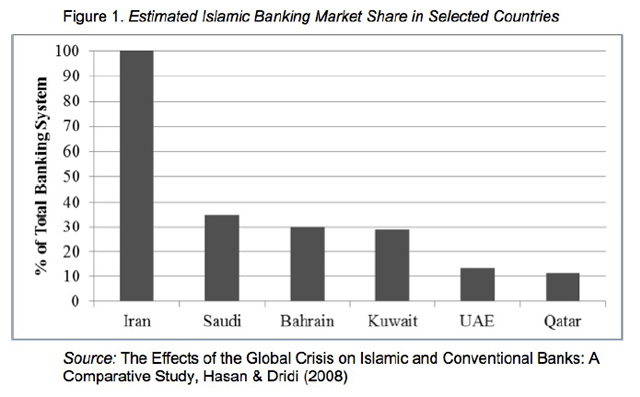

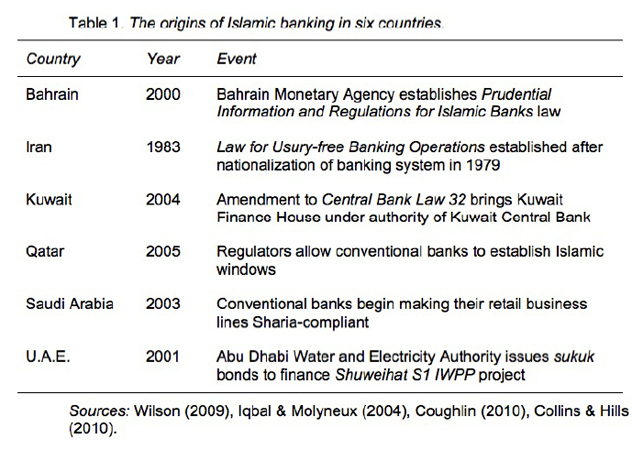

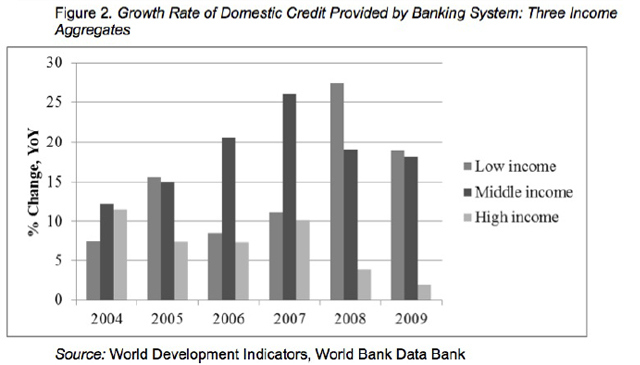

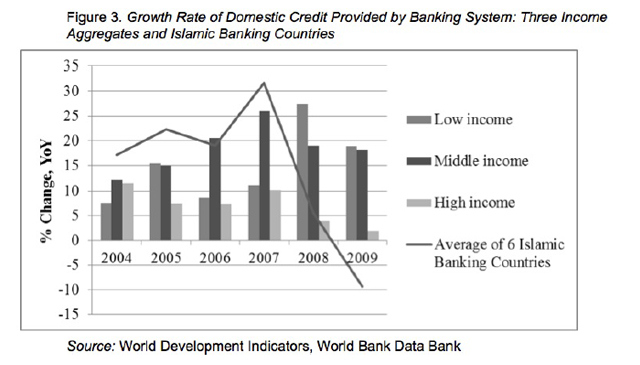

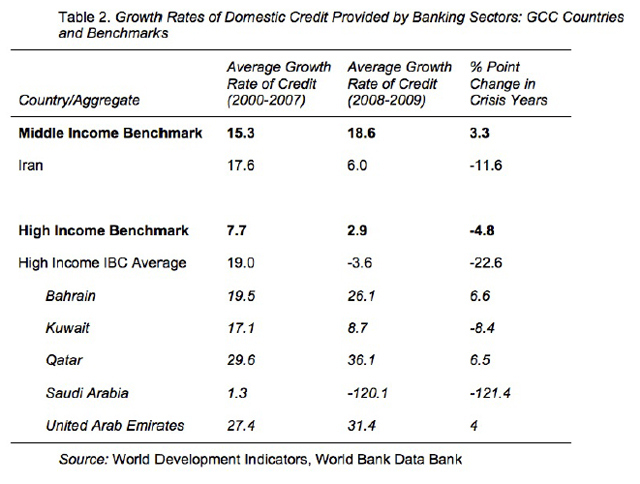

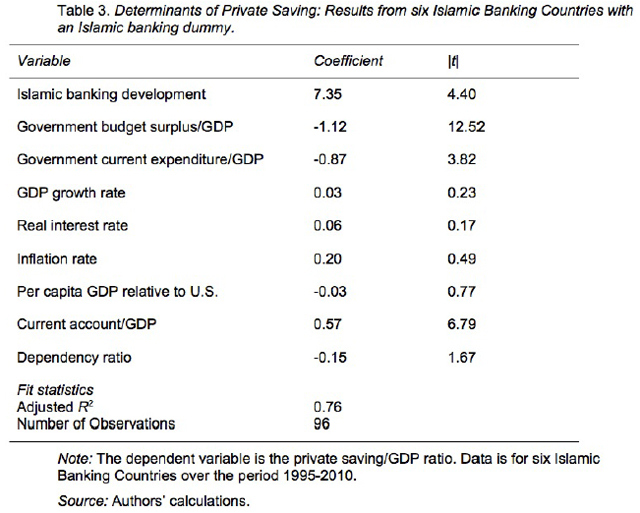

From Cornell International Affairs Review VOL. 6 NO. 1Effects of Islamic Banking on Financial Market Outcomes in GCC Countries and IranIII. Data And MethodologyOne challenge to empirical work on the macroeconomic impacts of Islamic banking is the lack of comprehensive data about Islamic banks and the size of Islamic banking sectors in different countries. This paucity stems from the lack of an absolute framework to designate a bank as “Islamic” or “conventional”—a proposal even further complicated by the growing importance of conventional banks operating Islamic windows—compounded by relatively weak reporting to begin with in the countries with significant shares of Islamic banking. Previous researchers have relied on banks’ selfdesignation as “Islamic” to construct datasets from bank-level data, but the size of the overall Islamic banking sector as well as the relative shares of Islamic and conventional banks in specific countries’ banking systems is still a matter of some debate. Most estimates are similar to those used by Hasan & Dridi in their working paper on Islamic and conventional banks during the 2008 crisis (Figure 1) and it is generally accepted that Iran and the five GCC countries excluding Oman are the current leaders in Islamic banking growth. I will refer to these six countries as the Islamic Banking Countries (IBCs) in my analysis. Provision of CreditFor this section I use country-level data from the World Bank’s World Development Indicators on the growth rate of domestic credit provided by banking systems. The behavior of credit growth differs greatly across countries at different income levels, but, as we see in Figure 2, growth rates slowed across all income levels as credit markets dried up following the 2008 subprime mortgage crisis.If the Islamic banking model is indeed more resistant to crises than conventional models, we may expect IBCs to have fared better at sustaining credit growth in 2009. In my analysis I compare average IBC performance to all three income aggregates, as well as each country to its relevant benchmark. Private SavingIn their 1998 paper “International Evidence on the Determinants of Private Saving,” Masson et al. use country-level data from 1971-1993 for a sample of industrial and developing countries to identify major determinants of private savings. In order to analyze the relationship between Islamic banking and private saving, I obtained similar variables to those identified by Masson et al. for the six IBCs over the period 1995-2010 from the International Monetary Fund’s World Economic Outlook (WEO), the World Bank’s World Development Indicators (WDI), and the Economist Intelligence Unit (EIU). Private savings were calculated for each country as national savings minus the government budget surplus (EIU), and other variables included the government budget surplus (EIU), government current expenditure (WEO), the growth rate of real GDP (WEO), consumer price inflation (EIU), the real shortterm interest rate (EIU), per capita income relative to the US (WEO), the current account balance (EIU), and the age dependency ratio of non-working age individuals to working age individuals (WDI). The lack of reliable data for Islamic banking growth over time made it difficult to identify a meaningful panel variable for Islamic banking market share, but by identifying the point in time at which Islamic banking was liberalized or formally recognized by governments or central banks, I was able to construct a binary or “dummy” variable for each country tracking the beginning of significant Islamic banking growth. These events are summarized in Table 1 above. IV. ResultsProvision of CreditComparing the average performance of the six Islamic Banking Countries to the three income aggregates from above, we see initially that, as a group, the IBCs outgrew other countries in the years leading up to the crisis, but performed significantly worse in 2008 and 2009. Table 2 presents results on a country-bycountry basis, looking at the average growth rate of credit leading up to the crisis from 2000- 2007, the average growth rate during the crisis in 2008-2009, and relative change between these two periods. Countries are compared to their corresponding income aggregates, with an average calculated for the high-income IBCs. The performance of IBCs appears somewhat better individually—in particular, the banking sectors of Bahrain, Qatar, and the United Arab Emirates grew their credit provision faster during the crisis period than over the early period—but still fails to illustrate the supposed resilience of Islamic banks in the face of crisis. On the whole, it does not appear that the presence of Islamic banks allowed Iran or GCC countries to maintain credit growth any better than other countries during the global financial crisis. This result may be because Islamic banks do not yet represent a large enough share of banking systems to have a noticeable impact— although evidence from Iran’s fully Shariahcompliant banking system would suggest otherwise—or, as discussed above, it may be because the economics of Islamic commercial banks are not materially different from those of conventional banks. Private SavingTable 3 presents the results of a panel regressing private savings rates in the six Islamic banking countries on a number of potential explanatory variables, including for each country a variable tracking the development of Islamic banking in that country. I use a fixed effects estimation in order to account for the potential effects of excluded variables and include below results for all potential determinants of private saving in order to compare my findings to those presented by Masson et al. in 1998. An initial observation is that these results closely corroborate those presented by Masson et al., with coefficients on all terms except per capita GDP relative to the United States showing the same sign and similar magnitude. These are also the results one might expect from standard economic intuition. Among the determinants that are statistically significant in this model, households save in response to government dissaving and current spending, a higher current account balance is correlated with higher private saving, and a higher dependency ratio is correlated with lower private savings other things equal. More interesting, though, is the coefficient on the variable for Islamic banking development in these six countries, which is both positive and significant. While this result does not indicate causation, we can safely conclude that recent Islamic banking development has been correlated with higher private savings rates in the six countries in our analysis. This relationship may be due to a third variable not included in our model that is jointly correlated with both Islamic banking and private saving (e.g. level of Islamic devoutness), but it is strong preliminary evidence that Islamic banking development may have improved financial inclusion in some Muslim-majority countries. One shortcoming of this model is that, by using country-level rather than bank or household-level data, we can say nothing about the mechanism by which Islamic banks may have caused private savings to increase. An increase in private savings suggests that Islamic commercial banks have complemented conventional banks in the markets in which they now coexist, but it is also difficult to tell to what extent Islamic banks have replaced conventional banks in these markets. As Islamic banking continues to grow and more reliable data sources become available, it would be interesting to reproduce this study using bank-level data. In the meantime, these results shed light on the positive relationship between Islamic banking and financial sector development in Iran, Bahrain, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates. V. ConclusionsDue to their heavy reliance on nonprofit and lost sharing forms of financing, Islamic commercial banks in today’s world are structurally more similar to conventional banks than their proponents claim. This may help to explain why, despite their supposedly conservative borrowing and lending practices, it does not appear that countries with large Islamic banking sectors fared any better than countries relying exclusively on conventional banking in weathering the recent financial crisis. One tangible distinction of Islamic banks, however, is their classification as complying with Islamic religious norms. Whether this classification is deserved or simply superficial, it has allowed Islamic banks to experience rapid growth among Muslim populations by catering to the needs of devout Muslims who would not otherwise be comfortable depositing money with conventional, riba-based banks. A consequence of this growth, as devout Muslims have gained access to savings vehicles that meet their religious needs, appears to be that private savings rates in countries with significant Islamic banking sectors have increased. ReferencesTables, charts, and graphs provided by the author Ali, Salman Syed. Islamic Banking in the MENA Region. ISLAMIC DEVELOPMENT BANK – ISLAMIC RESEARCH AND TRAINING INSTITUTE, 2011. Print. Cihak M., and Hesse H. “Islamic Banks and Financial Stability: An Empirical Analysis.” J.Financ.Serv.Res.Journal of Financial Services Research 38.2 (2010): 95-113. Print. Collins, Nick, and Ed Hill. The Role of Islamic Finance in Abu Dhabi’s 2030 Vision., 2010. Print. Coughlin, Paul. Standard & Poor’s Islamic Finance Outlook 2010., 2010. Web. Hasan, Maher, et al. “The effects of the global crisis on islamic and conventional banks a comparative study.” International Monetary Fund. 2010. /z-wcorg/. http://worldcat.org. Imam, Patrick, Kangni Kpodar, and International Monetary Fund. African Dept. “Islamic banking how has it diffused?” International Monetary Fund. 2010. /z-wcorg/. http://worldcat.org. Iqbal, Munawar, and Philip Molyneux. Thirty Years of Islamic Banking : History, Performance, and Prospects. Basingstoke: Palgrave Macmillan, 2004. Print. Khan, Feisal. “How Islamic is Islamic Banking?” Journal of economic behavior & organization. 76.3 (2010): 805. Print. Masson, Paul R., Tamim Bayoumi, and Hossein Samiei. “International Evidence on the Determinants of Private Saving.” The World Bank Economic Review 12.3 (1998)Print. Musa, Tariq A. “Islamic Banking and the Financial Crisis: Shariah Compliance and Bank Stability in the Arab Gulf.” Bachelor’s of Arts Harvard College, 2010. Web. Oliver Wyman (Firm). The Next Chapter in Islamic Finance : Higher Rewards but Higher Risks. [New York]: Oliver Wyman, 2009. Print. Ramajo, Julián, Agustín García, and Montserrat Ferré. “Explaining Aggregate Private Saving Behaviour: New Evidence from a Panel of OECD Countries.” Applied Financial Economics Letters 2.5 (2006): 311-5. Print. Schmidt-Hebbel, Klaus, Steven Benjamin Webb , and Giancarlo Corsetti. Household Saving in Developing Countries : First Cross-Country Evidence. Washington, DC (1818 H St., N.W., Washington 20433): Country Economics Dept., World Bank, 1991. Print. Solé, Juan, and International Monetary Fund. Monetary and Capital Markets Dept. Introducing Islamic Banks into Conventional Banking Systems. [Washington, D.C.]: International Monetary Fund, Monetary and Capital Markets Dept., 2007. Print. The Consultative Group to Assist the Poor (CGAP), and The World Bank Group. Financial Access 2010: The State of Financial Inclusion through the Crisis., 2010. Print. Warde, Ibrahim. Islamic Finance in the Global Economy. Edinburgh: Edinburgh University Press, 2000. Print. Wilson, Rodney. “The Development of Islamic Finance in the GCC.” Kuwait Programme on Development, Governance and Globalisation in the Gulf States (2009) Web. World Bank., and International Monetary Fund. “Financial sector assessment a handbook.” World Bank and International Monetary Fund. 2005. /z-wcorg/. http://worldcat.org. Endnotes

Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |