Using Anti-Money Laundering Measures in the Financial World to Combat Organized Crime

By

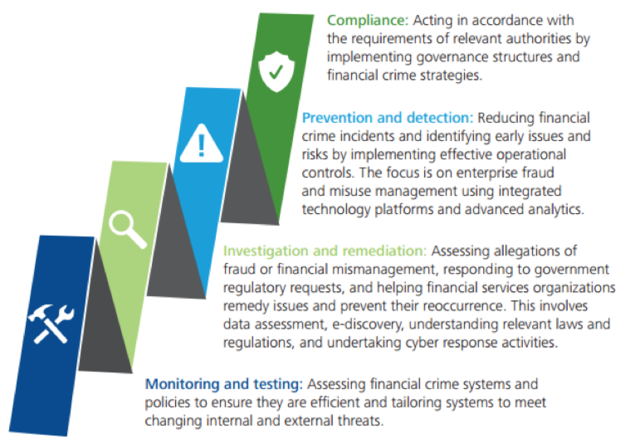

2015, Vol. 7 No. 10 | pg. 2/2 | « Transnational Anti-Money Laundering RegimeFrom London to Dubai, and from Nairobi to Havana, money laundering and financial crime exploit markets and weaken governments. Professor Wechsler (2001) asserts, “financial abuses have been around for as long as there have been finances to abuse.” Therefore, it is imperative for the international community to encourage and oversee the successful implementation of an anti-money laundering policy and regulatory regime. Multilateral efforts undertaken by governments and international organizations inaugurated the establishment of the Financial Action Task Force in 1989. It is an inter-governmental organization that introduced forty Recommendations and nine Special Recommendations, which together constitute a comprehensive and consistent framework for combating financial crime with a particular focus on money-laundering and terrorist financing (FATF, FATF Recommendations). Since 1989, many more legislative actions (e.g.: USA Patriot Act of 2001) have followed, and multilateral organizations have reemerged or have been established (e.g.: IMF, World Bank, Basel Committee) to effectively combat financial crime. The most significant statute in the European Union is the commonly known 2005 Third Money Laundering Directive, which introduced considerable amendments to “the existing regime governing anti-money laundering compliance,” according to Etay Katz (2007). The incorporation of simplified due diligence (SDD) and enhanced due diligence (EDD) requirements to the existing customer due diligence (CDD) measures constituted a step forward towards a more robust prevention regime (Katz, 2007).In essence, CDD is a mandatory process of identification and verification of customers so that the service providers know exactly with whom they are engaging, and so they can better identify suspicious transactions provided they know their customers and comprehend the reasoning behind their actions. Without adequate due diligence process, financial institutions may become vulnerable by exposing themselves to reputational, operational, legal and concentration risks, which can generate substantial financial burdens (Basel Committee). The SDD procedure then can be applied only to a specific pool of the client base where the risk of money laundering is low. For example, government institutions or entities listed on stock exchanges often provide no high risk classification criteria. It no longer necessary to complete the full “KYC” (know your customer) profile beyond the identification stage (Katz, 2007). Conversely, the objective behind the introduction of EDD measures is to increase the level of due diligence when dealing with clients and products/services/delivery channels/geographic locations that pose a higher risk to the business. In a nutshell, the activities performed by financial institutions when administering EDD checks and completing KYC profiles involve the identification and verification of the client and the ultimate beneficial owners (the natural person who exercises an effective ultimate control), establishing the real source of funds and of wealth, and performing negative news searches (Katz, 2007). Examples of high risk clients include politically exposed persons (PEPs), correspondent banking relationships, and businesses located in regions/countries with lax anti-money laundering and counter-terrorist financing measures. Ultimately, by introducing and applying these requirements, regulators and businesses attempt to mitigate the risks associated with new and existing clients, especially in instances where there is a greater chance of money laundering or terrorist financing. An Example of Measures Applied by Financial Institutions to Combat Money Laundering: Know Your Customer (KYC) ProfileDue to increasing anti-money laundering regulations, financial institutions across the world have to preserve anti-money laundering programs that compel them to "develop internal policies, procedures and controls, designate a compliance officer, conduct ongoing employee training programs, and perform independent audit functions," claims Satapathy (2003). All of these multifaceted efforts should comprise a holistic approach to successfully tackle financial crime, as exemplified by Deloitte’s financial crime lifecycle that enumerates four key principles indispensable in the fight against money laundering: compliance, prevention and detection, investigation and remediation, and monitoring and testing (Deloitte, 2014). In the age of increasingly ‘innovative’ money laundering methods, newly emerging payment systems, unrelenting terrorist threats, worldwide fraudulent activites, and cyber attacks, along with more efficient and swift movement of funds and greater anonymity for customers, have caused KYC to be a challenging, intimidating, and yet ever more critical task (Deloitte, 2015). Indeed, as indicated in the previous section, the first step to be taken in a successful battle against money laundering as part of the CDD process is the creation of a robust and comprehensive KYC profile that aims at attaining the following objectives as stressed by Deloitte (2015):

Once these objectives are effectively realized, any financial institution should become aware of risks associated with their clients by enhancing its capability of comprehending what is, as asserted by Deloitte (2015), as “usual and expected for the customer, apply[ing] accurate levels of controls and due diligence to its customer base, keep[ing] ‘bad actors’ out of [their institution], and focus[ing] resources on higher risk customers” thus minimizing their exposure to money laundering schemes. The importance of KYC measures was noted in the recent KPMG survey conducted in 2014, which read that KYC reviews, updates and maintenance constituted the second major anti-money laundering investment endured by financial institutions. According to their respondents’ input and the latest regulatory findings, defining and implementing adequate CDD, as well as administering EDD measures, continues to pose a major challenge across the financial world, thus contributing to the increased spending in the area of remediation and enhanced regulatory visits. On the other hand, those institutions that have successfully instituted the initial KYC process struggle with performing regular updates to their client base (KPMG, 2014). ConclusionsIn the ever globalizing world, modern day technological advancements, predominantly the advent of the Internet, have equipped governments, financial institutions, and societies with an unrestricted and unfathomable source of information and knowledge. Yet if harnessed incorrectly by criminal organizations, these innovations may lead to misdeed and catastrophe. One such troublesome consequence of the global village phenomenon is money laundering activity that nowadays is administered on a large scale and poses a unique challenge to the status quo of both the financial world and the law enforcement community. International regulatory cooperation and the establishment of multilateral organizations whose objective is to introduce adequate countermeasures and effectively combat financial crime have been at the forefront in hindering criminal activities such as money laundering. Regulators as well as financial organizations have been fostering the customer due diligence process that assists in facilitating adequate customer identification through incorporation of "know your customer" measures, thus enabling organizations to identify and adequately deal with potentially suspicious clients or transactions. It has to be borne in mind that without elementary vigilance at the local, national, and international level, financial crime will continue to permeate the social and financial spheres, bringing along their dire economic and political consequences. ReferencesBasel Committee. (2001, October). Customer due diligence for banks. Retrieved April 01, 2015, from http://www.bis.org/publ/bcbs85.pdf. BBC. (2000, February 16). Russian money launderers plead guilty. BBC. Retrieved April 01, 2015, from http://news.bbc.co.uk/2/hi/americas/645717.stm. CPA Audit LLP. (2007, December 15). The Third EU Money Laundering Directive – Key points. Retrieved May 05, 2015, from http://www.cpaaudit.co.uk/pdfs/ThirdMoneyLaunderingDirective.pdf. Deloitte. (2014). Insight on financial crime: Challenges facing financial institutions. Retrieved May 05, 2015, from http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Risk/gx-cm-insight_on_financial_crime.pdf. Deloitte. (2015). Meeting new expectations – Foundational considerations when upgrading Know Your Customer programs. Retrieved May 05, 2015, from http://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-meeting-new-expectations-012915.pdf. FATF. F.A.Q. Retrieved April 01, 2015, from http://www.fatf-gafi.org/pages/faq/moneylaundering/. FATF. (October, 2004). FATF Recommendations. Retrieved April 01, 2015, from http://www.fatf-gafi.org/topics/fatfrecommendations/documents/the40recommendationspublishedoctober2004.html. IMF. (1998, February 10). Money Laundering: the Importance of International Countermeasures. Retrieved April 01, 2015, from https://www.imf.org/external/np/speeches/1998/021098.htm. Katz, E. (2007). Implementation of the Third Money Laundering Directive – an overview. Law and Financial Markets Review, 1(3), 207-211. KPMG. (2014). Global Anti-Money Laundering Survey 2014. Retrieved April 01, 2015, from https://www.kpmg.com/KY/en/IssuesAndInsights/ArticlesPublications/PublishingImages/global-anti-money-laundering-survey-v3.pdf. Levi, M., & Reuter, P. (2006). Money Laundering. Chicago Journals, 34(1), 289-375. Satapathy, C. (2003). Money Laundering: New Moves to Combat Terrorism. Economic and Political Weekly, 38(7), 599-602. UN. (2000, April 06). No Country Alone Can Cope With Growth of Transnational Crime, Says Deputy Secretary-General to Vienna Crime Congress. Retrieved April 01, 2015, from http://www.un.org/press/en/2000/20000406.dsgsm92.doc.html. Unger, B. (2009). Money Laundering – A Newly Emerging Topic on the International Agenda. Review of Law and Economics, 5(2), 807-819. UNODC. Introduction to money-laundering. Retrieved April 01, 2015, from http://www.unodc.org/unodc/en/money-laundering/introduction.html?ref=menuside. UNODC. The Money-Laundering Cycle. Retrieved April 01, 2015, from https://www.unodc.org/unodc/en/money-laundering/laundrycycle.html. UNODC. (2011, October). Estimating illicit financial flows resulting from drug trafficking and other transnational organized crimes. Retrieved April 01, 2015, from https://www.unodc.org/documents/data-and-analysis/Studies/Illicit_financial_flows_2011_web.pdf. Wechsler, W.F. (2001). Follow the Money. Foreign Affairs, 80(4), 40-57. Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Law & Justice |