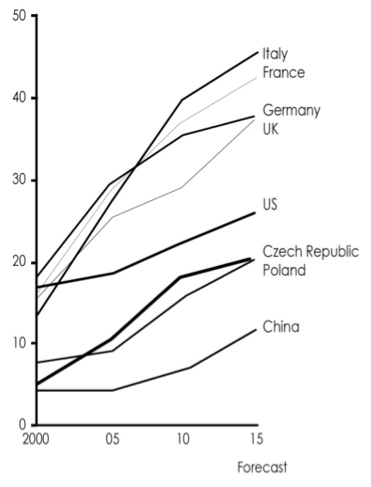

This influx of FDI and receptiveness to external practices has also led to an increase of multifactor productivity in China, though estimates vary regarding the degree of improvement. On one hand, Du & Yue, 2009 estimated a productivity improvement of 21% on a wage increase of 9.8% per annum from 2000 to 2007. On the other, estimates from the Asian Development Bank suggest an productivity improvement of 14% on a wage increase of 16% per annum from 2000 to 2010 (The Economist, 2011). Nevertheless, despite these varying estimates the general consensus is that an assymetry between wage and productivity growth exists: that the productivity to wage growth ratio remains relatively high vis-à-vis other regions (Figure 5; Knight et al., 2011).

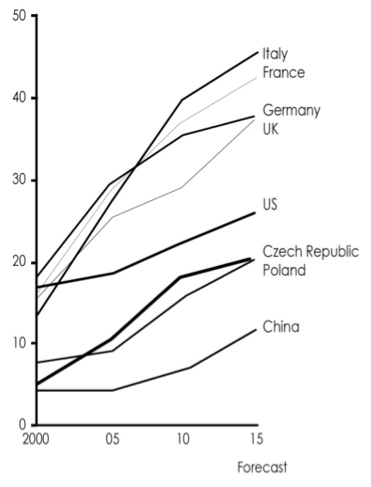

Figure 4: Nominal production worker wages, adjusted for productivity ($ per hour)(Marsh, 2011).

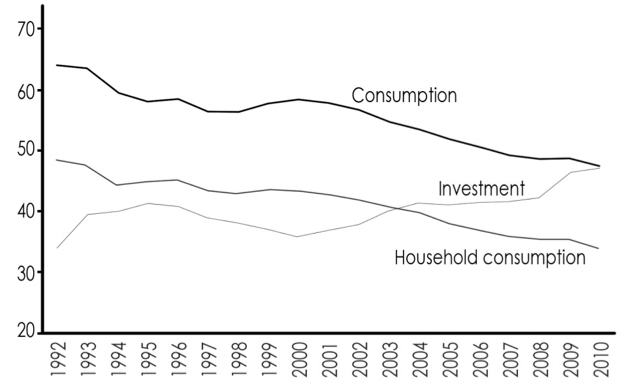

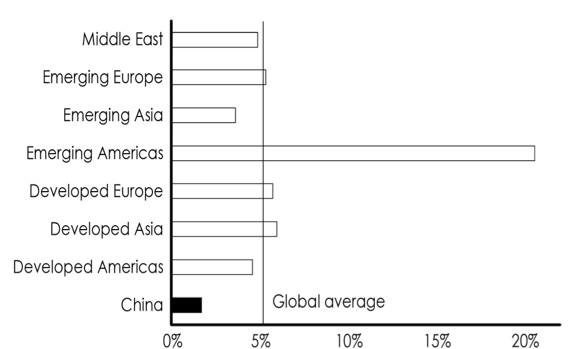

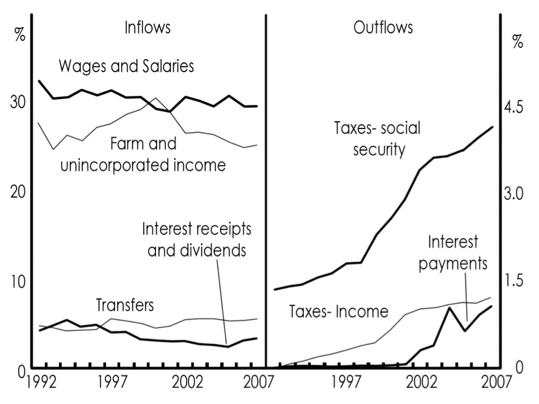

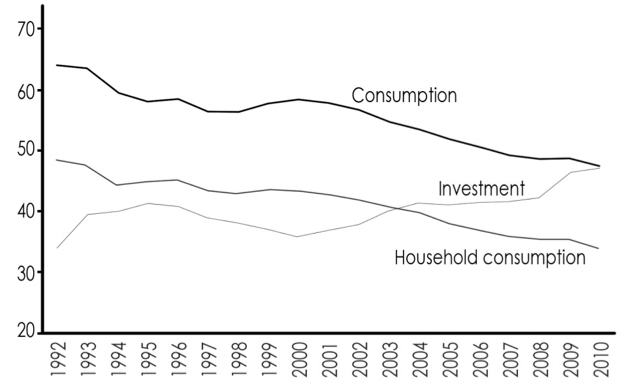

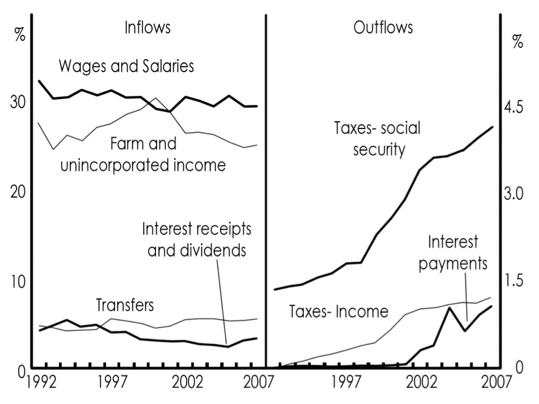

Multiple authors have further argued that China’s growth is due to a significant domestic imbalance between household wealth and investment growth (figure 5), deflating the real cost of capital in China (figure 6; Hung, 2008, Pettis, 2011, Deer and Song, 2012). These authors have attributed this imbalance to ‘implicit taxation’ of households with increments in income and welfare taxes (figure 7), divergences in productivity and wage growth and an alleged undervaluation of its currency, leading to a net transfer of wealth from households to corporations (Deer and Song, 2012, International Monetary Fund, 2011, Reserve Bank of Australia, 2010, The Economist, 2012c).

Figure 5: China domestic demand in % of GDP (International Monetary Fund, 2012).

Figure 6: Real Cost of Capital (2005-9; International Monetary Fund, 2011).

Figure 7: China: Household Income Accounts (% of GDP; Reserve Bank of Australia, 2010).

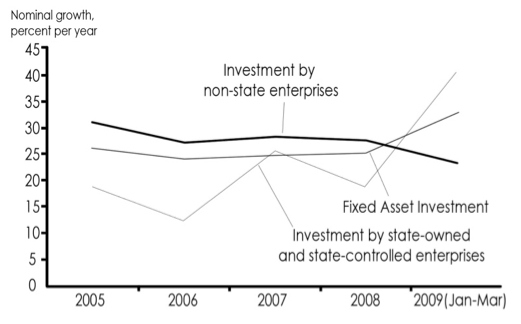

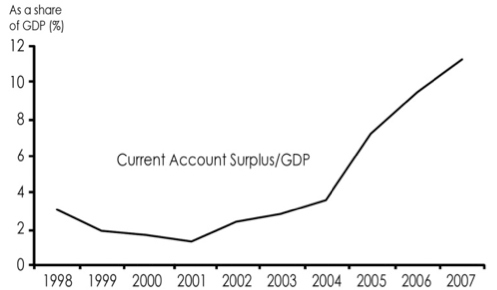

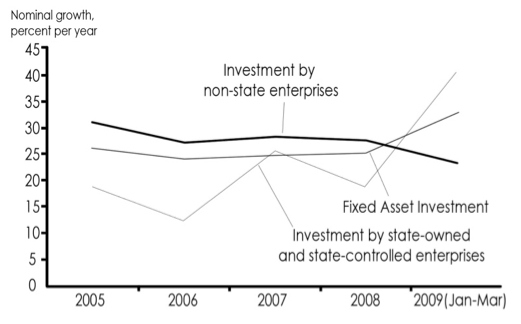

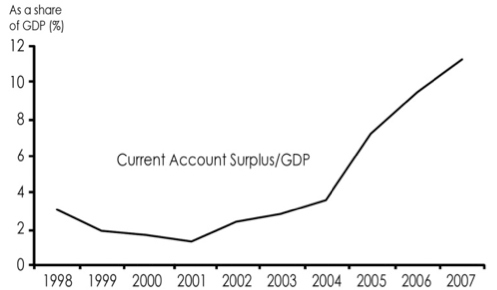

It is further argued that this low cost of capital and pro-investment policies have contributed to overinvestment in key economic areas, characterised by rising investments rates in Fixed Asset Investments (FAI) until at least the onset of the US financial crisis (Figure 8). This overcapacity within China was masked by a rise in the growth rate of FAI and an accelerated growth rate of exports (Yu, 2009). As a result, growth was sustained at the expense of the widening imbalances between investments and private consumption. Until recently, the net result was that China’s economy became increasingly reliant on external demand, with the share of its current account surplus (mainly the trade surplus) in GDP rising rapidly (Figure 9).

Figure 8: Fixed asset investment growth in China.

Figure 9: Share of the current account surplus in GDP.

As a result of maintaining growth via exports, China runs large trade surpluses with the US and the EU, totalling 2.0trln USD (2003-11) and 780bln euro (2007-2011) respectively (U.S. Census Bureau, 2012, European Commission: Trade, 2012). An interventionist monetary and fiscal policy has kept inflation within tolerable limits via the heavy regulation of Chinese financial institutions resulting in a non-competitive financial sector (The Economist, 2012c). As a result, most corporations still mostly derive business finance through banks rather than through the issuance of financial securities (table 1). This hints at the possibility that the Chinese financial sector is only marginally developed, contributing to artificially low factor costs (International Monetary Fund, 2011, Richard and Burdekin, 2008).

Table 1: Financing sources for China’s Domestic Non-Financial Sector. Figures in billions of RMB; percentages in italics (The People's Bank of China, 2012).

|

2010 |

2009 |

2008 |

2007 |

2006 |

2005 |

2004 |

2003 |

| Total |

11,113.6 |

13,079.4 |

6,048.6 |

4,970.5 |

3,987.4 |

3,150.7 |

2,902.3 |

3,515.4 |

|

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

| Bank Loans |

8,357.2 |

10,522.5 |

4,985.4 |

3,920.5 |

3,268.7 |

2,461.7 |

2,406.6 |

2,993.6 |

|

75.2 |

80.5 |

82.4 |

78.9 |

82.0 |

78.1 |

82.9 |

85.2 |

| Government Securities |

973.5 |

818.2 |

102.7 |

179.0 |

267.5 |

299.6 |

312.6 |

352.5 |

| 8.8 |

6.3 |

1.7 |

3.6 |

6.7 |

9.5 |

10.8 |

10.0 |

| Corporate Bonds |

1,171.3 |

1,236.7 |

607.8 |

217.8 |

226.6 |

201.0 |

32.7 |

33.6 |

| 10.5 |

9.5 |

10.0 |

4.4 |

5.7 |

6.4 |

1.1 |

1.0 |

| Equities |

611.6 |

502.0 |

352.7 |

653.2 |

224.6 |

188.4 |

150.4 |

135.7 |

|

5.5 |

3.8 |

5.8 |

13.1 |

5.6 |

6.0 |

5.2 |

3.9 |

Beneficiaries of this increasing trade with China include countries with significant links to China such as the East Asian, South East Asian countries and Australia. These countries are generally large primary resource exporters, or specialise in manufacturing that China is unable to perform on an equivalent scale. In this regard, some argue that China acts as a major regional assembly centre for multinational corporations where countries export parts to China for final assembly only. On this note, in 2006 55% of China’s imports represented goods assembled from imported parts and components (Morrison and Labonte, 2011, Hufbauer et al., 2006). China’s trade surplus with the US and the EU may thus partially represent the trade surplus of the East Asian region (Jin and Li, 2007).Continued on Next Page »

Armstrong, S. 2011. Assessing The Scale And Potential Of Chinese Investment Overseas- An Econometric Approach. China And World Economy, 19(4): 22-37.

Australian Government Department Of Foreign Affairs And Trade 2010. Composition Of Trade 2010 Of Australia.

Boltho, A. & Weber, M. 2009. Did China Follow The East Asian Development Model? The European Journal Of Comparative Economics, 6, 267-286.

Branstetter, L. & Lardy, N. 2006. China's Embrace Of Globalization.

Caixin Weekly 2010. Betting On Africa: How Sinsosteel Gambled And Won.

Cheung, L., Wong, A., Fan, K. & Xiao, H. 2010. Current Account Deficits And Macroeconomic Stability: Lessons From Australia. Hong Kong: Hong Kong Monetary Authority.

Cheung, Y.-W., Guonan, M. & Mccauley, R. N. 2011. Renminbising China's Foreign Assets. Pacific Economic Review, 16, 1-17.

Deer, L. & Song, L. 2012. China's Approachto Rebalancing- A Conceptual And Policy Framework. China And World Economy, 20, 1-26.

Downs, E. S. & Saunders, P. C. 1998. Legitimacy And The Limits Of Nationalism: China And The Diaoyu Islands. International Security, 23, 114-146.

Drysdale, P. 2011. A New Look At Chinese Fdi In Australia. China And World Economy, 19, 54-73.

Du, Y. & Qu, Y. 2009. Labor Compensation, Labor Productivity And Labor Cost Advantage- An Empirical Study Of Chinese Manufacturing Enterprises During 2000-2007. China Economist, 12, 25-35.

European Commission: Enterprise And Industry 2004. The Challenge To The Eu Of A Rising Chinese Economy. European Competitiveness Report 2004. Luxembourg: European Communities.

European Commission: Trade 2012. China-Eu Bilateral Trade And Trade With The World.

Giovanni, J. D., Levchenko, A. A. & Zhang, J. 2012. The Global Welfare Impact Of China: Trade Integration And Technological Change. Imf Working Paper.

Glen, C. M. & Murgo, R. C. 2007. Eu-China Relations: Balancing Political Challenges With Economic Opportunities. Asia Europe Journal, 5, 331-344.

Green, M. J. 1999. Managing Chinese Power: The View From Japan. In: Johnston, A. I. & Ross, R. S. (Eds.) Engaging China: The Management Of An Emerging Power. New York: Routledge.

Guo, S. & Li, C. 2011. Excess Liquidity, Housing Price Booms And Policy Challenges In China. China And World Economy, 19, 76-91.

Huang, Y. & Wang, B. 2011. Chinese Outward Direct Investment: Is There A China Model. China And World Economy, 19, 1-21.

Hufbauer, G. C., Wong, Y. & Sheth, K. 2006. United States-China Trade Disputes, Peterson Institute.

Hung, H.-F. 2008. Rise Of China And The Global Overaccumulation Crisis. Review Of International Political Economy, 15, 149-179.

International Monetary Fund 2011. People's Republic Of China 2011 Article Iv Consultation. Article Iv Consultation.

International Monetary Fund 2012. Iv. Is China Rebalancing? Implications For Asia. World Economic And Financial Surveys: Regional Economic Outlook- Asia And Pacific: Managing Spillovers And Advancing Economic Rebalancing. Washington D.C.: International Monetary Fund.

Iwata, K. 2004. Japan's Economy Under Demographic Changes [Online]. Available: Http://Www.Boj.Org.Jp/En/Announcements/Press/Koen_2004/Ko0412c.Htm.

Jacques, M. 2009. When China Rules The World: The End Of The Western World And The Birth Of A New Global Power, United States Of America, Penguin Press.

Jin, L. & Li, S. 2007. The Us-Chinatrade Deficit, Debunked. The Wall Street Journal Asia, 22 May 2007.

Knight, J., Yao, Y. & Yueh, L. 2011. Economic Growth In China: Productivity And Policy. Oxford Bulletin Of Economics And Statistics, 73, 719-721.

Krugman, P. 1998. It's Baaack! Japan's Slump And The Return Of The Liquidity Trap [Online]. Mit. Available: Web.Mit.Edu/Krugman/Www/Bpea_Jp.Pdf.

Lam, W. 2009. China's Quasi-Superpower Diplomacy: Prospects And Pitfalls, Washington Dc, The Jamestown Foundation.

Liaowang. 2005. 'Chan Neng Guo Sheng Jing Deng' (A Warning Signal Regarding Overcapacity) [Online]. Available: Http://News.Sohu.Com/20051210/N140927257.Shtml.

Lowe, P. 2010. The Development Of Asia: Risk And Returns For Australia [Online]. Available: Http://Www.Rba.Gov.Au/Speeches/2010/Sp-Ag-160910.Html.

Marsh, P. 2011. Us Set To Regain Industrial Crown [Online]. Financial Times. Available: Http://Www.Ft.Com/Intl/Cms/S/0/70ab5cba-7692-11e0-Bd5d-00144feabdc0.Html [Accessed 24 July 2012].

Medcalf, R. 2012. Rory Medcalf: Grand Stakes: Australia's Future Between China And India [Online]. Available: Http://Tv.Unsw.Edu.Au/Video/Rory-Medcalf-Grand-Stakes-Australia-S-Future-Between-China-And-India.

Morrison, W. M. & Labonte, M. 2011. China's Currency Policy: An Analysis Of The Economic Issues. Congressional Research Service.

National Bureau Of Statistics Of China. 2011a. China's Total Population And Structural Changes In 2011 [Online]. Available: Http://Www.Stats.Gov.Cn/English/Newsandcomingevents/T20120120_402780233.Htm.

National Bureau Of Statistics Of China. 2011b. National Economy Maintained Steady And Fast Development In The Year Of 2011 [Online]. Available: Http://Www.Stats.Gov.Cn/English/Newsandcomingevents/T20120117_402779577.Htm.

People's Daily. 2003. Foreign Trade Volume Likely To Hit $800 Bln In 2003 [Online]. Available: Http://English.Peopledaily.Com.Cn/200311/08/Eng20031108_127866.Shtml [Accessed 24 July 2012].

Pettis, M. 2011. The Contentious Debate Over China's Economic Transition [Online]. [Accessed 2 May 2012].

Reserve Bank Of Australia. 2010. Household Consumption Trends In China [Online]. Available: Http://Www.Rba.Gov.Au/Publications/Bulletin/2010/Mar/3.Html.

Reserve Bank Of Australia. 2011. China's Labour Market [Online]. Available: Http://Www.Rba.Gov.Au/Publications/Bulletin/2011/Sep/4/Html.

Reserve Bank Of Australia. 2012. Bilateral Local Currency Swap Agreement With The People's Bank Of China [Online]. Available: Http://Www.Rba.Gov.Au/Media-Releases/2012/Mr-12-08.Html 2012].

Richard, C. & Burdekin, K. 2008. China's Monetary Challenges, Cambridge University Press.

The Economist 2009. Yuan Small Step: The Dollar’s Role As The World’s Main Reserve Currency Is Being Challenged. The Economist. Hong Kong: The Economist.

The Economist. 2011. Asian Labour Markets [Online]. Available: Http://Www.Economist.Com/Node/21526944.

The Economist. 2012a. China's Achilles Heel [Online]. Available: Http://Www.Economist.Com/Node/21553056.

The Economist. 2012b. China's Labour Force: One Billion Workers [Online]. Available: Http://Www.Economist.Com/Blogs/Freeexchange/2012/01/Chinas-Labour-Force.

The Economist. 2012c. Chinese Financial Reform: Free-Range Banks [Online]. Available: Http://Www.Economist.Com/Node.21556943?Fsrc=Scn/Tw/Te/Ar/Freerangebanks.

The Economist. 2012d. Demography: The Vanishing Workforce [Online]. Available: Http://Www.Economist.Com/Blogs/Buttonwood/2012/02/Demography.

The Economist. 2012e. The Slowing Economy: Stimulus Or Not? [Online]. Available: Http://Www.Economist/Node/21556308.

The People's Bank Of China. 2012. China Monetary Policy Report, Various Issues [Online]. Available: Http://Www.Pbc.Gov.Cn:8080/Publish/English/982/Index.Html.

The White House, Office Of The Press Secretary. 1999. Joint Press Conference Of President Clinton And Premier Zhu Rongji Of The People's Republic Of China, 1999 [Online]. Available: Http://China.Usc.Edu/(S(Ivfmlzuvquerbb45edthpbze)A(9klr2lurywekaaaaywqzzmnizgmtztbhnc00mdc1ltg5ztitogq4ogu4mgi0ntk3tk-Ud7uv4xbf0iup0b0vd2kc-Ew1))/Showarticle.Aspx?Articleid=742&Aspxautodetectcookiesupport=1 [Accessed 2 May 2012].

Times, I. B. 2012. China’s Foreign Exchange Shifts From Us To Eu [Online]. Available: Http://Au.Ibtimes.Com/Articles/308241/20120303/China-S-Foreign-Exchange-Shifts-Eu.Htm [Accessed 7 May 2012].

Trading Economics. 2012. China Gdp [Online]. Available: Http://Www.Tradingeconomics.Com/China/Gdp [Accessed 24 July 2012].

U.S. Census Bureau Of Foreign Trade. 2012. Trade In Goods With China [Online]. Available: Http://Www.Census.Gov/Foreign-Trade/Balance/C5700.Html [Accessed 5 May 2012].

Wilson, L. 2003. Investors Beware: The Wto Will Not Cure All Ills With China. Columbia Business Law Review, 3, 1007-1030.

Yu, Y. 2009. China's Policy Responses To The Global Financial Crisis. Richard Snape Lecture. Melbourne: Reserve Bank Of Australia.