From Cornell International Affairs Review VOL. 2 NO. 2Financial Crisis and Regulatory Challenges

By

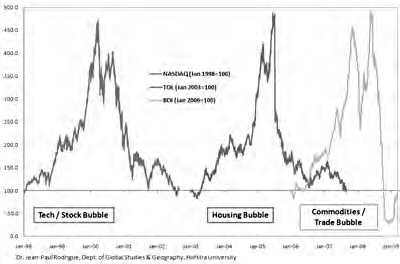

Cornell International Affairs Review 2009, Vol. 2 No. 2 | pg. 1/1 A number of reports have established a diagnosis of the financial crisis. The first was produced by the Financial Stability Forum, in April 2008 and was the basis for the preparation of the first G 20 meetings in 2008. The International Monetary Fund (IMF) and the G 30 produced updated analysis in 2008 and 2009. More recently, the Larosière Group, although mainly focused on E.U. issues, also addressed global concerns , as well as the Adair Turner report which presented the new regulatory strategy of the UK Financial Services Authority (FSA). The main features of this unprecedented financial crisis are linked to immense and growing global imbalances between the Asian and US economies which provided the world with abundant liquidity, low interest rates together with low inflation (due to low wages in emerging countries) and a geographic mismatch between savings and investment needs and opportunities. Investors' search for yield coexisted with low risk aversion and gave way to an unprecedented development of credit, fostered by securitisation and financial innovation. Credit discipline was lost from sight and a credit bubble developed between 2002-2007, mainly in the real estate sector but also in the credit card and leveraged buyout (LBO) activities. The so-called originate to distribute model (OTD) flourished in a grey area (don't need quotation marks) of unregulated or under regulated activities and markets (the OTC market, where professionals operate on a contractual basis). Externalisation of risk allowed banks to appear resilient: their equity ratios seemed adequate and even comfortable, since the risks were transferred to investors such as hedge funds, pension funds and clients of the asset management industry, through deconsolidated devices (the conduits and sivs) which operated as shadow banks and funded structured products by issuing commercial paper. Derivatives and structured products (RMBS, ABS, CDOs, to name a few) developed rapidly, the assumption being that risk dissemination and insurance, based on complex products (Credit Default Swaps, for example) and specific protection schemes (the monolines), was the new paradigm of the financing of economic growth in a globalised world. Global leverage lost control, as well as liquidity, operational and counterparty risks. A monetary policy that aimed to control inflation caused interest rates to go up, leading over-indebted households to start defaulting in summer 2007. The price of structured products went down and credit rating agencies suddenly downgraded them. Holders, including hedge funds, started selling massively due to covenants and redemptions. The crisis started in the asset management field and might have triggered a panic in the public had banks not repatriated the risks in their books, either to comply with liquidity commitments to their "sivs" and "conduits" or to protect their commercial reputation, as many of them where involved in the production and distribution of structured products and also in the management of their asset management subsidiaries. It consequently appeared that their capital was not sufficient to face the required provisioning, that there was no active market for these structured products and that their valuation was uncertain. Confidence in the banking system was affected, while banks started hoarding liquidity to face their obligations. These factors produced a liquidity crisis in the banking system and the freezing of interbank markets, leading governments and central bankers to intervene from summer 2007 to summer 2008). The demise of Lehman Brothers in September 2008 gave way to a second phase of the crisis, which developed into a solvency crisis affecting a number of banks and forcing governments to play the role of lender of last resort, bailing the banks out through capital injection, guarantees and even nationalisation. Thus started the third stage of the crisis, the transmission to the "real" economy through the credit crunch which triggered the re-launch programs in the US, EU and elsewhere. In parallel with governments' efforts to consolidate the banking system in order to fight recession and to restore confidence, this global crisis raises three sets of regulatory issues which are being considered by the G 20. The first set of issues concerns the need to improve macroeconomic and macroprudential management at the global and, possibly, regional level, in order to better identify global imbalances and take the necessary measures in a more coordinated way. This is both a political and technical question. The G 7 approach is no longer relevant in a world where major emerging economies play a significant role and have to be part of the global architecture of macroeconomic monitoring. Similarly, the role and capacity of the IMF has to be reconsidered: the IMF should recover a capacity to bring together all the relevant information in order to foresee possible imbalances and to trigger collective and coordinated reactions; it should have the necessary authority to monitor national policies and implementation of international standards and orientations; it should have enhanced financial capacity to provide support to emerging countries affected by imbalances or recession. A second set of issues is related to the necessary enlargement of the scope and content of regulation. The word "regulation" is here understood in a broad sense which encompasses all means aiming to monitor a complex system, including not only ruling but also supervision, reporting, self regulation, best practices, and so forth. One of the specificities of this crisis is due to the fact that the triggering events took place outside the classical regulation of intermediaries and markets: unregulated, or poorly regulated, entities, products and markets played a major role. There is a need to improve banking supervision in order to master leverage, which is key to sound intermediation. Among the many questions under consideration, three new topics have been identified: liquidity risk and maturity mismatch should be more thoroughly taken into consideration in the determination of capital requirements; deconsolidation has to be rigorously determined in order to put an end to the practice of flawed and ambiguous securitisation; procyclicality of capital adequacy requirements has to be addressed through the possibility of "through the cycle" dynamic management of reserves. There is a need to enlarge market supervision which should encompass unregulated entities, and Over the Counter (OTC) markets, and to strengthen market infrastructures (namely clearing and settlement of derivatives). In that domain, transparency is a central concern. The OTD model has to be repaired, starting with origination of credit, transparency of arrangement, rating and distribution. Along the chain of securitisation, transparency together with risk management and prevention of conflict of interests have to be restored. Accounting standards are also essential in this new model. While accounting should not be instrumentalised in order to solve managerial or prudential concerns, the standards should be relevant to firms' business models: hence the need to differentiate more clearly the trading book which should be accounted for at market value, the "available for sale" items, which should be at fair value, and the banking book, which should remain at cost, since the items are held to maturity. The three market bubbles of the past decade that were in part responsible for the Great Depression-like crash that the economy experienced in 2008 Finally, a third set of issues concerns the global architecture of regulation. In that domain, much has been achieved since a decade or so. A number of international institutions have improved their visibility, enlarged their standards, and enhanced the cooperation between their members. The Basle Committee is the leading organisation for prudential standards applicable to banks. Significant progress has been made through the adoption of Basle 2, although new improvements are under consideration. The International Association of Insurance Supervisors (IAIS) is the organisation for insurance and plays a major role in the field of prudential standards (Solvency 2) and conduct of business rules. The International Organisation of Securities Commissions (IOSCO) is the global organisation for securities regulation and serves as a good example of the progress made since over a decade. In 1998, it unanimously adopted a common set of objectives and principles. In 2000, it endorsed the 39 Inter-Agency Standing Committee (IASC) core standards for accounting, which paved the way to the creation of the International Financial Reporting Standards (IFRS) and their adoption throughout the world, beginning in Europe. In the aftermath of the Internet bubble and early millennium scandals, it took a series of initiatives to combat financial fraud (the signing of a multilateral memorandum of understanding to improve international cooperation in enforcement, new standards for audit and financial analysis, a first code of conduct for rating agencies, completed in 2008 to address the issue of structured products). These three major organisations have learnt to work together within the Joint Forum on issues of a cross sectoral nature, such as conduct of business rules, securitisation or risk management. In the aftermath of the 1997 Asian crisis, the G7 established the Financial Stability Forum (FSF), which gathers together international standard setters, ministries of Finance, Central Banks, International Financial Institutions (the IFIs, such as the IMF, the World Bank, the Bank for International Settlements, the Organisation for Economic Co-operation and Development (OECD), and representatives of a few major financial centers. The FSF plays a useful role as a high level secretariat for the G7 and as a global coordinator of all the major institutions involved in standard setting, monitoring and enforcement in the macro prudential and micro financial fields. One could legitimately question the efficiency of all these efforts, which have been unable to prevent the crisis. Firstly, although globalisation has thrived for 20 years and regulators have made significant progress in the field of cooperation and standardisation, nationalistic behaviors are still predominant. Competition between marketplaces sometimes leads to diverging regulation and regulatory arbitrage. Ideology also plays an important role and diverging views prevent from addressing relevant issuesthat was obviously the case with regards to securitisation and risk transfer which was considered by major regulators as the new paradigm of 21st-century finance. It was also the case with regard to the so-called "light touch regulation" which considered that market players were smart enough to self regulate and manage risk, while overregulation would have perverse effects and would increase costs. Trillions of losses later, it appears that there is no common measure between the cost of regulation (tens of millions…) and the consequences of deregulation. Another flaw in the system is due to the existence of unregulated or uncooperative jurisdictions which originate loopholes in cooperative arrangements, ruin the efficiency of enforcement and encourage misbehaviour of market participants and anticompetitive maneuvers. This is not acceptable in a globalised economy. While legal innovation and even tax competition may be acceptable under certain circumstances, the organisation of opacity is fundamentally detrimental to the normal functioning of a sound market. Uncooperative jurisdictions have to join the regulatory community and to behave along the principles of international cooperation. If they do not, they should be banned from doing business with the rest of the world and market participants which use them should be severely penalised. It is now time to foster international cooperation and to strengthen the global architecture of regulation. There is no need to start from scratch and reinvent the wheel because the components of a sound system already exist. Political will is of the essence. A crisis, however serious it may be, is always an opportunity to rebound and progress. This financial crisis should lead to addressing a number of technical issues in order to make the financial system more robust, more efficient and better adapted to the challenges of globalisation. Beyond technicalities, this financial crisis is also an opportunity to remind market participants that ethical principles and behaviour should be at the center of a sound financial system. Never in the past has greed been observed to such a level of provocation, with a serious risk of popular reactions. Never in the past have conflicts of interests been used in such a cynical way. Never in the past have such huge scams been observed which ruin the confidence of the public and destabilise the credibility of supervisors. There is an urgent need to repair the system. This neither implies over-regulation nor over reaction which might have unexpected consequences. This deserves determined action by governments, regulators and market participant organisations, in a coordinated way and on a global basis. This is the only way to restore confidence, which is a fundamental precondition for an efficient market economy, having in mind the fact that market economy, like democracy, is the best of all systems or, at least, the better system. AuthorMichel Prada, Former Chairman of the French Securities Commission, the Autorité des Marchés Financiers (2003-08) and of IOSCO Technical Committee Photos courtesy of:

Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |